Power of Blue Sky Discoveries + Green Technology. Private Diary: Chronicles of the Energy rEVolution.

Thursday, 31 December 2020

Happy And Healthy New Year! Stay safe.

Saturday, 26 December 2020

TNR Shotgun Gold In The USA, "Elephant Country". Crescat Capital: "Gold Supply Cliff - Macro Presentation"

"What is the relationship between Donlin and Shotgun Gold? My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin."

TNR Shotgun Gold Project In "The Alaskan Elephant Country". Dr Tim Baker: "Major Porphyry Gold Deposits".

We extend our congratulations to TNR Gold shareholder NovaGold and their Donlin Gold JV partner Barrick Gold. JV partners of Donlin Gold have announced solid results from the largest drilling campaign since 2008 on the project. On the back of this news, it is time for us to discuss our own relationship with developing Donlin Gold Mining Camp and my own personal vision of how Donlin Gold project can potentially grow into a 50 million-plus oz Au resource project and become a major Gold Mining Camp in the world based on the U.S. soil.

How is this relevant, what is the relationship between Donlin and Shotgun Gold? My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin.

I am the largest shareholder of TNR Gold with 25% stake on a partially diluted basis, so my personal visions must be followed by your own research, including reading all legal disclaimers. There is no investment advice on my blog or any social media feeds and you should always consult a qualified investment adviser before making any investment decisions.

All visions, all great paths forward should be supported by solid science and Dr Tim Baker provides us today with sober scientific observations from his studies about the "Major Porphyry Intrusion-Related Gold Deposits" in the world. What follows is my attempt to translate the high-level geological and geochemical data collected by Dr Baker after studying for many years "Major Porphyry Granite Related Gold Deposits" in the world including Shotgun Gold into a few digestible ideas.

How are these "Elephants" - the giant porphyry Gold deposits - formed? Where should you look for these "Elephants"? And why a found "trunk of an Elephant" which snakes up all the way to the surface in Alaska, can leave many geologists awake at night at the right time of the Gold Cycle?

Stubbornly rising Gold prices are great seasoning for great projects nestled in safe, ready to grow mining jurisdictions like Alaska. Rising Gold price is what allows us, after all this time, finally move from the preparation stage and into action. Shotgun Gold Project is already part of academic research and scientific papers, now we are moving forward with our strategy to make its development the part of Gold industry studies to unlock its full potential.

Our preparations are set for this golden opportunity. We have the academic research and inferred resource has been already defined in produced Shotgun Gold NI 43-101 Technical Report. Gold Bull market finally brought us a favourable environment in which Eric Sprott doubles his "mental valuations" from $50 to $100 per oz Au in the ground. Barrick Gold warns of supply crisis and calls for consolidation, while VanEck International Investors Fund calls gold mining stocks "undervalued based on the statistical norm of share prices to cash flow … at a time when producers are on their best financial footing in recent history".

We all remember the very brave super-smart short-sellers that were so worried about losing a lot of money in this Gold Bull market that they produced a company-killer report about NovaGold which made many other investors worry about Donlin Gold, especially in regards to its economic viability and Barrick Gold's plans for this JV project with NovaGold. Thomas Kaplan came out with all guns blazing, sued the super-smart FUD producers and made the best move which can happen in the mining industry. Amid worldwide pandemic, NovaGold Donlin Gold Team conducted 23,400m in 85 holes of the largest since 2008 drilling campaign on the project.

NovaGold NR October 26, 2020.

CEO Mark Bristow has confirmed that Donlin Gold is a key project for Barrick Gold. Now the project will grow further, updated model and a new resource estimation are expected. Drilling intersections are spectacular with high-grade sections of 4.17m grading 80.6 g/t Gold starting at 123.48 drilled depth, including a subinterval of 3.15m grading 106.2 g/t gold starting at 124.5m drilled depth. Drill hole DC20-1872 was drilled to the depth of 632.8m and Gold mineralisation intersection of 6m was found from 603.23m to 609.23m grading 2.33 g/t. Now you can better understand why I am talking about the potential development of Donlin Gold project into 50 million-plus oz Au resources to become one of the largest Gold Mining Camps in the world based on the U.S. soil.

