You will see more headlines now which could be attributed to the "sudden revelation" even for industry insiders that lithium price breaking $20,000 per LCE Tonne in China is not something that will come and go as a nightmare. It means that there is a shortage of lithium already even before Tesla Gigafactory and Megafactories from BYD, LG Chem, Foxconn, Boston Power, Samsung and A123 are coming on-line. Tesla Model 3 has reached now 276,000 orders in less then 4 days and shows appetite for the good electric cars. We are at the tipping point for the electric cars to go mainstream.

SQM is moving to Argentina breaking its own myth about "One Thousand Years Of Lithium Supply". Everybody who is waiting for Lithium to be delivered from clay ... can continue to wait including Tesla. Industry insiders like Jow Lowry were talking about it for months and SQM with Lithium Americas dropping Western Lithium name with its own clay ambitions can be the best confirmation now. In our small Lithium Universe in China these days Ganfeng Lithium supplies BYD, LG Chem and Panasonic, which supplies Tesla with lithium cells. International Lithium is developing two J/V with its strategic partner - Ganfeng Lithium in Argentina and Ireland, building the vertically integrated business. Now with new strategic partners International Lithium moves to build the secure supply chain for lithium in North America.

Tesla's Elon Musk: All Cars Will Be Electric - International Lithium Presentation April 2016.

Tesla Model 3 Unveiled - electric car with 215 miles range for mass market!

Watch the Event: http://kirillklip.blogspot.co.uk/2016/04/elon-musk-at-tesla-we-dont-make-slow.html?m=0

All good things take time, care and patience. Lithium Technology is here and Energy rEVolution is coming next to you with GM Bolt and Tesla Model 3 igniting the mass market for electric cars. Tune in today to see the future with Tesla Model 3 being unveiled. People are camping outside Tesla showrooms just to make the reservation! Netherlands is going to sell only electric cars after 2025 and India is talking to go full electric by 2030. It is all about lithium technology making batteries better and cheaper every year. And now smart phones on wheels will be taking out streets one by one.

Slowly, but surely we are building our Vertically Integrated Lithium Business with Ganfeng Lithium with our J/V projects in Ireland and Argentina. Now it is time for Canada to shine and that wind for our sails I was talking last Fall about is coming. We have survived during the storm on the sand bank, now we know what to do when the tide is coming. I welcome all our new Partners to International Lithium, fasten your seatbelt, we are moving forward. Read more."

Tesla Model 3: Apple, Google Or Facebook? Who Will Buy Tesla Motors Now To Make Electric Cars For All Of Us?

Update from Elon Musk, this is super positively insane!

Model 3 orders at 180,000 in 24 hours. Selling price w avg option mix prob $42k, so ~$7.5B in a day. Future of electric cars looking bright!

"Reservations for Tesla Model 3 have already passed 150,000, what does it mean? It means that people are ready to buy the good electric cars and Tesla is making the best of them. Who will buy Tesla Motors now to make electric cars for all of us? This opportunity will be paying handsomely back to the shareholders whoever will be able to make this move, we are talking about the first Trillion Market Cap company here. Will it be Apple, Google or Facebook? And do not you worry International Lithium will find enough Lithium for all of us! Read more."

Energy rEVolution And Mass Market For EVs: Lithium On The Rise With Threefold Price Increase In Past 12 Months.

"We are at the very initial stage of our Energy rEVolution, but we have already a full blown shortage of Lithium in China. Now this virus will be spreading very fast into other parts of the world chasing the Lithium Universe and China's leapfrog directly into the 21st century post carbon economy. In China now 28 companies are making 51 models of electric cars, they cannot match Tesla yet, but Elon Musk and his lithium technology are coming to China very soon with Tesla Model 3. We are just at the very beginning of exponential rise for EV sales with GM Bolt and Tesla Model 3 coming out this and next year respectively. Tune on to Tesla Motors on March 31st to see the future. Read more."

Bloomberg:

BYD Co., China’s largest electric car and bus manufacturer, plans to obtain supplies of lithium to guard against spiraling costs of the raw material used in vehicle batteries, amid rising pressure on automakers to lower prices.

