Ganfeng Lithium has enjoyed the exponential growth in the last years and has grown to the ranks of Top Lithium Producers. It supplies BYD, LG Chem and Panasonic, which supplies cells for Tesla Motors. It became the strategic partner of International Lithium and finances our two lithium J/Vs now in Argentina and Ireland. During the last Shareholder Meeting in China on September 21st Ganfeng has presented latest information on its incredible growth, market share and that security of Lithium Supply is its major concern. You can find more details on Ganfeng Lithium website.

International Lithium: President's Message And Private Placement.

Today I have the opportunity to share with you, finally, the very good news which all our International Lithium Team was working very hard to deliver. It is one of many more to come and a very small token of appreciation of the value that we all have managed to build despite of the total massacre in the junior mining.

We have found new very strong partners who is sharing our vision of the future. This future is already here, it is just unfortunate that not everybody has it noticed. All cars will be electric. Lithium is the magic metal at the very heart of this rEVolution.

International Lithium is plugged into this Next Big Thing with our Team, Projects and Strategic Partners. Now the tide is coming: we have the beautiful boat, very strong Crew seasoned by the storms and today we are putting up our sails.

We are making our financing at the more than double premium to our market price just one month ago: at 8 cents vs 2.5 cents low in August. Any journey is full of uncertainties and risks; and it is always safer to stay on shore. Please read carefully all our legal disclaimers.

Nothing is for certain apart from death and taxes in this world, but we know how to navigate once we are at sea. And today I am pleased to share with you our destination:

International Lithium Corp. - A Green-Energy Metals Company.

"I have written extensively about International Lithium and our strategic partner Ganfeng Lithium. Our J/Vs in Argentina and Ireland are financed by this giant from China and we have very important access to the technology. Basically we are building the secure supply chain for Ganfeng Lithium using their expertise in raw materials needed for production of battery grade lithium from the very beginning. Our brine bulk sample from Mariana is being tested at Ganfeng state-of-the-art R&D facilities in China and in Ireland we have identified 22 exploration targets. Now, according to our latest NR, we are waiting for the approval of the budgets for both projects to be rapidly advanced after very encouraging results were received from the last exploration stage this year.

Today I would like to show you another side of International Lithium. We have the very strong technical team headed by our CEO Gary Schellenberg. Anthony Kovac - our COO and John Harrop - our VP of Exploration are among very few top level exploration managers and geologists in lithium sector. This Team depth has allowed International lithium to attract Ganfeng and strike two major J/V deals in all our industry. These days we are getting the first fruits of this very hard work. Coming volume shows that market is waking up and we are receiving at least some recognition of the value we have been building all these years.

I am talking a lot about the security of lithium supply and Tesla Lithium Hydroxide Supply Deal is another proof and was noticed by market overnight. Now venture capital is knocking on all doors chasing the upstream supply chain for electric cars and Energy rEVolution.

We have another great project at International Lithium: Mavis Lake Lithium And Tantalum Project which is located in mining friendly Canada in the area with excellent infrastructure and very encouraging initial exploration results with high grade Lithium and Tantalum. It will be our next strategic advance for the company. With J/Vs moving forward we are looking for the strong Strategic Partner to develop this project for the potential supply of this strategic commodity for the ongoing Next Industrial rEVolution. West will wake up one day to the fact that China has managed to control now not only over 90% of REE production, but 75% of Battery Grade Lithium Hydroxide as well.

Security of Supply means exactly this - Security. When the price is taking the second consideration and availability of critical materials is taking the central stage. My personal mission is to make this Security happen for the Western world for real as well, even if this part of the World still lives by HFT rules and Q by Q performance reflecting the coming bonuses. Our Asian friends are beating us all here with the state-level plans looking for The Next Fifty Years and building new strategic industries like Electric Cars in China.

We have Elon Musk, we need more like him, but it is a very good start. Our strategic partner for Mavis Lake is waiting somewhere in between of latest Q performance reviews. If you know the one - you know whom to call. Now I do not have really to explain any more What Is Lithium For - Elon Musk has made the great job and every single Tesla Model S is the best moving ad of the things to come. All cars will be electric and it will be very soon. And by the way any new hard rock mine for Lithium will take 5-7 years to build Lithium brine operations will take 4-5 years at best.

