"The upside is clear. Indeed, Novagold sees it well enough, since it retains a significant stake in TNR, and former Novagold director Greg Johnson now sits on the TNR board. How long it will take the rest of the market to wake up remains to be seen.

Nonetheless Klip is confident that this is a company that’s going places.“We are not dreamers,” he says. “We did it with the copper. We did it with the lithium. I would like to make it even bigger with the gold. I would like to do better, to keep a 25% stake.”Alastair Ford: "TNR Gold Has Huge Potential Upside At The Shotgun Gold Project, Plus Significant Potential Cashflow From Two Sizeable Royalties."

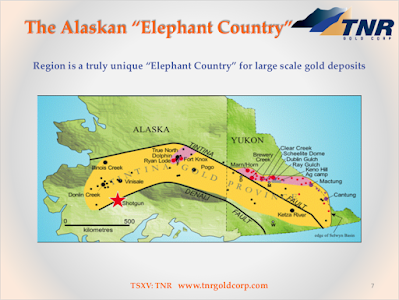

TNR Shotgun Gold Project In "The Alaskan Elephant Country" - Gregory Lang: "NOVAGOLD Reports "A Banner Quarter for Donlin Gold"

NovaGold CEO Gregory Lang provides us with an update from "The Alaskan Elephant Country" on the recent developments at Donlin Gold. Today you can read in-depth about the largest drilling program to date at this giant Gold project on the US soil and the update on the ongoing permitting progress. TNR Gold shareholder NovaGold and Barrick Gold are moving Donlin Gold Mining Camp development forward and you can find below for your own research more information about our Shotgun Gold Project and the strategy for its development.

CEO Mark Bristow has confirmed that Donlin Gold is the key asset for Barrick Gold and that they like what they see in the largest drilling program to date on the property. The decision about $22 billion new railway connecting Alaska and Alberta will bring new infrastructure development to Alaska adding another piece of the puzzle to the making of the Major Gold Mining Camps on the US soil.

Now you can make your own research on TNR Gold and our Shotgun Gold Project and find out why I am acquiring shares in our Company at every opportunity I have and why NovaGold is holding a stake in TNR Gold. Links on the article will allow you to go as deep as you like for your own research. Buckle up and stay safe during your journey! Join and follow TNR Gold.

"And, given the attractiveness of the third string to TNR’s bow – the Shotgun Gold project in Alaska, the company is still very definitely an exploration company.Indeed, according to Kirill Klip, the company’s chief executive, the main focus of effort over the coming months is likely to be on moving Shotgun forward to the point where a major company moves in and begins to help with development work there.So, is this the same model that proved so successful with Los Azules and Mariana?Not quite. This time round, with two potentially cash generative royalties in its back pocket, TNR is in a slightly stronger position. Klip’s aspiration this time round is for TNR to retain a much larger stake. The near-term goals are simple enough.“We need to bring US$10mln in to drill the project very strongly,” says Klip.

“The first US$5mln to take the project from the current 700,000 ounce resource up to the two million ounce mark, the rest to drill out five nearby targets. There’s no reason to suppose that our ground cannot hold multiple mineralised systems.”At Shotgun the thinking is that there may be upwards of five million ounces of gold in the ground, and there is precedent. At this stage the geology shows remarkable similarity to the 39mln ounce Donlin gold project in southern Alaska, which is owned jointly by Novagold Resources Inc (TSE:NG) and Barrick Gold (NYSE:GOLD).“We are talking about a high tonnage bulk system,” says Klip. “There are no nuggets, it’s very uniform.”

Among the notable intercepts the company has 242 metres grading 1.25 grams gold per tonne, 209 metres at 1.02 grams, and just under 47 metres at 1.14 grams.What’s more, the gold that’s been identified thus far sits at the top of a ridge, meaning that the stripping ratio for any mine will be low, which in turn will keep costs down.

The upside is clear. Indeed, Novagold sees it well enough, since it retains a significant stake in TNR, and former Novagold director Greg Johnson now sits on the TNR board. How long it will take the rest of the market to wake up remains to be seen.Nonetheless Klip is confident that this is a company that’s going places.“We are not dreamers,” he says. “We did it with the copper. We did it with the lithium. I would like to make it even bigger with the gold. I would like to do better, to keep a 25% stake.”

No comments:

Post a Comment