Power of Blue Sky Discoveries + Green Technology. Private Diary: Chronicles of the Energy rEVolution.

Monday, 29 March 2021

Energy rEVolution Electric Race Supercharging Commodities Super Cycle.

Friday, 26 March 2021

Bitcoin, MMT And Other Deepfake Video Games: "Fed Chair And Treasury Secretary Call For End Of Bitcoin And National Digital Tracking ID".

"Rep Bill Foster of IL gets the Fed Chair and Treasury Sec to go on the record about their dislike for digital currencies and the need for a National Digital Tracking ID system."

Time is spinning out of control and we are moving very fast through all the fog of the Dark Crypto Web to the light at the end of the tunnel. For some hodlers, it can be a light of a freight train that is moving towards them while Crypto Whales are uploading their "Crypto Store of Wealth" to the herd.

Mike Green's answer to the question: "What is the probability that FED will adopt Bitcoin?" - has received another confirmation from both the FED Chair and Treasury Secretary going on the record with Representative Bill Foster for Illinois.

We are moving now fast-forward from the rhetorical question: "Will they ban Bitcoin?" to the rather dramatic one - "How will they ban Bitcoin?" For starters, if not a single money manager in the US or US publicly traded company can touch Bitcoin, all this "irrational exuberance" squared: "Who will buy it next?" - will be ended the same day.

Today we have another sign that the FED and US Treasury are not buying it. If the last arguments left are laser eyes and that "other people" will be buying it - then you have to listen to Mike Green again very carefully.

We can discuss at length whether this is a real video or a "deepfake", and in the end, The FED is as "Federal" as "Federal Express", but we all better pay attention. Big Brothers and their FED hate competition and their messages are getting louder and clear by the day now.

Gold - The Catalyst: Bitcoin And Other Video Games Of The MMT Age.

Every bubble needs great people to make it great. Gold is the ultimate hedge and now confirms that it can provide a hedge not only for portfolios constructed with stocks and bonds but for all portfolios including cryptocurrencies as well.

Nobody knows the future, but for all brave hodlers, I can suggest that by allocating just 10% of your crypto portfolio into Gold you can get better sleep at night. If Crypto Whales who are pumping Bitcoin and selling it to you are right and its price will go to 1,000,000 - this investment in Gold will be a very small price to pay to be on your own yacht. You can have your own toilet made of that Gold in that case.

If Crypto Whales are playing dirty with your desire for Freedom - you will be able to stay alive with your holding of Gold to enjoy your Freedom even after all your "Crypto Store of Value" will go down that proverbial toilet. Do your homework, make informed decisions and stay safe.

Jim Puplava and John Ing are translating today for us all things "crypto" in English and discussing "New Normal", old Inflation and Gold in the MMT Age. It is highly recommended for all to listen in order to realise that Bitcoin and other Video Games of the MMT Age are just that - Games. These games are played by Crypto Whales with Gamers and have nothing to do with the real values in the real world. You do not even have to go as far as EMP, just remember that all virtual games are virtual and some very ruthless and determined people are planning the real War Games.

Bitcoin has become one of the main soft targets in the West and deserves national attention as a matter of state military risk management. Bitcoin's crash will not only bring a brutal awakening to "the brave fighters of the FED", but can bring very important companies like my beloved Tesla down spreading the shock waves across a very fragile overleveraged economy. The higher Bitcoin goes now, the more "great people" are getting sucked into and being sacrificed for this "Mother of All Bubbles" - the bigger shock will be for all parties involved after that lethal strike.

"Welcome to Bitcoin "market" with a price discovery driven by Tether digital printing press instead of FED's FIAT "digital press" and Elon Musk Twitter feed. Do brave FED fighters on blockchain even realise that?"

Jim Puplava and John Ing are discussing today in depth all these factors, which will propel Gold on its next leg up in this young Bull market. The best Gold miners are literally printing money at these prices of Gold already.

These seasoned market veterans are confirming my observations that M&A will be the main driving force for the junior mining space. Major Gold miners are facing Peak Gold Reserves and need new giant projects in the stable mining jurisdiction just to continue the same rate of production.

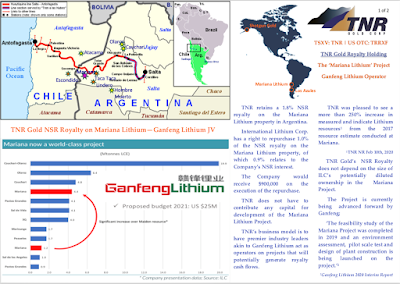

TNR Gold Lithium Royalty Holding: Ganfeng Increases Stake In Mariana Lithium Closer To 100% And Moves Project Towards Pilot Scale Test Stage - "The US $25 Million Budget Is Proposed For 2021".

"Last February 10, Ganfeng Lithium's top subsidiary in Salta, Argentina, Litio Minera Argentina S.A. (LMA) formally presented the Environmental Impact Report (EIR) of its lithium-brine project, Mariana, to the Provincial Mining Office in Salta, Argentina."

Ganfeng Lithium

“I’m a strong believer in personal interest,” stated Mr. Klip. “It’s very encouraging when it’s aligned with that of the shareholders. To that end, I’m pleased that other insiders of the Company have joined me in our recent private placements. While I am the largest individual shareholder of TNR Gold, it’s crucial for me that all of us at the TNR Gold Team are personally motivated to succeed. It’s because of this that shareholders can trust us to advance the Company forward with great passion. Our recent private placement was oversubscribed and we are well-positioned now to develop further our portfolio of strategic assets in gold and Energy rEVolution metals.

Kirill Klip continued, “Our forward-thinking approach is allowing us to integrate our strategic portfolio with the international capital markets, while maintaining efforts to minimize dilution for all our shareholders. During these favourable macro-economic conditions for gold and green energy metals, we have been enjoying an entirely new level of attention and participation from certain financial institutions.

This will allow us to accelerate the development of the Shotgun Gold Project as well as continue to advance our royalty portfolio within the next chapter of business: Green Energy Metals. We maintain the potential of adding to our core royalty holdings on the Los Azules Copper Project with McEwen Mining and the Mariana Lithium Project under the management of Ganfeng Lithium.”

TNR Gold holds NSR royalties on projects containing copper, gold, silver and lithium metals. TNR Gold does not have to contribute any capital for the development of Los Azules Copper Project and Mariana Lithium Project. Neither does our NSR Royalty depend on the size of International Lithium’s potentially diluted ownership in the Mariana Lithium Project. The essence of our business model is to have industry leaders like McEwen Mining and Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders."

Lithium prices made the bottom and LCE price jumped 97.5% this year in China, according to the Benchmark Mineral Intelligence report published in an article on March 16, 2021. In order to meet the exponentially rising EVs demand for batteries, the Lithium industry must produce over 1M T of LCE annually from 2026.

Last year just 369,000 T of LCE was produced globally. Only the strongest lithium players who have access to the capital and technology will be able to address numerous technical challenges in order to deliver Battery Grade Lithium.

Now you can better understand why GEM Royalty TNR Gold Team is really excited with all recent developments in the electric space. We do not have to contribute any capital for Mariana Lithium Project development and our potential future NSR Royalty cash flow is becoming more and more feasible. You can find more public information for your own research in the TNR Gold Investor presentation below and follow Mariana Lithium Project development on my blog and the updated Ganfeng Lithium website.