Argentinian president Alberto Fernandez, cabinet ministers and Ganfeng Lithium executives.

(Image by the Argentina President’s Office).

Redimin:

Argentina: The Ganfeng Lithium Company Begins the Construction of the Mariana Project in the Puna

The Project is located in the Salar de Llullaillaco in Salta, foresees an investment of 600 million dollars and will generate more than 1,000 jobs during the construction phase.

Last Monday, the construction of the Mariana Project was officially inaugurated, with the presence of the vice president of Ganfeng Lithium, Xiaoshen Wang, and the CEO and president of Litio Minera Argentina SA, Jason Luo, who, together with the governor of Salta, Gustavo Sáenz, led the start of the construction of the project, with a simultaneous transmission via streaming, from the base of operations in the Puna of Salta. At the end of the week, the company authorities met with President Alberto Fernández; the Minister of Productive Development, Matías Kulfas, and the Secretary of Mining, Fernanda Ávila, at Casa Rosada. Both Fernández and Sáenz highlighted the start of the project as a milestone for the province and the region.

The Mariana Project is 100% owned by Ganfeng and is located in the Salar de Llullaillaco in Salta, about 430 kilometers from the city of Salta, and 95 km from Tolar Grande.

In June 2021, Litio Minera Argentina SA received approval from the Salta Mining Secretariat of the Environmental Impact Report for the construction of 1,700 hectares of evaporation ponds and two brine processing plants. This work will constitute the largest extension of brine pools that currently exists in the province. The design is differentiated by the construction of the pools on the surface of the salar without using external input material, at a very high water table, close to the surface. The on-site process has the high complexity of working with forced evaporation to minimize brine concentration times.

Xiaoshen Wang explained that the company will make an investment of close to 600 million dollars in the province, including this project in its entirety and a plant to process concentrated lithium brine, to be built in the General Gemes Industrial Park. According to the feasibility studies, they estimate annual production of 20 thousand tons of lithium chloride (LiCl).

The transfer of the concentrated brine from the Mariana Project to Gemes will be carried out through tanks-containers that will give flexibility to the process. The most distinguished thing about the process at the Gü emes plant is that it was designed to have zero liquid effluents, reusing all currents for the preparation of reagents.

Sustainability

Wang expressed: “Our mission is to use lithium resources to create a green, clean and healthy life for human development and progress, accelerate automobile electrification and renewable energy to reduce carbon footprint, making our world much more sustainable". The construction of an environmentally friendly project stands out, an off-grid solar park with 120 MW of solar panels and 288MWp of battery storage with a planned expansion to 150MW of solar panels and 360MWp of battery storage exclusively produced by Ganfeng. In this sense, Wang emphasized that "this will be the first lithium project in the world that will use 100% renewable energy, and the largest off-grid solar park in the region."

The system is designed to respect and comply with international standards in quality, energy-saving and care for the environment, and has the capacity to supply the various operating facilities and a camp for approximately 500 people.

“Our technical skills, industry knowledge and market dominance support us in building lithium plants in an environmentally friendly way and recovering lithium in the most efficient way,” said Jason Luo, highlighting the energy use of solar to complete the extraction of resources and the selection of water resources that do not meet human consumption standards and which will be reused.

At this point, the vice president of Ganfeng mentioned that the Mariana project is distinguished by the decision to preserve the salt flat as a complex environmental system. Consequently, the operations and facilities were planned from a robust and studied environmental basis, respecting the vegetation, flora, fauna, limnology, water, soil, air and archaeology, in order to protect the sites of greatest biological importance. “At Ganfeng we understand how important it is to have sustainable growth, boost the local economy and contribute to the community.” He said.

Employment

“The Mariana project will create more than 1,000 construction jobs and 455 permanent jobs during operation. We are working to provide equal opportunities for both genders, offering more training to communities to create a larger pool of local talent," Wang said.

He also explained that, from the beginning of the activities in the different projects, the company made local contracts, carrying out searches from nearby communities and expanding it to other localities and departments of the Province. “We assume essential actions such as the safety of our workers, anti-corruption policies and gender equality, with 23% of women currently hired, 40% of them in hierarchical positions.” finished.

A commitment to community relations

Relations with communities are key, highlighting cooperation with municipal and provincial authorities and private institutions, and fundamentally, dialogue. Promoting local culture and moving towards a sustainable future by fostering employability, the development of local providers, the continuity of cultural practices, and physical and mental health care.

Xiaoshen Wang, Gustavo Sáenz and Jason Luo, at the inauguration of the Mariana Project in Salta.

Xiaoshen Wang, Gustavo Sáenz and Jason Luo, at the inauguration of the Mariana Project in Salta.The first producer of lithium metals

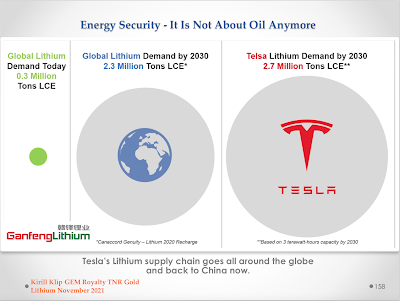

Ganfeng Lithium was born in the year 2000 and has become the first producer of lithium metals and the second producer of lithium compounds worldwide. With more than 328 experts in research and development, the company has a complete circuit in the entire lithium industry chain (electric vehicles, energy storage, consumer electronics, chemical industry, and pharmaceutical industry among other applications).

Since its origin, Ganfeng has spread to 5 continents. With operations in China, Australia, Ireland, Mexico, Mali and Argentina, three projects are currently being managed in our country including Cauchari in Jujuy, and Mariana and Incahuasi in Salta, making Argentina one of the most important lithium mining bases for Ganfeng Lithium.

Source: The Tribune" (Translated by Google)