Vancouver, British Columbia – June 26, 2023: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce that McEwen Mining Inc. (“McEwen Mining”) has provided an update on the Los Azules copper, gold and silver project in San Juan, Argentina. TNR holds a 0.4% net smelter returns royalty (“NSR Royalty”) (of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder) on the Los Azules Copper Project. The Los Azules project is held by McEwen Copper Inc. (“McEwen Copper”), a subsidiary of McEwen Mining.

The news release issued by McEwen Mining stated:

“McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to provide results of the updated Preliminary Economic Assessment (the “2023 PEA”) on the Los Azules Copper Project in San Juan Argentina (the “Project”). Los Azules is 100% owned by McEwen Copper Inc., which is 52% owned by McEwen Mining.

The PEA includes an updated independent mineral resource estimate, which increased to 10.9 billion (B) lbs. Cu (Indicated, grade 0.40%) and 26.7 B lbs. Cu (Inferred, grade 0.31%)

Base Case Highlights (Open-pit, Heap Leach, SX/EW, Nameplate capacity of 175 ktpa Cu Cathodes):

- Average annual copper (Cu) cathode production of 401 million lbs. (182,100 tonnes) during the first 5 yearsof operation, and 322 million lbs. (145,850 tonnes) over the 27-year life of the mine (LOM)

- Total Cu recoverable to cathode of 68 billion lbs. (3.94 million tonnes), based on the LOM extraction of mineralized material containing approximately 11.90 billion lbs.of total Cu (5.40 million tonnes), and average copper recovery of 72.8%

- After-tax net present value (NPV8%) of $2.659 billion (1), internal rate of return (IRR) of 2%,and a payback period of 3.2 years – at $3.75 per lb. Cu.

- Initial capital expenditure of $2.462 billion, and a project capital intensity of $7.66 per lb.Cu ($16,880 per tonne Cu)(2)

- Average C1(2)cash costs of $1.07 per lb. Cu and all-in sustaining costs(2) of $1.64 per lb. Cu (AISC Margin of 56%)(2)

- Average EBITDA(3)per year of $1.101 billion (Years 1-5) and $692 million (Years 6-27)

- Estimated carbon intensity of 670 kg CO2 equivalent per tonne of Cu (CO2-e/t Cu) (4) for Scope 1&2 GHG Emissions, well below the industry average of 1,980kg CO2-e/t Cu (5). McEwen Copper’s goal at Los Azules is to be carbon neutral by 2038, a target which is achievable through the use of emerging technologies and offsets

- Estimated site-wide water consumption of 137 liters per second (L/s) from years 1 to 10, increasing to 163 L/s from years 11 to 27, this compares to approximately 600 L/s (6) for a conventional mill producing copper concentrate

- 182 billion tonnes of mineralized material placed on heap leach pad with in-situ total copper grade of 0.46% and in-situ soluble copper grade of 0.31% (7)

The 2023 PEA Technical Report is prepared in accordance with the requirements set forth by Canadian National Instrument 43-101 (“NI 43-101”) for the disclosure of material information and is intended to meet the requirements of a Preliminary Economic Assessment (PEA) level of study and disclosure as defined in the regulations and supporting reference documents. The effective date of the report is May 9, 2023. All currency shown in this report is expressed in Q1 2023 United States Dollars unless otherwise noted.

This study is preliminary in nature and includes 26% inferred mineral resources in the conceptual mine plan. Inferred mineral resources are considered too speculative geologically and in other technical aspects to enable them to be categorized as mineral reserves under the standards set forth in NI 43-101. There is no certainty that the estimates in this PEA will be realized.

Study Contributors

The 2023 PEA technical report was prepared by Samuel Engineering Inc., with contributions from Knight Piésold Consulting, Stantec Consulting International Ltd, McLennan Design, Whittle Consulting Pty Ltd, and SRK Consulting UK Limited under the supervision of David Tyler, McEwen Copper Project Director. The 2023 PEA technical report has been filed on SEDAR and on the Company’s website.

