Tesla Energy rEVolution And The Golden Age For Copper: Kirill Klip GEM Royalty TNR Gold Copper Presentation May 2020.

"Now it is time, at least judging from Nicholas Winton and Northstar brilliant charts, to dive into the Copper story again. FT reports: "Barrick Gold On The Hunt For Copper Deals." Barrick Gold's search for "Strategic Copper" was interrupted by Covid-19 pandemic, but now Mark Bristow is on his quest again. M&A deals we were talking about in January, are getting in the headlines. Below you can find the digest of our discussions which can help you with your own research on the value matrix among top world mining companies and world-class Copper mining assets. As you already know, TNR Gold has its own place among all these players and GEM Royalty is plugged into the Energy rEVolution with our Royalty Holdings on Los Azules Copper with McEwen Mining and Mariana Lithium with Ganfeng Lithium as JV Operator."

TNR Gold GEM Royalty And Energy rEVolution: There Is Time To Sow And Time To Reap The Rewards - "Barrick Gold On The Hunt For Copper Deals."

"TNR also holds a 0.36% NSR on the Los Azules Copper Project, located in San Juan Province of Argentina. The Los Azules Project is owned 100% by McEwen Mining Inc (NYSE:MUX) and is expected to be the 26th largest copper mine in the world once it reaches production.

A PEA at the project completed in September 2017, demonstrated a post-tax NPV8 of US$2.2bn with a post-tax IRR of 20.1%. Based on the PEA figures the mine is expected to generate average revenue per annum of U$953mln, which could generate around US$3.5mln a year to TNR over 37 years."

"McEwen Mining conference call, Robert McEwen -- Chairman and Chief OwnerHappy to. We had past discussions with a senior base metal producer. What we were looking for was recovering part of the cash we put in. We were looking for $100 million upfront that the partner would advance the project to feasibility and then into production and we would continue with an interest of 20% or 25% of the property going forward."

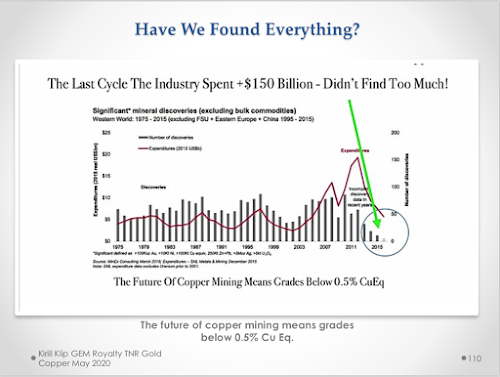

"Of the nearly 1.08-billion tonnes of copper resources discovered since 1990, only 8% is contained in deposits discovered in the past decade, a report published by S&P Global Market Intelligence shows.

The report outlines that 224 copper deposits have been discovered between 1990 and 2019 period, containing 1.08-billion tonnes of copper in reserves, resources and past production.

Of these, only 16 have been found in the last ten years, and only one since 2015, S&P points out.

S&P has been tracking the lower trend of new major discoveries for some time and says conditions have been worsening.

While S&P says this underperformance is mostly the result of less exploration for new discoveries, a portion of the shortfall reflects the additional exploration still required at recent discoveries to expand the endowment above the major discovery threshold.

To account for this, S&P estimates the amount of copper in discoveries will meet its criteria in the future. This has resulted in the amount of discovered copper increasing in recent years, with the total for the past decade having increased to 253-million tonnes.

While there is still an abundance of undeveloped discoveries, most are smaller or low grade, with relatively few high-quality assets available for development. There is a lack of high-quality discoveries available for development, the report notes.

Meanwhile, over the next five years, only seven of the undeveloped discoveries are expected to enter into production.

Even when the additional exploration efforts are completed over the coming years, 2010 to 2019 is expected to remain the worst decade for copper discoveries, says S&P. It notes that one factor contributing to the lack of major discoveries is a key shift in focus within the exploration sectors, with companies focusing more on established assets.

Over the next decade, only three deposits discovered since 1990 are almost guaranteed to start production, as they are currently under development. A further four assets will likely come on line by 2030.

While there are enough quality assets being developed to meet increasing demand over the near term, additional assets will be required for the medium term as existing operations ramp down or close.

This means that companies of all sizes need to invest more in grassroots exploration to discover the deposits that will be required to supply demand 20 years from now.

REGIONAL BREAKDOWN

Latin America remains the most prolific region for copper discoveries, but the discovery rate is decreasing, the report notes.

The region hosts many of the world’s largest copper mines and accounted for almost half of the world's copper mines in 2019.

The region remained the top location for discoveries in the past ten years, with 24.5-million tonnes of copper discovered during the period; however, this is considerably lower than in any other decade since 1990.

Conversely, the discovery rate in Africa has increased considerably in the past ten years, accounting for one-quarter of the copper discovered during the period.

Further, although not traditionally prolific locations for copper discoveries, Canada and the US have languished over the past decade, with no major copper discoveries at all.

S&P says this trend is unlikely to change anytime soon, as there have been only ten copper deposits with initial resources in North America over the past five years, with none containing more than 100 000 t of copper. ![]()

CREAMER MEDIA SENIOR DEPUTY EDITOR ONLINE"

No comments:

Post a Comment