Why International Lithium? You can check presentation above. Read more."

Lithium Investing News:

Top Lithium Producers.

Teresa Matich

For a long time, most of the world’s lithium was produced by an oligopoly of producers often referred to as the “Big 3.” Prior to being acquired by Albemarle (NYSE:ALB), Rockwood Lithium, part of Rockwood Holdings (NYSE:ROC), was on that list. The other members of the club were Chile’s Sociedad Quimica y Minera de Chile (NYSE:SQM) and FMC (NYSE:FMC), which operates in Argentina.

Those companies still produce the majority of the world’s lithium, but China continues to take a huge chunk out as well. China was the third-largest lithium-producing country last year in terms of mined production, according to the US Geological Survey, following Australia and China. More importantly, however, Australia does not currently produce lithium chemicals, and China is producing more and more of them.

Even though Australia narrowly beat out Chile last year in terms of mined production, its largest mine, the Greenbushes lithium project, is majority controlled by China’s Tianqi Group. Tianqi owns a 51-percent interest in Talison Lithium, which runs the mine, while Albemarle now owns a 49-percent stake in the company via its acquisition of Rockwood.

As Industrial Minerals (subscription required) reported recently, Sichuan Tianqi Lithium Industries (SZSE:002466) and Jiangxi Ganfeng Lithium (SZSE:002460) saw their 2015 H1 profits surge compared to the same period in 2014.

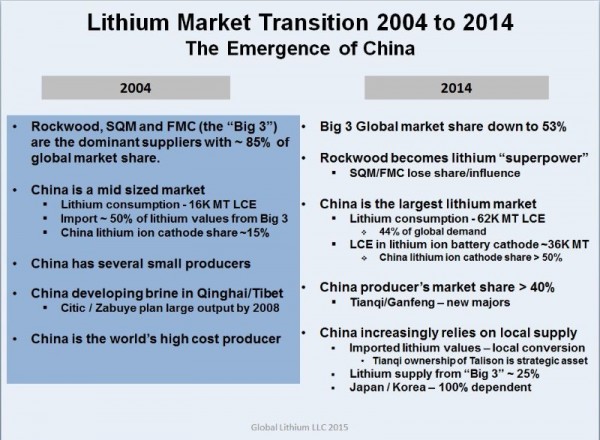

Lithium expert Joe Lowry has written extensively about China’s rising share of the lithium market. The graphic below outlines how the global lithium space has changed over the past decade or so:

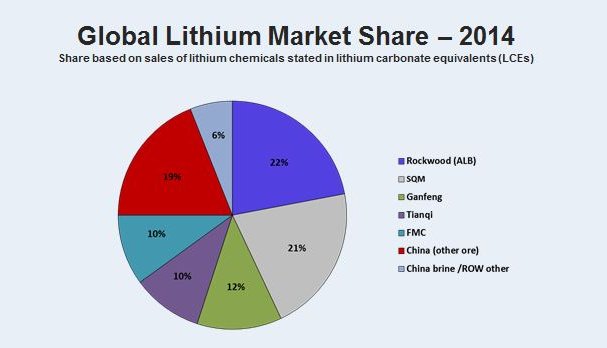

The market share for the “Big 3” has dropped from about 85 percent to 53 percent, while China now has about 40 percent of the world’s market share. Lowry has also created a more detailed breakdown of the global lithium market share, with Tianqi, Ganfeng and other sources of Chinese production clearly being significant:

In other words, lithium investors need to be keeping an eye on China, as well as on the New York-listed chemical companies that produce lithium. Here’s a look at some of the world’s largest lithium producers.

Albemarle

When Albemarle closed its acquisition of Rockwood Holdings and Rockwood Lithium earlier this year, it became the heavyweight in the lithium space. The company’s net sales for lithium were approximately $241 million for the first half of 2015, well above what was reported by SQM and FMC. Lowry calls Albemarle the lithium superpower.

