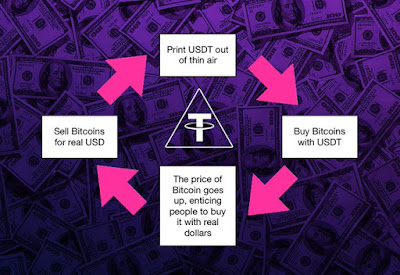

My dear friends, hedge your crypto dreams before tears. We have Tesla's Bitcoin "Environmental Report" from Tether. "Tether's First Reserve Breakdown Shows Token 49% Backed By Unspecified Commercial Paper." To be more precise: Tether is backed by Cash (2.9%), Treasury Bills (2.2%) and IOUs (94.9%). Lights out. And now we can talk about corporate governance and electricity as well...

P.S. (*There are some "Precious Metals" in 9.96% (Corporate Bonds, Funds and *PMs) but the amount is not specified and, as we all know, from Crypto High Priests: "Gold is going to zero", so I have the liberty to "upgrade" the reserve numbers without discounting PMs to zero value).

The new composition report is part of Tether’s efforts to stay in compliance with a settlement with the New York Attorney General." coindesk.com

Tether, the crypto stablecoin backed one-for-one by fiat currencies, surpassed $50 billion in circulation, a sum that’s more than the insured deposits at all but 44 of the thousands of U.S. banks......Tether is set to release the first quarterly statement on its reserves to the New York Attorney General this month. The disclosure is part of a settlement of a long-running dispute with state regulators over whether it actually has the reserves, but it is unclear whether investors will get a glimpse at it..." Bloomberg.

"And Then He Said: "I've Sold My Bitcoin" - That's All. Gold.

"Hyped by the Bubble TV mass marketing machine to the herd, Bitcoin has become one of the main soft targets in the West. Attack on Bitcoin and collapse of this "Mother of All Bubbles" will lead to an enormous economic shock for the markets and can even bring such technological leaders as my beloved Tesla down. The higher Bitcoin goes now, the bigger shock will be for all parties involved after that lethal strike."

Update May 1, 2021Tether, the crypto stablecoin backed one-for-one by fiat currencies, surpassed $50 billion in circulation, a sum that’s more than the insured deposits at all but 44 of the thousands of U.S. banks......Tether is set to release the first quarterly statement on its reserves to the New York Attorney General this month. The disclosure is part of a settlement of a long-running dispute with state regulators over whether it actually has the reserves, but it is unclear whether investors will get a glimpse at it...

Mr. Whale @CryptoWhale

The quarterly report will be released to New York in May, according to Stuart Hoegner, general counsel for the crypto exchange Bitfinex and Tether. The companies, which are based primarily in the British Virgin Islands, settled without admitting or denying any wrongdoing.When the settlement was announced, New York Attorney General Letitia James said “Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency as fully backed by U.S. dollars at all times was a lie.” Bloomberg.

Felix Zulauf: The Big Picture Cycles For Gold, Bitcoin And Commodities - Risk Management And Taiwan.

Today I would like to share with you a very deep conversation with Felix Zulauf during his interview with Real Vision Finance. He is painting brilliantly the very dramatic big picture view on the main driving forces in our modern societies across the globe. This is one of the best macro presentations on the market forces and economic cycles which are moving the markets now.

Is Bitcoin already "Too Big To Fail"? Felix's belief over the years has been that Bitcoin will be banned by the governments, but now "maybe they have missed already that point" when it could be done "without a huge havoc". "Bitcoin will go to zero overnight in that case" and it will bring a shock to the financial system.

"As we have discussed with you, the major catalyst is coming for the Gold market. There is no Gold 2.0 and the realisation of this simple fact may bring the fireworks to the Gold market before Independence Day this year. Bitcoin is moving very fast from the "Deepfake Video Game" and "Mother of All Bubbles" status to the National Security Risk Threat. We have more and more clear warnings from all levels of the officials in the US now, so Bitcoin's future remains to be seen."

"Now Federal Reserve Chair, Secretary of Treasury, New York State Attorney General and CIA via Peter Thiel from Palantir - all are sending clear warnings about Bitcoin. Only Whales who need to sell their "Crypto Store of Wealth" in order to realise paper profits are preaching HODL to the heard. Be warned, Do Your Own Research and stay safe."

Judging by Barron's covers, extreme caution is warranted if you are playing this "Chinese Roulette". Do not dive into the empty Crypto pool, hedge accordingly with a position in Gold. Do not forget to take your profits before "Crypto Whales" will pull the plug again as they did in 2017.

At the top of the "Tulip Bubble Mania", you could buy a house in Amsterdam with one tulip bulb. Bitcoin became "Find The Greater Fool" at this stage. Can you find enough fools to sell them Bitcoin all the way up to 1,000,000? This remains to be seen. We are witnessing "The Madness of Crowds" in the MMT digital age of Deepfake Video Games - a socially engineered online experiment in behavioural finance. It is Artificial but does not count on Intelligence. Just never forget that tulips now are going a "dozen for $1.90".

"Bitcoin has become one of the main soft targets in the West and deserves national attention as a matter of state military risk management. Bitcoin's crash will not only bring a brutal awakening to "the brave fighters of the FED", but can bring very important companies like my beloved Tesla down spreading the shock waves across a very fragile overleveraged economy. The higher Bitcoin goes now, the more "great people" are getting sucked into and being sacrificed for this "Mother of All Bubbles" - the bigger shock will be for all parties involved after that lethal strike."

FED and US Treasury are not buying Bitcoin. Central Banks are holding Gold and they are buying more of it like Hungary did recently. Felix is buying Gold miners during the sell-offs and considers them "as options on the Gold price". At the FOMO stage of this Gold Bull, investors will be calculating the amount of the Gold in the ground controlled by these companies.

Now you can better understand how we are building TNR Gold in order to participate in the ongoing megatrends during these different market cycles. Gold becomes the ultimate hedge not only for portfolios constructed with stocks and bonds but for portfolios with Crypto-assets as well.

Copper and Lithium are supercharged by the Energy rEVolution and industry leaders like McEwen Mining and Ganfeng Lithium are the ones who know how to build and maximise the value of these giant projects. GEM Royalty TNR Gold is plugged into Energy rEVolution with our NSR Royalty Holdings on Los Azules Copper and Mariana Lithium projects. I am participating in TNR Gold financing again and below you can find more information about our assets. Do Your Own Research and stay safe.

No comments:

Post a Comment