NovaGold NR October 26, 2020.

It is important to mention here that TNR' Shotgun Gold Project is a Porphyry Gold system as well, with a similar geo signature as Donlin Gold.

"Shotgun Gold is a multiphase intrusion-related system associated with 69.7 Ma magmatism, tying Shotgun Gold to a widespread magmatic Gold mineralising event including the 70 Ma Donlin Gold project. Mineralisation and magmatism at Shotgun Gold resemble Donlin Gold and other deposits in the area where regional structures focus the first order emplacement of magmas, and local structures control mineralisation at the deposit scale."

Shotgun Gold has seen very limited drilling of the total 7,000m. "Mineral resource is located from surface to a depth of 150m. The resource is located on a ridge forming a topographic high. Mineralisation appears to be uniform with little-to-no "nugget effect".

All Shotgun Gold inferred resource of 705,960 oz Au was defined at the Shotgun Ridge. "Mineralisation appears to be open at depth and along strike. Mineralisation from some drill holes was not included in the resource model. It can add additional resources with future drilling."

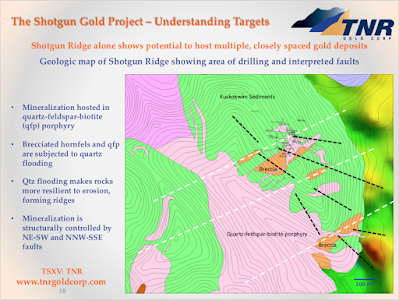

The next slide demonstrates very well the concept of an "Elephant and its trunk" which may be leading to "a hiding in the ground Elephant" when you study "Depth-fluids Models For IRGS" presented by Dr Tim Baker and TNR's Shotgun Gold exploration studies combining drilling results and 3D chargebility model.

All Shotgun Gold resource was defined just in one target at Shotgun Ridge. "Shotgun Ridge has untested structural intersections that may host significant Gold deposits. If the IP method is showing mineralization as interpreted, then the potential exists to expand the near-surface mineral resource in close proximity to the existing resource."

"Geology supports the target model. Only one of 5 targets is tested to date. 705,960 oz Au defined in one target with less than 5,000m drilling. Deposit is open at depth and along strike."

"Today we have Peak Gold Supply in the spotlight again. Majors have to buy new Gold projects in order to replenish their resources in the pipeline for development. Kinross Gold is acquiring 70% of the Peak Gold project and putting all our Shotgun Gold development Story into the new light of potential developments now:

"CALGARY - Kinross Gold Corp. is moving to secure additional supply for its Alaska gold operations by buying a controlling interest in the Peak Gold project from Royal Gold, Inc., and Contango Ore, Inc., for $125 million.

Toronto-based Kinross has agreed to pay Royal Gold about $66 million for its entire 40 per cent stake and $59.6 million for half of Contango's 60 per cent share, leaving Contango with a minority 30 per cent holding.

The miner says it plans to process ore from the open-pit Peak Gold mine at its existing Fort Knox mine, 400 kilometres to the northwest, to reduce costs and extend the life of the existing mill and infrastructure." BNN Bloomberg.

Shotgun Gold Project is located 190 km south from Donlin Gold, where our shareholder NovaGold is developing this giant project together with Barrick Gold."

Higher Gold prices and rising demand are pushing all industry insiders to adjust their strategy, the whole mining districts can be built around the central for particular mining camps facilities like Kinross is doing now. M&A and consolidation of the resources in the satellite deposits around such existing and developing mining infrastructure centres have already started. Developing Donlin Gold Mining Camp provides a unique opportunity for TNR's Shotgun Gold Project to grow with further exploration and potentially become a part of the one of the largest Gold Mining Camps on the U.S. soil. Now it is time for you to make your own research and make your own conclusions, stay safe.