The company owns lithium brine operations in the US and Chile, and, as mentioned above, it owns a 49-percent stake in the massive hard-rock Greenbushes mine Australia. Albemarle said this September that it has plans to up its battery-grade lithium production with the addition of a new plant using feed from Greenbushes. It is unclear just how much production would be added, and the company has not yet decided where the plant will be built.

The company also produces bromine and other performance chemicals, and has refining solutions and Chemetall surface treatment business segments as well. Lithium made up approximately 15 percent of Albemarle’s core business revenues for the last financial year.

SQM

Revenues from lithium and derivatives for the first half of 2015 came in at US$100.4 million for SQM, down 3.6 percent compared to the same period in 2014. The company stated that its lithium business accounted for approximately 17 percent of its gross profit margin for the first half of the year.

Beyond its lithium business, SQM is also a significant potash producer and the world’s largest producer of iodine.

The company has faced some challenges in 2015. Although it has said that two bouts of heavy rains and an earthquake did not affect its operations, the company did halt operations as a preventative measure. Furthermore, it has continued to butt heads with Chile’s Corfo over its leases in the Atacama, where the company’s brine operations are located.

Finally, earlier this year, the company got some unwanted attention as part of a broader probe into into bribery and tax evasion in Chile, leading the company’s CEO to resign and to three directors representing Potash Corp of Saskatchewan (TSX:POT) leaving the company as well.

FMC

FMC, which operates its lithium business in the Salar del Hombre Muerto in Argentina, reported lithium segment revenues of $110.9 million for the first half of 2015, with earnings coming in at $10.1 million.

The company saw positive price and demand trends for the mineral, but stated that lower sales volumes of lithium carbonate and lithium chloride had put a dent in things. Unfavorable foreign currency exchange impacts in Argentina didn’t help matters either.

In addition to its lithium business segment, FMC also has health and nutrition and agricultural solutions businesses.

FMC announced in September that it would raise lithium prices by 15 percent for most of its lithium products, including lithium carbonate, lithium chloride and lithium hydroxide. It will raise prices for its specialty organics products by $3.50 per kilogram.

Sichuan Tianqi Lithium

Tianqi Lithium is a subsidiary of Chengdu Tianqi Group, headquartered in Chengdu, China. The company states that it has been focused on advancing its entire lithium processing chain in regards to securing a large share of the lithium battery market. It is the world’s largest hard-rock-based lithium producer.

Tianqi beat out Rockwood Holdings to take control of Talison Lithium, which owns the Greenbushes mine in Australia, in 2012. However, it subsequently sold a 49-percent interest in the company to Rockwood, which is now owned by Albemarle.

Jiangxi Ganfeng Lithium

Ganfeng Lithium is another important Chinese lithium producer that investors should be keeping an eye on. Headquartered in Xinyu, China, the company is China’s second-largest lithium producer.

Like Tianqi, Ganfeng is also buying up interests in lithium companies outside of China. It owns a 14.7-percent stake in junior lithium company International Lithium (TSXV:ILC), and recently signed a MOU for an offtake agreement with Australia’s Reed Industrial Minerals, owned by Neometals (ASX:NMT) and Mineral Resources (ASX:MIN).

Furthermore, Lowry has said that Chinese lithium producers are becoming much more significant as suppliers to the global lithium ion-battery market. China now produces more cathode for lithium-ion batteries than Japan and Korea combined.

Tesla Motors’ (NASDAQ:TSLA) supply chain has gotten plenty of focus from the press, but it’s worth remembering that, at least for now, the cathode for Tesla’s batteries is made in Japan. According to Lowry, the lion’s share of lithium hydroxide exports from China to Japan go to Sumitomo Metal Mining, which makes nickel-cobalt-aluminum (NCA) cathodes for Panasonic (TSE:6752), the maker of battery cells for Tesla (NASDAQ:TSLA).

As a final note, while Tesla is certainly a major demand driver for the lithium space, Lowry believes that Tesla tends to obscure demand growth in China.

Certainly, China is not only a heavyweight in terms of production, but is also big for demand as well. The country has had significant growth in cathode going to all segments of the battery market, including consumer electronics, grid storage and transportation applications such as e-bikes and buses.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article."

No comments:

Post a Comment