2023 PEA vs 2017 PEA

The base case development strategy selected in the 2023 PEA is distinctly different from that presented in the prior PEA published in 2017. In 2017, the strategy was to construct a mine with a conventional mill and flotation concentrator producing a concentrate for export to international smelters. The 2023 PEA proposes a heap leach (leach) project using solvent extraction-electrowinning (SX/EW) to produce copper cathodes (LME Grade A) for sale in Argentina or international markets. There are three principal reasons why the implementation strategy was changed to leach in the 2023 PEA:

- Environmental Footprint: Fresh water consumption is reduced by approximately75% (150 vs. 600 L/s). Electricity consumption is reduced by approximately 75% (57 vs. 230 MW). GHG emissions are reduced by approximately 57% (670 vs. 1,560 CO2-e/t Cu Scope 1&2), with paths to further reductions by implementing new technologies, with the goal of reaching net-zero carbon by 2038 with some offsets. Los Azules copper cathodes will thus be attractive to end-users seeking to measurably reduce their upstream environmental impacts.

- Reduced Permitting Risk: When proposing any mega-project development, it is vital to understand the local standards and sensitivities around permitting. The Project uses technology (heap leach) that is in operation in San Juan today. It also eliminates tailings and tailings dams, conserves scarce water resources, and reduces the overall complexity of the mine, optimizing the permitting process.

- Producing Cathodes: The leach process produces LME Grade A copper cathodes, which can be directly used in industry, including within Argentina reducing export taxes. This eliminates reliance on 3rdparty foreign smelters for the processing of concentrates into refined copper products. It also eliminates significant GHG emissions associated with transportation, and pollution associated with smelting. Counterparty and pricing risks are also reduced.

McEwen views the progress made with the 2023 PEA towards reducing our environmental footprint and greater environmental and social stewardship sets the Project apart from other potential mine developments, which appropriately justifies certain economic trade-offs. The primary trade-offs to achieve these environmental benefits is lower overall copper recovery, slightly higher unit costs, and less immediate cashflow due to extended leach cycles. Nevertheless, the leach project remains very robust. Furthermore, McEwen believes that some of these drawbacks can be mitigated by implementing developing technologies such as Nuton™, discussed below.

Property Description

The Los Azules deposit is a classic Andean-style porphyry copper deposit. The large hydrothermal alteration system is at least 5 kilometers (km) long and 4 km wide and is elongated in a north-northwest direction along a major structural corridor. The Los Azules deposit area is approximately 4 km long by 2.2 km wide and lies within the alteration zone. The limits of the mineralization along strike to the North and at depth have not yet been defined. Primary or hypogene copper mineralization extends to at least 1,000 meters (m) below the surface. Near surface, leached primary sulfides (mainly pyrite and chalcopyrite) were redeposited below the water table in a sub-horizontal zone of supergene enrichment as secondary chalcocite and covellite. Hypogene bornite appears at deeper levels together with chalcopyrite. Gold, silver, and molybdenum are present in small amounts, but copper is the economic driver at Los Azules.

A New Vision and Approach

We developed regenerative guiding principles to reframe the approach to sustainable innovation and set forth high-reaching goals that explore all facets of the mining processes considered for Los Azules. The project development seeks to significantly reduce the environmental footprint of mining operations and their associated GHG emissions by integrating the latest renewable and environmentally responsible technologies and processes. The Project aims to obtain 100% of its energy from renewable sources (wind, hydro, and solar) in a combination of offsite and onsite installations. The Project is also seeking to have long-term net positive impacts on the greater Andean ecosystem, local flora and fauna, the lives of miners, and of the other citizens of nearby communities, while contributing positively to the local and national economy of Argentina. Refer to the full 2023 PEA Technical Report for more information about our regenerative approach.

Metal Price Assumption

The copper price use in the 2023 PEA was $3.75 per pound (except for the mineral resource estimate), in line with analysts’ consensus projections for long-term copper prices that range between $3.25 and $4.25 per pound, with a mean price of $3.75 per pound.