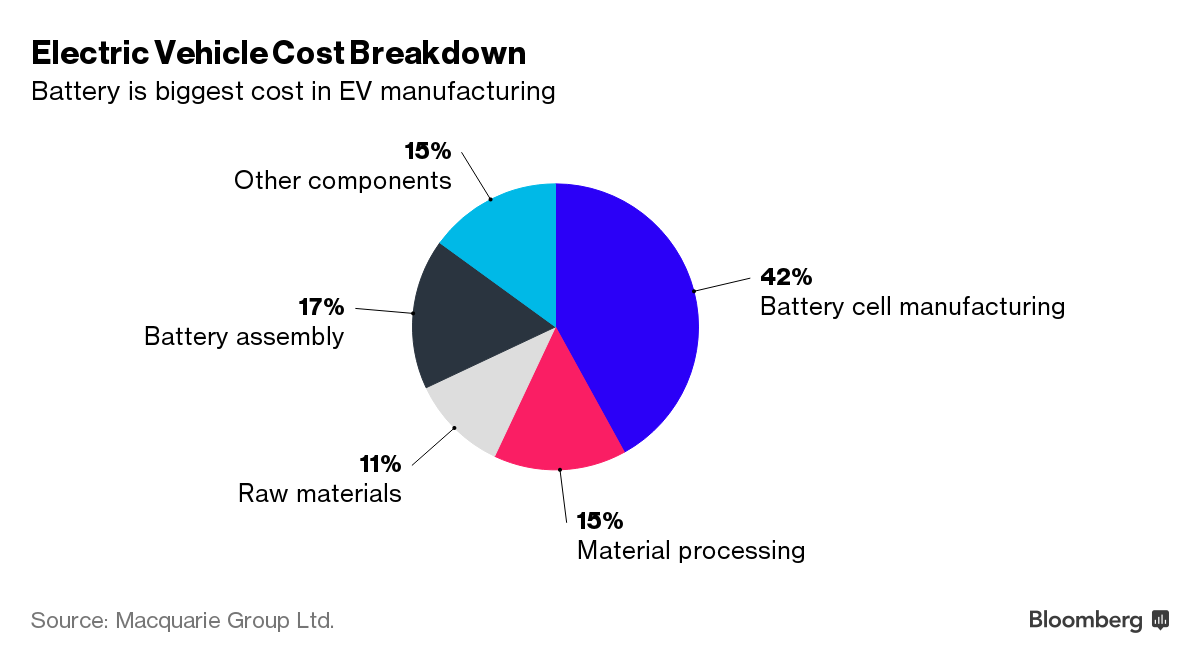

Besides seeking to “get hold of lithium resources,” BYD will also improve designs of its batteries to help lower costs, the company said in an e-mail to Bloomberg News. Macquarie Group Ltd. estimates the power units make up about two-thirds of the cost for BYD’s E6 electric car and K9 bus.

The prices of lithium carbonate -- a key element in lithium-ion batteries -- tripled in China last year and have continued to surge in 2016, according to Asian Metals Inc., an industry consultancy. Prices are rising as Chinese automakers step up their production of new-energy vehicles even as domestic lithium-mining capacity remains restrained.

Curbing component costs is taking on increasing importance as China is said to consider cutting the amount of subsidies for electric buses and imposing a price ceiling for qualifying passenger vehicles. That may put pressure on automakers to rein in expenses to protect their profit margins, according to Cui Dongshu, secretary general of the China Passenger Car Association.

BYD fell as much as 3.4 percent in Hong Kong trading, the biggest intraday decline in more than two weeks. The benchmark Hang Seng Index slid 1.1 percent.

Incentives for electric buses may be cut by an average of 32 percent, with funding for the largest models reduced by as much as 49.5 percent, people familiar with the matter said this week. Electric passenger vehicles costing more than 350,000 yuan ($54,000) also won’t be eligible for government subsidies under the proposal, which is under review and subject to approval by the State Council.

BYD declined to provide details on how it plans to secure access to lithium supplies. Chairman Wang Chuanfu this week forecast the company may sell as many as 150,000 new-energy vehicles this year, compared with the 58,000 it delivered in 2015.

The company is also China’s biggest producer of lithium-iron phosphate batteries, which go into models such as the Tang and Qin sport utility vehicles. In 2011, BYD bought an 18 percent stake in Zhabuye Lithium, a lithium and boron mining company in Tibet, for 202 million yuan ($31 million).

The rising lithium prices have spurred big gains for explorers and miners in Australia. Pilbara Minerals, which is targeting to bring a Western Australia lithium mine to production in 2018, has risen almost 11-fold in the past 12 months in Sydney trading. Chinese producers Sichuan Tianqi Lithium Industries Inc. and Jiangxi Ganfeng Lithium Co.’s stocks have more than doubled in the last year.

“Increased mining capacity and increased materials recycling should minimize the impact of raw material prices on a longer-term basis,” said Janet Lewis, a Hong Kong-based analyst at Macquarie. “The pressure is primarily on the battery makers to reduce their costs.”

Elon Musk

Elon Musk

No comments:

Post a Comment