Guest post:

TNR Gold Is Fully Plugged Into Tesla rEVolution And Gold As The Ultimate Hedge For Uncertain Times.

TNR Gold is fully plugged into the reality of the times. From the release of practical & popular EV mobility systems to the mass uptake of ancillary battery storage for rising renewable grids, a bet on copper and lithium is a bet on the new chapter of business.

A mighty global consumer pull towards EVs and a breakneck international policy push of renewable utilities/macro size batteries is a magical moment for lithium & copper. While the former shows strength so far only in Far East M&A’s, western equity markets are much more open to a traditional metal like Cu and it has been rising hard as a leading indicator of inflation & speculation.

Indeed, copper remains Goldman’s favourite commodity based on cyclical and structural support. For good reason, too - China unveiled that it had set aside $900 billion to be spent over the next five years towards developing a familiar infrastructural mix of mass ultra-high voltage power transmission installations, vehicle charging systems and also deploy “new digital infrastructure”.

Furthermore, every week brings another crisis of copper mining strikes somewhere South in the world. Last week action was averted at Glencore’s, while yesterday a strike at Lundin’s Candelera in Chile went through, while today we read about Escondida showing some chiseled teeth to hit the copper supply as well.

The EU & US have their own answer to China’s infrastructure plan. The global(ist) Build Back Better mantra finally has the green light to show some financial teeth. And these are fiscal fangs, not monetary, and the kind that have been severing the jugulars of committed short sellers so far while monetary institutional herbivores grimace and grind their teeth to the best of their negative interest rate ability.

“Fiscal policy is the big game in town now,” said Stephen King, senior economic adviser to HSBC Holdings Plc. “As a central banker, you have to accept in that sense you’ve lost a bit of power to the political process.”

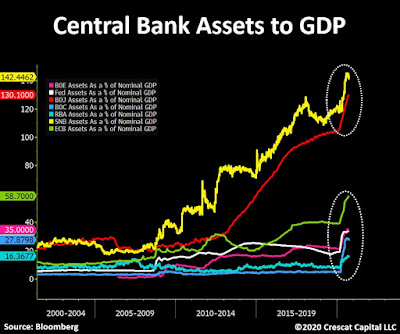

An internal audit for the International Monetary Fund expressed lamentation for the decision to call for austerity in the wonderful years of 2010 & 2012 when the economy was still crippled by the global ‘self-automated’ car crash. A new message is affirmed by the IMF: Print Now ‘Till 2025, Consequences for the Balance Sheet be Damned. German officials say there’ll be no return to balanced budgets in their own country anytime soon. Yoshihide Suga, Japan’s new prime minister, has said debt consolidation will have to wait until growth is back — and suggested there’s no hard limit to how much his government can borrow.

The West is fully encouraged now by regulatory institutions to flood irrigate investment and stimulate - without relent - their way out of the current recession. Maybe this is the right decision - sometimes the drinking water is to put the house fire out, and the audit comes later.

Regardless, mass investment irreconcilably leads to mass infrastructure, particularly during an election season where generating jobs is so crucial. But this will be mass infrastructure like we haven't seen before - this is the development of macro infrastructure under the stubbornly green policy, which means renewables which in turn signals banks and batteries of backup infrastructure - more building, more jobs, more copper and lithium.

A contended election that’ll be drawn out ‘till Spring, a pandemic that's at best at a penultimate peak, and a global economy fully headed to a ‘P’ recovery (P for Print). It’s never been more important to hedge with gold. Gold mining is all jurisdiction, so we’ve gone back to the classics for gold in USA Alaska. Mark Bristow of Barrick “cautioned producers against merely “rearranging the deck chairs” through deals. Gold miners must invest in finding new deposits to replace reserves, he said.”

Don’t wait for the big players to reorient your portfolio within the energy & metals sector. For as BP’s Bob put it, “If someone said, ‘Here’s 10bn to invest in renewables,” we wouldn’t know how to do it.”

TNR Gold is plugged into these interesting times via copper and lithium royalty holdings with industry leaders McEwen Mining and Ganfeng Lithium.

TNR’s CEO, Kirill Klip, commented: “Recent M&A Royalty deals in Argentina are elevating the entirety of TNR Gold’s portfolio towards legitimately positive re-evaluation. Rob McEwen called Taca Taca Copper deposit as a very good proxy towards the true value of giant Los Azules Copper. Only last week, Nova Royalty paid USD $12.75 for 0.24% of NSR Royalty on Taca Taca. In comparison, TNR Gold holds 0.36% NSR Royalty on the entire Los Azules Copper project. This deal by Nova Royalty provides an excellently favourable benchmark for the potential valuation of TNR Gold Corp’s Los Azules Copper NSR Royalty Holding”.

“McEwen Mining Chairman, Chief Owner and CEO Rob McEwen said: "With First Quantum acquiring Lumina Copper and their Taca Taca project, Los Azules moves to the forefront in terms of world-class, undeveloped, high-grade copper assets not owned by a major mining company. As we have said in the past, Taca Taca serves as a good proxy for the value of Los Azules and we believe this transaction demonstrates the value in projects located in Argentina."

Kirill continued: “TNR Gold shareholder NovaGold is moving forward developing the giant Donlin Gold project together with their JV partner Barrick Gold. CEO Mark Bristow has confirmed that Donlin is a key project for Barrick. They are conducting the largest drilling program at Donlin Gold to-date and, apparently, like what they see. TNR Gold has found Gold at our Shotgun Gold Project located near Donlin Gold as well.

Very limited drilling has allowed us to produce NI 43-101 report identifying initial inferred resources of 705,960 Au Oz. We are very well positioned for further development in line with our strategy now. Valuations for the Gold in the ground are rising already as well. NovaGold was trading as high as USD $205 per Au Oz this year, Eric Sprott is applying his “mental valuation” of USD $100 per Au Oz for different projects and Ronald Stewart from AuCu Research is tracking the increase in valuations from USD $50 to $70 per Au Oz in the ground for exploration companies this year already.”

No comments:

Post a Comment