Study Highlights

This 2023 PEA development strategy begins with processing of resources associated with the oxide and supergene copper mineralization in the near surface portion of the deposit using heap leaching methods. This approach results in low average C1 costs of $1.07 per lb. Cu ($0.88 per lb. in the first 8 years) and an attractive 3.2-yearpayback period. Copper cathode production during the first 5 years of operation averages 401 million lbs. per year (182 ktpa), and average over the 27-year LOM is 322 million lbs. per year (146 ktpa).

A nominal copper cathode production capacity of 385 million lbs. per year (175 ktpa) is met or exceeded during the first 11 years of mining and was selected as the Base Case, with a smaller Alternative Case presented at 275 million lbs. per year (125 ktpa) of copper cathodes. The 2023 PEA financial model does not include potential future development phases focused on primary copper mineralization found beneath the supergene copper layer but some of these opportunities are discussed in the report, including the potential of deploying Nuton™ technologies.

The processing facility will function through to the completion of mining in Year 23 with stockpile reprocessing and residual leaching operations to Year 27. Mining operations ramp up over the proposed mine life from approximately 80 million total tonnes per year to 150 million tonnes per year through the life of the project as copper grades decrease, and material movements increase.

Summary results for the Base Case and Alternative Case are provided in Table 1.

| Table 1: Summary Results |

| Project Metric | Units | Base Case 175 ktpa | Alternative Case 125 ktpa |

| Mine Life | Years | | 27 | | | 32 | |

| Tonnes Processed | Billion tonnes | | 1.182 | | | 1.182 | |

| Tonnes Waste Mined | Billion tonnes | | 1.366 | | | 1.366 | |

| Strip Ratio | | | 1.16 | | | 1.16 | |

| Total Copper Grade | % Cu | | 0.457% | | | 0.457% | |

| Soluble Copper Grade (CuSOL) | % CuSOL | | 0.311% | | | 0.311% | |

| Copper Recovery (Total Copper) | % | | 72.8% | | | 72.8% | |

| Soluble Copper Recovery(8) | % | | 107% | | | 107% | |

| Copper Production (LOM avg.) | tonnes/yr | | 145,820 | | | 123,060 | |

| Copper Production (Yr 1-5) | tonnes/yr | | 182,100 | | | 136,100 | |

| Copper Production – cathode Cu | ktonnes | | 3,938 | | | 3,938 | |

| Initial Capital Cost | USD Millions | $2,462 | | $2,153 | |

| Sustaining Capital Cost | USD Millions | $2,243 | | $2,351 | |

| Closure Costs | USD Millions | $180 | | $180 | |

| C1 Cost (Life of Mine) | USD/lb Cu | $1.07 | | $1.11 | |

| All-in Sustaining Costs (AISC) | USD/lb Cu | $1.64 | | $1.67 | |

| Before Taxes | | | |

| Net Cumulative Cashflow | USD Millions | $15,820 | | $15,679 | |

| Internal Rate of Return (IRR) | % | | 26.5% | | | 22.9% | |

| Net Present Value (NPV) @ 8% | USD Millions | $4,436 | | $3,278 | |

| After Taxes | | | |

| Net Cumulative Cashflow | USD Millions | $10,240 | | $10,159 | |

| Internal Rate of Return (IRR) | % | | 21.2% | | | 18.4% | |

| Net Present Value (NPV) @ 8% | USD Millions | $2,659 | | $1,929 | |

| Pay Back Period | Years | | 3.2 | | | 3.4 | |

Sensitivity Analysis

The Base Case project economics are reasonably robust (>15% post-tax IRR) at a copper price above $3.00 per pound and are similarly resistant to an increase in LOM capital expenditure of up to 30% and an increase in operating expenses of up to 60%. Table 2 below shows the sensitivity of the Base Case project economics to the Copper Price (+/- 20%) on a post-tax basis. The project NPV8% is breakeven at a copper price of $2.34 per pound.

