There are quite polarized views on the carefully designed and executed by China New Energy Plan to gain control of lithium market. This plan is nothing new and even we have been discussing it here for years, but recent M&A deals are becoming too big just to ignore it. China is executing its plan with military discipline in order to dominate and control lithium supply chain. In the Post Carbon World, if you can control $3B Lithium Market (by sales in 2017) you can control Disruption of $12T Energy and Transportation Industries. I would like to point a few quite obvious, but very important facts which will affect Tesla Energy rEVolution for years to come.

Audi is talking about DIEsel cars again: in light of all recent news about new cheating devices found in numerous German auto brands and models, we can stop our celebration about Siemens joining NorthVolt project short of getting fully excited. This constant double talk by all major western automakers will make their production facilities multi-billon example of Stranded Assets left after Energy rEVolution and their business life will be left as the subject of history books very soon but, unfortunately, we will be paying the very big price for it. All American automakers are not much better as well - GM even had to announce that its "electrification plan" will continue, while they are all salivating in line and waiting for Trump Administration to roll back the emission standards.

Tesla is the only company in the West which is standing close to the mass production of electric cars and will be competing for Security of Lithium Supply with the military machine "Made in China". Tesla is not getting any significant quantities of lithium as raw material now, lithium cells are supplied mainly by Panasonic and some by Samsung. We have discussed the importance of Kidman deal for Tesla just a couple of weeks ago. It is a great first real step to secure the lithium supply for the future, but it is very small and more must be done very fast here by Elon Musk.

"But only strong soft power of peace can withstand the kiss of the Dragon. We are talking here about the geopolitical map of the post ICE Age world when Oil power will be greatly diminished and trillions in stranded assets will the price to be paid for the years of the bloody domination by the West in the 20th century. We still can make it and Elon Musk can lead the way as usual."

Elon Musk's attempts to negotiate and built lithium producing facilities in Chile were enough to put all efforts of Tianqi to acquire that SQM stake in the ludicrous mode and official China was very fast to warn Chile to think twice before raising any concerns about concentration of Chinese control in the Lithium Market. We can talk all day whether Tianqi is just another miracle representing private capital enterprise from Communist China or not. And whether 24% of voting SQM shares will bring Tianqi any influence on the SQM operations - only the future will tell. The most important here is the fact that it was enough for China not to allow us even the opportunity to speculate whether Tesla can have any such control on the Lithium Supply in the future in case if Tesla would acquire this SQM stake.

Now lithium market is tested by this $4B largest Chinese acquisition so far. Ganfeng Lithium $1B plus Hong Kong IPO will be next and $500M FMC IPO of its Lithium division will be next in the Fall.

After the recent attack on the Lithium Market by hired banksters, who suddenly get overwhelmed by the coming Lithium Oversupply from SQM, the celebration for capital raise by Nemaska has come with tears and very heavy price of a dilution with 60% discount to the company's share price back in January. The lithium market is drying up for lithium juniors again and "healthy consolidation" can be the old mining "synergy saga" when "two holes put together are making an even larger hole".

Another very important trend now is rising very fast Capital cost ("CAPEX") for the new Lithium projects to be put into production. It used to be an industry standard that CAPEX of $15,000 can buy you a 1,000 LCE Lithium T/Y production per year. The most popular dream about 25,000 LCE Lithium T/Y production used to come with $375M - $400M financing plan. New revised FS for many lithium projects are coming with over $25,000 CAPEX per 1,000 LCE Lithium T/Y production. In case of Nemaska, this number can be even as high as $30,000. According to some reports, Nemaska has raised $1B for 33,000 LCE Lithium T/Y plant in Canada.

In order just to meet UBS target of 1,000,000 LCE Lithium T/Y production rate by 2026, we have to make a jump from 220,000 LCE Lithium T/Y produced in 2017. New production facilities for min 780,000 LCE Lithium T/Y must be built and if we assume the low CAPEX of $20,000 per 1,000 LCE Lithium T/Y industry urgently needs $16B - $20B in investment in the next 2-3 years. Part of it will come from SQM's expansion plan. Who will finance SQM? If it will be Tianqi we can expect the takeoff rights being attached and the rhetorical question who controls SQM lithium supply now will be answered. Where the rest of the capital for lithium industry will come from? This question will be the key to the Tesla Energy rEVolution in the next 2-3 years.

