"China's Ganfeng Lithium considers Argentine battery plant"We want to support the industrial development of Argentina to make it one of the most important lithium-producing countries in the world," Ganfeng Chairman Li Liangbin said in that statement.Ganfeng is also pursuing a lithium brine project in Argentina's Salta province, near Jujuy, and expects to this year receive the environmental assessment permit needed to start construction." Mining Weekly.

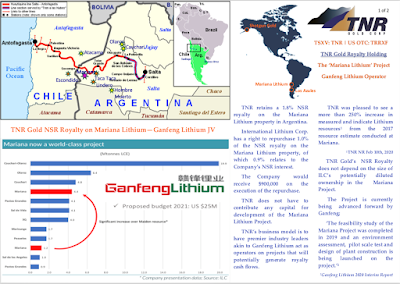

TNR Gold Lithium Royalty Holding: Ganfeng Increases Stake In Mariana Lithium Closer To 100% And "It Is planned To Commence Construction After The EAP For Plant Construction Is Obtained In 2021 ".

"TNR Gold holds NSR royalties on projects containing copper, gold, silver and lithium metals. TNR Gold does not have to contribute any capital for the development of Los Azules Copper Project and Mariana Lithium Project. Neither does our NSR Royalty depend on the size of International Lithium’s potentially diluted ownership in the Mariana Lithium Project. The essence of our business model is to have industry leaders like McEwen Mining and Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders."

TNR Gold Lithium Royalty Holding: Ganfeng Increases Stake In Mariana Lithium Closer To 100% And Moves Project Towards Pilot Scale Test Stage - "The US $25 Million Budget Is Proposed For 2021".

"Last February 10, Ganfeng Lithium's top subsidiary in Salta, Argentina, Litio Minera Argentina S.A. (LMA) formally presented the Environmental Impact Report (EIR) of its lithium-brine project, Mariana, to the Provincial Mining Office in Salta, Argentina."

Ganfeng Lithium

“I’m a strong believer in personal interest,” stated Mr. Klip. “It’s very encouraging when it’s aligned with that of the shareholders. To that end, I’m pleased that other insiders of the Company have joined me in our recent private placements. While I am the largest individual shareholder of TNR Gold, it’s crucial for me that all of us at the TNR Gold Team are personally motivated to succeed. It’s because of this that shareholders can trust us to advance the Company forward with great passion. Our recent private placement was oversubscribed and we are well-positioned now to develop further our portfolio of strategic assets in gold and Energy rEVolution metals.

Kirill Klip continued, “Our forward-thinking approach is allowing us to integrate our strategic portfolio with the international capital markets, while maintaining efforts to minimize dilution for all our shareholders. During these favourable macro-economic conditions for gold and green energy metals, we have been enjoying an entirely new level of attention and participation from certain financial institutions.

This will allow us to accelerate the development of the Shotgun Gold Project as well as continue to advance our royalty portfolio within the next chapter of business: Green Energy Metals. We maintain the potential of adding to our core royalty holdings on the Los Azules Copper Project with McEwen Mining and the Mariana Lithium Project under the management of Ganfeng Lithium.”

TNR Gold holds NSR royalties on projects containing copper, gold, silver and lithium metals. TNR Gold does not have to contribute any capital for the development of Los Azules Copper Project and Mariana Lithium Project. Neither does our NSR Royalty depend on the size of International Lithium’s potentially diluted ownership in the Mariana Lithium Project. The essence of our business model is to have industry leaders like McEwen Mining and Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders."

Lithium prices made the bottom and LCE price jumped 97.5% this year in China, according to the Benchmark Mineral Intelligence report published in an article on March 16, 2021. In order to meet the exponentially rising EVs demand for batteries, the Lithium industry must produce over 1M T of LCE annually from 2026.

Last year just 369,000 T of LCE was produced globally. Only the strongest lithium players who have access to the capital and technology will be able to address numerous technical challenges in order to deliver Battery Grade Lithium.

Now you can better understand why GEM Royalty TNR Gold Team is really excited with all recent developments in the electric space. We do not have to contribute any capital for Mariana Lithium Project development and our potential future NSR Royalty cash flow is becoming more and more feasible. You can find more public information for your own research in the TNR Gold Investor presentation below and follow Mariana Lithium Project development on my blog and the updated Ganfeng Lithium website.

No comments:

Post a Comment