| Tables 2: Base Case (175 ktpa) Copper Price Sensitivity |

| Sensitivity (%) | Metal Pricing | Post-Tax |

| Copper Price | NPV | IRR | Payback |

| $ Cu/lb | $M | % | Years |

| -20% | $3.00 | $1,277 | 15% | 5.48 |

| -15% | $3.19 | $1,624 | 17% | 4.84 |

| -10% | $3.38 | $1,969 | 18% | 4.24 |

| -5% | $3.56 | $2,314 | 20% | 3.68 |

| 0% | $3.75 | $2,659 | 21% | 3.18 |

| 5% | $3.94 | $3,003 | 23% | 2.90 |

| 10% | $4.13 | $3,346 | 24% | 2.75 |

| 15% | $4.31 | $3,689 | 25% | 2.61 |

| 20% | $4.50 | $4,032 | 27% | 2.49 |

Table 3 below show the sensitivity of the Base Case project economics to initial and sustaining capital expenditure escalation on a post-tax basis.| Table 3: Base Case (175 ktpa) Initial & Sustaining CAPEX Sensitivity |

Sensitivity

(%) | Post-Tax |

| NPV | IRR | Payback |

| $M | % | Years |

| 0 | | $2,597 | 21% | | 3.18 |

| 5% | | $2,484 | 20% | | 3.54 |

| 10% | | $2,372 | 19% | | 3.94 |

| 15% | | $2,260 | 18% | | 4.25 |

| 20% | | $2,148 | 17% | | 4.56 |

| 25% | | $2,036 | 17% | | 4.88 |

Table 4 below show the sensitivity of the Base Case project economics to operating expenditure escalation on a post-tax basis.| Table 4: Base Case (175 ktpa) OPEX Sensitivity |

Sensitivity

(%) | Post-Tax |

| NPV | IRR | Payback |

| $M | % | Years |

| 0 | | $2,597 | 21% | | 3.18 |

| 5% | | $2,496 | 21% | | 3.28 |

| 10% | | $2,396 | 20% | | 3.38 |

| 15% | | $2,295 | 20% | | 3.49 |

| 20% | | $2,195 | 19% | | 3.62 |

| 25% | | $2,095 | 19% | | 3.75 |

Capital Costs Estimates

The Project includes the development of an open pit mine with muti-stage crushing and screening, a heap leach pad, and a copper solvent extraction-electrowinning (SX/EW) facility with a nominal production capacity of 175 ktpa copper cathodes. There is also a sulfuric acid plant and other associated infrastructure to support the operations. Initial capital infrastructure for the Base Case includes the following facilities:

- Mine development and associated infrastructure

- Coarse rock storage and handling (crushing, conveying, agglomeration)

- Heap leach pads and conveyor stacking systems

- SX/EW facility

- Sulfuric acid plant

- On-site utilities and ancillary facilities including a construction camp

- Off-site infrastructure: power transmission line (outsourced), access roads, and permanent camp

The project initial capital costs are based on budgetary quotes for major equipment, recent in-house cost information and installation factors, and regional contractor inputs and facilities obtained between Q4 2022 and Q1 2023. The capital costs for the project are summarized in Table 5 and should be viewed with the level of accuracy expected for a preliminary analysis.

The approximate construction cost of the 132 kV power supply line to site is $155 million and has not been included in the capital estimate because it is assumed that YPF Luz, a large Argentinean power utility company, will be constructing the line at their expenses pursuant to a long-term renewable power purchase agreement.

| Table 5: Initial Capital Costs by Case |

| Capital Cost | Base Case | Alternative Case |

| 175k tpa Cu ($) | 125k tpa Cu ($) |

| Mining | $65,600,000 | $65,600,000 |

| Ore Storage & Handling | $234,500,000 | $192,500,000 |

| Heap Leaching | $158,500,000 | $142,100,000 |

| SX/EW Facilities | $250,400,000 | $167,700,000 |

| Acid Plant | $94,900,000 | $79,900,000 |

| Ancillary Facilities | $23,300,000 | $23,300,000 |

| Site Development & Yard Utilities | $126,300,000 | $112,200,000 |

| Off-Sites | $167,400,000 | $167,400,000 |

| Total Direct Costs | $ 1,120,900,000 | $ 950,700,000 |

| Common Indirect Costs | $ 379,200,000 | $ 323,800,000 |

| Owners Costs | $ 466,700,000 | $ 455,900,000 |

| Subtotal | $ 1,966,800,000 | $ 1,730,400,000 |

| Contingency | $495,000,000 | $423,100,000 |

| Total Capital Cost | $ 2,461,800,000 | $ 2,153,500,000 |

Operating Costs Estimates

Table 6 summarizes the LOM project operating costs per tonne of material processed and per pound of copper produced.