Thursday, 24 December 2020

Friday, 18 December 2020

Tesla Surges Over $655, Copper Breaks $3.60 Supercharged To 7-Year High Above $8,000. TNR Gold Investors Digesting Copper Royalty Deal On Taca Taca.

The Switch is here. It is happening. The World Just Before The Internet. Millions of people are switching from ICE cars to electric cars now. This is the End of the ICE Age.

Investors are taking notice and the brave crowd on Robinhood is chasing everything electric. Tesla breaks $655 just before inclusion to S&P 500 and Copper now goes a full melt-UP breaking $3.60 per lb on its way to 7-year high of over $8,000 per T.

"Now with Copper price crossing $3.30, Taca Taca Copper Royalty deal seems to be very interesting. With Copper price at $4.00, buyers will be considered as very smart investors, with Copper price at $5.00 - they will be considered as geniuses."

Now you can better understand my approach of investigating Warren Buffett's Mr Market behaviour and applying the Time Machine quantum theory to my personal portfolio. TNR Gold investors are digesting Copper Royalty deal on Taca Taca. I am participating in TNR Gold Private Placement and increasing my stake again. Only your own research can help you to understand this situation. Links below can help all those who are interested. Read all legal disclaimers, run the calculators, buckle up and stay safe.

Tesla Energy rEVolution And The Golden Age For Copper: Kirill Klip GEM Royalty TNR Gold Copper Presentation December 2020

"TNR Gold receives a very good valuation benchmark for our Royalty Holding on the entire giant Los Azules Copper Project which is being developed by the legendary Rob McEwen. All our long-term followers remember that McEwen Mining was stating in their news releases that "Taca Taca serves as a good proxy for the value of Los Azules".

McEwen Mining Chairman, Chief Owner and CEO Rob McEwen said: "With First Quantum acquiring Lumina Copper and their Taca Taca project, Los Azules moves to the forefront in terms of world-class, undeveloped, high-grade copper assets not owned by a major mining company. As we have said in the past, Taca Taca serves as a good proxy for the value of Los Azules and we believe this transaction demonstrates value in projects located in Argentina."

Now deal by Nova Royalty provides all our devoted followers with more information to crunch the numbers and arrive at their own conclusions about the potential valuations for TNR Gold. Below you can find more information for your own research.

Nova Royalty pays for 0.24% of NSR Royalty on Taca Taca USD$12.75 million, TNR Gold holds 0.36% NSR Royalty on the entire giant Los Azules Copper project.

"Nova Royalty Corp. said on Thursday that it has struck royalty purchase agreements with private parties to acquire an existing 0.24% net smelter return (NSR) royalty on First Quantum Minerals Ltd’s Taca Taca copper-gold-molybdenum project, in Argentina for around US$12.75 million in a cash-and-stock deal."

TNR Gold Los Azules Copper Royalty Holding - Rob McEwen: “We’re Currently Thinking Of Spinning It Out... And Fund That To Push It Forward To A Feasibility Study.”

The good news is coming in to bright up the days this Fall for TNR Gold and all our shareholders. We all more than deserve it after very hard work and I would like to extend our deep appreciation and gratitude to all our shareholders for your support of our Company. On your behalf, I would like to thank our very talented GEM Royalty TNR Gold Team. Our projects are growing. I am investing in our Company again and you are welcome to follow, learn more and join us, please do not hesitate to contact me personally. Do your own research, as usual, stay safe and enjoy the journey!

Today Rob McEwen is sharing with The Northern Miner his plans to awaken his "sleeping giant" - Los Azules Copper project. We discussed with you recent Royalty deals providing finally mark-to-market benchmark for potential valuation of TNR Gold Royalty Holding on Los Azules Copper based on the recent market transactions. Today you can listen to Rob McEwen about his plans for the development of this giant Copper deposit. Proud people of Argentina are ready to build their future and become the economic powerhouse in South America to feed The Switch and Tesla Energy rEVolution. TNR Gold is plugged into this energy transition with our Royalty Holding in Copper and Lithium.