Regarding China, nothing is really "super sinister or outrages" so far, they will always participate in "50 cents trades" or maybe even make it happen, but the most important is that the West cannot just rely on China to supply its needs in critical commodities for the Post Carbon Economy. It is not a brave "free market theory" anymore: numerous reports are providing insights in the Lithium Universe in China now and that Chinese EVs will be allowed enjoying government subsidiaries only in case if they are representing "Made in China" in all major categories including Lithium Batteries and the most advanced technology - long-range Battery Electric Vehicles ("BEV").

The future of Tesla Energy rEVolution, disruption and electrification of $12T Energy and Transportation Industries and Post Carbon Economy depend on Security of Lithium Supply. After the major $4B investment by Tianqi buying 24% of SQM China's grip on the Lithium Market is only getting stronger. Only much needed $16B - $20B of investments in Lithium Market in the next 2-3 years can bring some balance to this tightly controlled market and prevent the total dependence on China to produce and provide Lithium Batteries for the Electric Cars and Energy Storage Systems ('ESS").

"Looking ahead, Klip predicts, "Lithium-producing nations will ban exports of lithium, and only export rechargeable batteries. If that happens, China will monopolize lithium because of its vested interest in the product."

If the price of lithium hits the roof due to low supply, China and only China will be able to secure cheap lithium, and proceed with development of rechargeable batteries and EV. That is the predicted scenario that is being quietly talked about by those in the know."

The Mainichi.

LEGAL DISCLAIMER

Please read legal disclaimer. There is no investment advice on this blog. Always consult a qualified financial adviser before any investment decisions. DYOR.

Tesla Energy rEVolution: TNR Gold CEO On The Beginning Of A Megatrend Led By Electric Cars.

LEGAL DISCLAIMER

Introducing GEM Royalty Co. - The Green Energy Metals Royalty Company TNR Gold Corp.

LEGAL DISCLAIMER

InvestorIntel:

Renowned mining investor Frank Holmes has spoken out about his fondness of mining royalty companies.

In terms of value proposition, they outperform mining equities and serve the important role of connecting exploration plays with financiers during lean bear markets, he says.

Kirill Klip, CEO and President of TNR Gold Corp. (TSXV: TNR), fell into this business model when he bought shares in gold mining royalty company Royal Gold for about $5 each, back when gold traded at $300 an ounce (it hasn’t traded in the $300s since 2003). He cashed out of that investment at over $70 a share and has been hooked on the royalty model ever since, where royalty proceeds funnel into new opportunities, he told InvestorIntel.

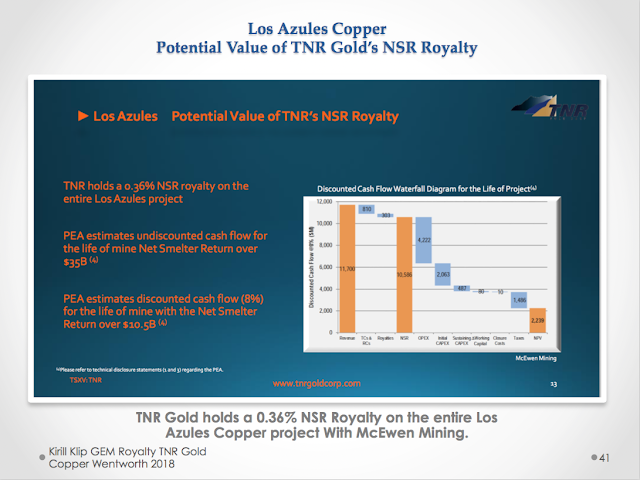

Klip says his version of a royalty company is slanted towards metals with high exposure to usage in electrical vehicles – lithium, copper, and even gold. His most mature investment to date is a position in International Lithium Corp. (TSXV: ILC), in which TNR holds a 14.1% equity interest after convertible debentures and warrants are exercised and a 1.8% net smelter royalty (NSR) on the Mariana brine project in Argentina. The key to this project is the involvement of joint venture partner Ganfeng Lithium Co., one of China’s largest processors of the material..."