| Table 6: LOM Cash Costs |

| | Base Case

175 ktpa | Alternative Case

125 ktpa |

| Description | LOM

Cost/tonne ($) | LOM

Cost/lb. ($) | LOM

Cost/tonne ($) | LOM

Cost/lb. ($) |

| Mining | 4.14 | 0.56 | 4.27 | 0.57 |

| Processing | 2.73 | 0.37 | 2.74 | 0.37 |

| General & Administrative | 0.94 | 0.13 | 1.11 | 0.15 |

| Selling Expenses | 0.15 | 0.02 | 0.15 | 0.02 |

| LOM C1 Costs | 7.96 | 1.07 | 8.27 | 1.11 |

Royalties and Taxes

The 2023 PEA includes all government and private royalties on production, export taxes, as well as income taxes and banking taxes. Royalty calculations vary, however royalties and retentions based on net smelter return (NSR) total approximately 9.2%. In the financial model it was assumed that 10,000 tonnes per year of copper cathodes are sold within Argentina and consequently they are not subject to export taxes. 95% of VAT is assumed to be recoverable after two years. A 0.2% portion of the bank tax is recoverable in the following year.

| Table 7: Royalties and Taxes (All Cases) |

| Income Tax | Argentine Corporate Income | % Profit | 35 % | |

| VAT Taxes | Argentine Value Added Tax | % on Capital | 10.5 % | |

| % on Operating | 21 % | |

| Royalties | San Juan Province | % “Mine Mouth” | 3 % | |

| TNR Royalty | % NSR | 0.4 % | |

| McEwen Mining Royalty | % NSR | 1.25 % | |

| Export Retentions | Argentine Export Retention | % NSR | 4.5 % | |

| Bank Tax | Debit and Credit Bank Tax | % on Operating | 1.2 % | |

Nuton OpportunityNuton LLC is a copper heap leaching technology venture of Rio Tinto that became a strategic partner in 2022. Its Nuton™ suite of proprietary technologies provide opportunities to leach both primary and secondary copper sulfides, providing significant opportunity to optimize the mine plan and the overall mining and processing operations. In addition, Nuton™ provides significant other benefits, such as lower overall energy consumption, allowing earlier conversion to renewable energy sources, and lower water consumption than conventional sulfide mineralization treatment processes.

Based on preliminary scoping testing, Nuton™ technologies offer the potential for copper recoveries of more than 80% from predominantly chalcopyrite, depending on the specific mineralogy make-up of the mineral resource. At Los Azules, Nuton™ has the potential to economically process the large primary sulfide copper resource as an alternative to a concentrator, with low incremental capital following the oxide and supergene leach, no tailings requirement, and a smaller environmental footprint. Producing copper cathode with Nuton™ on-site also has the advantage of simplifying outbound logistics for copper concentrates and offers a finished product to the domestic and international market.

The outcomes modelled using the Nuton proprietary computational fluid dynamics model, are very encouraging and indicate that unoptimized copper recovery to cathode from primary material should range from 73% to 79%. Furthermore, Nuton recovery from secondary material is high, ranging from 80% to 86%. This could provide a significant opportunity to optimize the mine plan and the need for selective mining, as simultaneous stacking of both secondary and primary mineralization will not impact on the copper recovery from either material type. Based on the current resource estimate, this could have a significant positive impact on the expected life of the mine, without significantly increasing the initial capital investment required.

Nuton is currently validating modelled data with column leach tests. Column leaching of the composite samples at their facilities is underway and expected to be completed in Q1 2024. Validation of the modelled results could be obtained much sooner, depending on the trends provided by the actual column leach results.

