US Dollar was going parabolic making high after high this year. FED missed the coming Inflation Shock after printing trillions of dollars, was well behind the curve and turned hawkish breaking all markets and bursting all bubbles at the same time.

The announcement made on September 9th of 2021 was the ultimate message of the coming Major Market Top: "FED officials to sell stocks to avoid an apparent conflict of interest". Panic sell-off in the markets started with crypto assets in 2021 and spread into stocks and bonds in 2022.

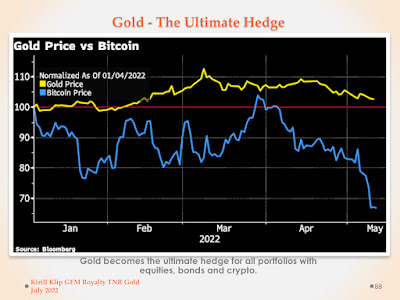

There is no Gold 2.0, there are only more than 5,000 years of humankind's history with Gold.

"There is no Gold 2.0, there are over 5,000 years of humankind's history with Gold. Investors are tired of loosing money by chasing Crypto Dragons and Bitcoin Dreams in the Tether Metaverse."

The extreme volatility and the recent crash in the crypto markets have evaporated more than 2 trillion dollars of "crypto capital" and have wiped out millions of "investors", some of them with all their life savings.

"Crypto myths are being dismantled one by one: Bitcoin is NOT Gold 2.0, Bitcoin is not an inflation hedge and Bitcoin is not a new asset class that will take the place of bonds in the "deworsified" model portfolios. Bitcoin is triggering, following and igniting the burst of all bubbles starting with technology sectors."

Gold is The Ultimate Hedge for all portfolios constructed with equities, bonds and crypto-assets. The new generation of investors is seeking safety and security, they are finding Gold and they are coming back home.

Massacre in Crypto space screams "Real Assets" and electrification of Energy and Transportation will require a secure supply of Energy Metals like Copper, Lithium and Silver.

Please note how Lithium is holding "flat" after making an all-time high earlier this year despite the sell-off in other base metals. The Lithium market is driven by the end users and contract-based relationships.

Copper will be next to shine after the brutal sell-off. I consider personally that the recent drop in Copper prices is the aftershock following the burst of The Crypto Mania Bubble and the direct result of recent lockdowns in China.

Infrastructure development plans will bring a new stimulus to the markets. Smart money has received another opportunity for a unique entry point into the generational megatrends.

After the initial pull out of liquidity from all markets by speculators facing margin calls, investors are coming in. ReTail investors who managed to survive the real losses after the crash of their Crypto Dreams in the MetaVerse will never touch anything crypto again.

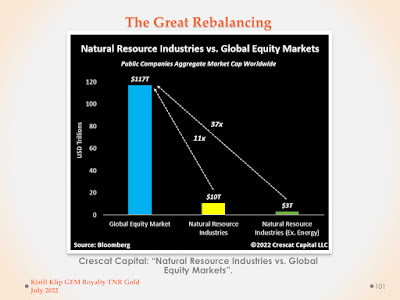

Institutions can betray the trust "only once"... and they have done it already every single cycle for all generations of new investors: 2000, 2008 and 2022. Now the Sovereign Wealth Funds will be picking up the pieces among Real Assets to drive national infrastructure development plans. We have The Great Rebalancing underway.

TNR Gold is plugged into Tesla Energy rEVolution with our Royalty Holdings on Mariana Lithium Project with Ganfeng Lithium, Los Azules Copper, Gold and Silver Project with McEwen Mining and Batidero I and II Properties of Josemaria Copper-Gold Project with Lundin mining.

On my blog following the links below, you can find more information about TNR Gold Corp. and our Royalty Holdings. Do your own research, read all disclaimers, as usual, and stay safe and prosper. Join rEVolution!

No comments:

Post a Comment