The Northern Miner: "Asked about the situation in Argentina, McEwen noted that the country “has the unfortunate experience of almost every ten years it seems to go into a period of high inflation,” and are in the midst of that right now. “They are desperate for foreign investments, it’s a mineral-rich country, and they just haven’t got their mining laws together. They are inconsistent,” he said. “But I think we’re approaching a time where they are going to be more inviting and provide some safeguards to investments for foreign investors there.”

McEwen noted that the company’s Los Azules project in Argentina contains a large copper deposit, with indicated and inferred resources totalling 30 billion lb. copper and also has some gold and silver. To put it into perspective for gold and silver investors and convert the copper and silver into a gold-equivalent, Los Azules has about 19 million oz. gold-equivalent in the indicated category and another 37 million oz. gold in the inferred.

“We did a PEA on it using a US$3 per lb. copper price, and the economics on it are really robust. It envisions 415 million lb. of copper a year at US$1.14 per lb. copper. Copper right now is about US$3.14 per lb., so if I were to convert that again to a gold-equivalent, when you include the gold and silver credits, that would be about 800,000 oz. a year at US$800 an ounce.”

McEwen added that the large capex of $2.4 billion, at US$3 per lb. copper, could be paid back in under four years and run for 36 years. While he admitted that the size of the asset and capex is beyond McEwen’s balance sheet, the company continues to move it along and make it more attractive and is considering a variety of ways to advance the project.

“We’re currently thinking of spinning it out, and putting it with a copper project that we have in Nevada and create a separate company where we retain a large interest, to have the value reflected on our balance sheet and fund that to push it forward to a feasibility study.”

“I think it’s an overlooked asset in our portfolio mix,” he continued, adding that “a lot of investors like to have companies invested in gold and silver or in copper, but not have all of that in one company, especially in a smaller company.”

Sunday, 13 December 2020

TNR Gold Lithium Royalty Holding: Tesla Goes SpaceX Vertical, Ganfeng Increases Stake In Mariana Lithium Closer To 100% And Moves Project Towards Pilot Scale Test Stage.

Tesla goes SpaceX vertical following the decision about inclusion in the S&P 500. Norway goes full-electric mode with almost 80% EVs share of the auto sales and everything electric is driving Robinhood crowd FOMO crazy upon any new EV IPO arrival. Electric Cars are here. The Switch is happening as we speak when millions of people are switching from ICE cars and buying EVs.

All this electricity in the air and high voltage anticipation of the investment crowd in the EV space provides a very sharp contrast to the deceitful tranquillity and calmness of the Lithium brine ponds in the Lithium industry. There is a lot of drama and chemistry involved in supply chains for electric cars behind the scene.

Lithium prices are still trying to make a bottom and it seems that nobody among brave Robinhood souls has made any real connection between Coca-Cola and sugar industry in the Electricity Storage Age. We like what we see and we are buying more of it now. I am participating in another round of financing for TNR Gold and you will have to make your own research to decide for yourself whether Mr Market has provided us with another ticket for his Time Machine adventure.

The investment thesis for the best Lithium plays is quite simple now. We have a total disconnect between billions of dollars which are chasing electric dreams of "The Next Tesla", real Energy Transition and lack of the Capital to build secure Lithium supply chains to feed this rEVolution.

Nobody really knows where the Capital will be coming from to build up Lithium production capacity from just over 300,000 T of LCE produced this year to over 1 million T of LCE required annually by 2026. As usual, the best approach will be to stick with those who know how to do it and have done it before. TNR Gold is plugged into this Tesla Energy rEVolution with our NSR Royalty Holding on Mariana Lithium. The new giant from China Ganfeng Lithium is developing Mariana Lithium JV and building a global vertically integrated Lithium business.