McEwen Copper does not currently have a commercial arrangement with Nuton that enables it to deploy their technologies at Los Azules, and there is no guarantee that such an agreement will come to fruition, however McEwen Copper and Nuton intend to work in good faith toward such an arrangement. The results in Table 8 below assume that Nuton™ technologies are implemented without including costs associated with technology licensing or some other commercial cost structure.

| Table 8: Nuton™ Opportunity Economic Summaries |

| Project Metric | Units | Base Case-Nuton

175 ktpa |

| Mine Life | Yr | 39 |

| Strip Ratio | | 1.43 |

| Tonnes Processed | Billion tonnes | 1.737 |

| Copper Grade (Total) | % Cu | 0.409 |

| Copper Production – cathode Cu | ktonnes | 6,411 |

| Initial Capital Cost | USD Millions | $2,444 |

| Sustaining Capital Cost | USD Millions | $2,793 |

| C1 Cost (Life of Mine) | USD/lb Cu | $1.04 |

| All-in Sustaining Costs (AISC) | USD/lb Cu | $1.54 |

| After Taxes | | |

| Internal Rate of Return (IRR) | % | 23.9% |

| Net Present Value (NPV) @ 8% | USD Millions | $3,701 |

| Pay Back Period | Yr | 2.7 |

Project Development ScheduleThe Gantt chart below presents a conceptual project development timeline based on regional contractor inputs and long-lead equipment and materials delivery assumptions provided by vendors. The schedule assumes that the feasibility study work is completed by the end of 2024, finalization of the environmental permitting process (IIA/DIA) and other necessary permits to begin work are completed during the proposed feasibility study and preliminary timeframe and financing are in place to achieve the scheduled milestones. Following this conceptual schedule, the SX/EW plant start-up could occur in Q1 2029.

McEwen Copper Capital Structure

McEwen Copper is a Canadian-based private company with 28,885,000 common shares issued and outstanding. Its current shareholders are McEwen Mining Inc. 51.9%, Stellantis 14.2%, Nuton 14.2%, Rob McEwen 13.9%, Victor Smorgon Group 3.5%, other management and shareholders 2.3%.

Updated Mineral Resource Estimate

The database for resource estimation has a cutoff date December 31 st , 2022. An additional 22,252 m of drilling (mostly infill) from 49 holes, completed in 2023 to date, were not included in the resource estimate.

The mineral resources have been classified according to guidelines and logic summarized within the Canadian Institute of Mining, Metallurgy and Petroleum (CIM 2019) Definitions referred to in NI 43-101. Resources were classified as Indicated or Inferred by considering geology, sampling, and grade estimation aspects of the model. For geology, consideration was given to the confidence in the interpretation of the lithologic domain boundaries and geometry. For sampling, consideration was given to the number and spacing of composites, the orientation of drilling and the reliability of sampling. For the estimation results, consideration was given to the confidence with which grades were estimated as measured by the quality of the match between the grades of the data and the model.

Mineral resources are determined using an NSR cut-off value to cover the processing cost for each recovery methodology. For supergene and primary material using sulfuric acid leaching and SX/EW recovery the cutoff was $2.74/t. The supergene and primary material can be treated in a float mill with NSR cutoffs of $5.46/t and $5.43/t, respectively. NSR values are based on a copper price of $4.00/lb, gold at $1,700/oz, and silver at $20/oz, where applicable. Variable pit slopes between 30°and 42° were applied depending on depth.

The current database is adequate for the preparation of a long-range model that serves as the basis for the 2023 PEA. The extent of mineralization along strike exceeds 4 kilometers and the distance across strike is approximately 2.2 kilometers. The deposit is open at depth and to the North. Over the approximately 2.5 km strike length where mineralization is strongest, the average drill spacing is approximately 150 m to 200 m but there are localized areas where drilling is on 100-m spacing. The assay database includes 56,528 m of assay interval data from 162 drillholes. Resource estimation work was performed using Datamine Studio modeling software.

Resources disclosed in Table 9 are reported in two categories related to processing amenability:

1) materials that are suited for processing in a commercially proven conventional, ambient conditions, copper bio-leaching scheme (Leach); and

2) materials that are better suited to processing either in a more advanced bio-leaching scheme such as Nuton™ technologies or traditional milling/concentrator approach (Mill or Leach+).