Tesla Battery Day presentation has demonstrated that the mass market for electric cars is literally around the corner with costs of Lithium batteries going down and that we are closing on EV and ICE car cost parity. Elon Musk was talking about a new $25,000 electric car being developed by Tesla.

Solid technical data and demonstration of incredible achievements of advancing EV technology by Tesla Team followed by Elon Musk dream about unlimited Lithium supply which can easily match his imagination on demand. It took Lithium investors a few days after a brutal sell-off to understand that Elon Musk was applying "The Art of War" to the Lithium companies. He was talking about deserts full of Lithium clay and table salt which will be making the pure Gold out of it after this dirt will be moulded in the batteries for new Teslas.

Meanwhile, Tesla was signing real offtake agreements with the real Lithium spodumene projects owners to secure real Lithium supply. On another side of the globe companies like Ganfeng Lithium are growing in the land of the original "The Art of War". They are exercising ruthless mercy to all the others who are still daydreaming after digesting the DIEsel fumes. Ganfeng is already supplying Lithium to Tesla, VW and BMW among many others.

The "Opaque Lithium Kingdom" is full of its own drama with Tianqi facing the "Get Big Fast" consequences after being the proud buyer of a big stake in SQM at the very top of the Lithium market.

Gangfeng Lithium is taking control over the raw materials supply chain and the crown of the largest integrated Lithium producer in China and was even declared the largest Lithium hydroxide producer in the world in September.

Unfortunately, the deal for leasing additional Lithium production capacity between Ganfeng Lithium and Jianxi Special Electric Motor fell apart, but the company was really busy anyway shaking off the pandemic fever and growing into $15B market cap this year.

The main strategic priorities remain the same - building the markets, increasing production capacity and building the diversified secure supply base for the Lithium raw materials. Ganfeng and Lithium Americas JV project is moving forward following the new dreams of the policymakers in Argentina "to unleash the full market power for the Lithium mining sector".

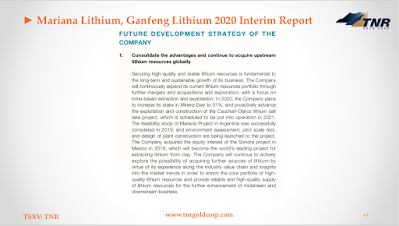

Now Ganfeng Lithium is moving development of Mariana Lithium into the next stage with the proposed USD $25 million budget for 2020 - Ganfeng has already increased its stake in Mariana Lithium closer to 100% with 88.4% ownership according to public filings released in MD&A in November.

Ganfeng Lithium Interim Report 2020 stated: "The feasibility study of Mariana Project in Argentina was successfully completed in 2019, and environment assessment, pilot scale test, and design of plant construction are being launched to the project."

Now you can better understand why TNR Gold Team is really excited with all recent developments in the electric space. We do not have to contribute any capital for Mariana Lithium development and our potential future NSR Royalty cash flow is becoming more and more feasible. You can find more public information for your own research on the links below and follow Mariana Lithium project development on my blog and the updated Ganfeng Lithium website.

Lithium Will Power Us For The Next 50 Years And Then Robots: Kirill Klip GEM Royalty TNR Gold Lithium Presentation December 2020

"TNR Gold is plugged into the Tesla Energy rEVolution with our NSR Royalty Holding on Mariana Lithium JV under the management of this giant from China.

Ganfeng proposed USD $25 million budget for Mariana Lithium in 2020 and "The feasibility study on Mariana Lithium was completed in 2019, and environmental assessment and construction of the project are planned to be conducted," as it has stated in Ganfeng Lithium 2019 Annual Report.

Ganfeng Lithium has provided a further update on Mariana Lithium in 2020 Interim Report: "The feasibility study of Mariana Project in Argentina was successfully completed in 2019, and environment assessment, pilot scale test, and design of plant construction are being launched to the project."