Table 9 Notes:

- Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant factors.

- The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is expected that further infill drilling will result in upgrading some of this material to an indicated or measured classification.

- Reasonable prospects of eventual economic extraction are demonstrated by using a calculated NSR value in each block to evaluate an open pit shell using both Indicated and Inferred blocks in Geovia Whittle™ pit optimization software.

- NSR was calculated using the following: metal prices of $4.00/lb for copper, $1,700/oz. for gold and $20/oz. for silver, processing costs of $4.17/t, total freight costs of $150/t, selling costs of $0.02/lb for copper and a constant recovery of 95% applied.

- An NSR cut-off of $2.74/t was used based on extraction of the resource from the enriched zone using sulfuric acid leaching and SX/EW recovery; 100% of the soluble copper and 15% of the non-soluble copper grade is recovered in the heap-leach method.

- The supergene and primary material can potentially be treated in a mill/concentrator with NSR cut-offs of $5.46/t and $5.43/t respectively. This has the added benefit of also recovering the gold and silver present in the resource. Additional parameters are used for the NSR calculation for this scenario.

- Depending on the potential depth of the pit, total pit slope angles ranged from 42° near surface to 32° below 1000m depth. Overburden slopes were set at 30°.

- Composites of 2 m length were capped where needed; the capping strategy is based on the distribution of grade which varies by location (i.e. domain or proximity to controlling structures) and the associated potential metal removal. The resource estimate is based on uncapped copper grades; local capped grades are used for gold and silver.

- Block grades were estimated using a combination of ordinary Kriging and inverse distance squared weighting depending on domain size.

- Model blocks are 20m x 20m x 15m in size.

End Notes:

(1) All dollar amounts are United States Dollars (USD) unless otherwise stated.

(2) Project capital intensity is defined as Initial Capex ($) / LOM Avg. Annual Copper Production (lbs. or tonnes). C1 cash costs per pound produced is defined as the cash cost incurred at each processing stage, from mining through to recoverable copper delivered to the market, net of any by-product credits. All-in sustaining costs (AISC) per pound of copper produced adds production royalties, non-recoverable VAT and sustaining capital costs to C1. AISC margin is the ratio of AISC to gross revenue. Capital intensity, C1 cash costs per pound of copper produced, AISC per pound of copper produced, and AISC margin are all non-GAAP financial metrics.

(3) Annual earnings before interest, taxes, depreciation, and amortization (EBITDA). EBITDA is a non-GAAP financial measure.

(4) Kilograms of Carbon Dioxide Equivalent per tonne of Copper Equivalent produced. Carbon Dioxide Equivalent means having the same global warming potential as any another greenhouse gas.

(5) Wood Mackenzie Limited average Scope 1&2 emissions intensity for 394 assets during the period between 2022 and 2040.

(6) 2017 NI 43-101 Technical Report on Los Azules Project, Hatch Engineering (Throughput of 120,000 tpd of mineralized material).

(7) The sequential assay method used at Los Azules for both the resource assay and metallurgical programs provides an indication of the copper mineralization present in the form of acid soluble copper and cyanide soluble copper, both assays combined provide an approximation for ‘soluble’ copper.

(8) Soluble copper recovery exceeding 100% implies partial leaching of material which was not categorized as “soluble” based on the sequential assaying method and data available.

Qualified Persons

Technical aspects of this news release, excluding mineral resource disclosure, have been reviewed and verified by James L. Sorensen – FAusIMM Reg. No. 221286 with Samuel Engineering, who is a qualified person as defined by National Instrument 43-101– Standards of Disclosure for Mineral Projects.

Disclosure related to the updated Los Azules mineral resource estimate has been reviewed and approved by Allan Schappert, CPG #11758, SME-RM, with Stantec Consulting, who is Qualified Persons as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43- 101”).

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 52% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing its share price and providing a yield. Rob McEwen, Chairman and Chief Owner, has personal investment in the company of US$220 million. His annual salary is US$1.”

The McEwen Mining press release appears to be reviewed and verified by a Qualified Person (as that term is defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects) and the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no Qualified Person engaged by TNR has done sufficient work to analyze, interpret, classify or verify McEwen Mining’s information to determine the current mineral resource or other information referred to in its press releases. Accordingly, the reader is cautioned in placing any reliance on the disclosures therein.

“We are pleased that significant developments on the advancement of the Los Azules Copper Project towards feasibility have brought Stellantis as a strategic partner in the future development of this giant copper, gold and silver project. An additional investment of US $30 million in McEwen Copper was also invested by Rio Tinto’s Venture Nuton in 2023 after its initial investment of US $25 million in 2022,” stated Kirill Klip, TNR’s Chief Executive Officer. “TNR Gold’s vision is aligned with the leaders of innovation among automakers like Stellantis, with the aim of decarbonizing mobility, and our mining industry leaders like Rob McEwen’s vision ‘to build a mine for the future, based on regenerative principles that can achieve net zero carbon emissions by 2038’.

The green energy rEVolution relies on the supply of critical metals like copper; delivering “green copper” to Argentina and the world will contribute to the clean energy transition and electrification of transportation and energy industries.

Strong team performance is accelerating the McEwen Copper Los Azules program in 2023. The 2023 Los Azules Project PEA results highlight the potential to create very robust leach project, while reducing environmental footprint and greater environmental and social stewardship sets the Project apart from other potential mine developments.

It’s very encouraging to see an updated independent mineral resource estimate that has increased significantly. Together with Nuton, McEwen Copper is exploring new technologies that save energy, water, time and capital, advancing Los Azules towards the goal of the leading environmental performance. The involvement of Rio Tinto with its innovative technology, may also accelerate realizing the enormous potential of the Los Azules Project.

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). TNR Gold does not have to contribute any capital for the development of the Los Azules Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-seven years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% net profits royalty holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

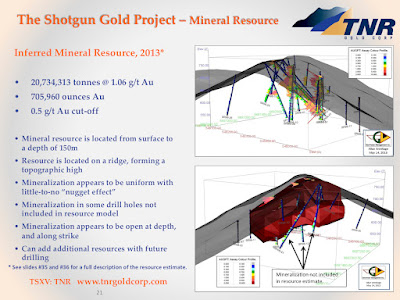

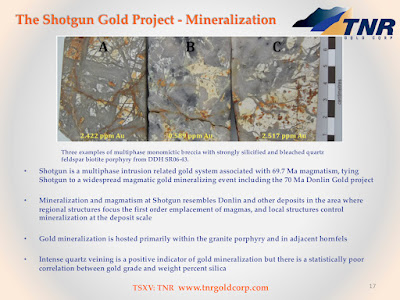

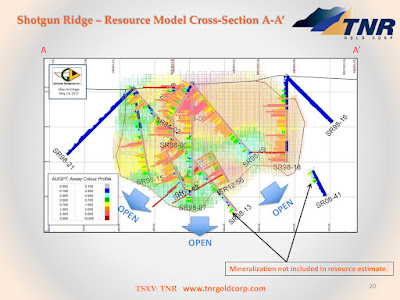

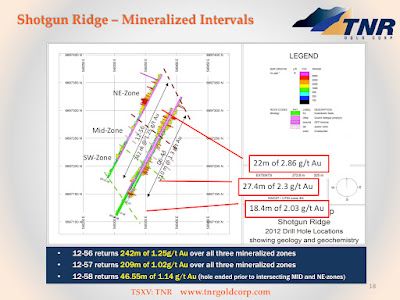

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

Kirill Klip

Executive Chairman

www.tnrgoldcorp.com

For further information concerning this news release please contact Kirill Klip +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, changes in share capital, market conditions for energy commodities, the successful completion of sales of portions of the NSR royalties and decisions of the government agencies and other regulators in Argentina. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s profile on www.sedar.com. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will be able to repay its loans or complete any further royalty acquisitions or sales; debt or other financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties challenging in the future the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium, and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."