Last time we have discussed here The Big Picture And Gold In The USA with Jim Rickards presenting his new book "Aftermath" - When You Have To Pay The Banks Just To Hold Your Money. We have a tectonic shift in the history of the financial institutions and markets. Negative interest rates have escaped out of the financial labs at Deutsche Bank cooking derivatives for Wall Street into our real life. In Germany, more and more banks are already charging holders of the accounts with more than 500,000 euros with the penalty just to have the privilege of banking. Very soon it's coming to all banks and to all accounts.

For a lot of people, this new sobering narrative and all these ideas about The Switch in the state of perceived reality - the last snowflake before the avalanche - seem to be harder to contemplate when markets are hitting all-time highs. Let's try to dissect it here. What is the relationship between real interest rates and gold? Negative real interest rates have propelled gold to the all-time high of $1,889.70 in 2011, will the record pile of negative-yielding debt do the same trick again? I do believe so and also that it will happen much faster that a lot of people think.

Ray Dalio will be the best person to help us to understand why negative interest rates are a perfect environment for gold. In his recent "Paradigm Shifts" article he provides a very comprehensive picture of the dramatically changing financial landscape. We are entering the financial death spiral:

The enormous amounts of money in no- and low-returning investments won’t be nearly enough to fund the liabilities, even though the pile looks like a lot. That is because they don’t provide adequate income. In fact, most of them won’t provide any income, so they are worthless for that purpose. They just provide a “safe” place to store principal. As a result, to finance their expenditures, owners of them will have to sell off principal, which will diminish the amount of principal that they have left, so that they a) will need progressively higher and higher returns on the dwindling amounts (which they have no prospect of getting) or b) they will have to accelerate their eating away at principal until the money runs out."

For years gold has been mocked for its "fundamental flaw" that it does not provide yield. Quite suddenly, for a lot of people, the pyramid is turning upside down. Record pile of negative-yielding debt cannot compete with gold anymore. "Paradigm Shifts". The Switch. There is no confidence anymore that the US Dollar will provide this precious value of preserving wealth.

Both red sectors on the chart above were shaped by predominately negative real interest rates and both phases were a positive environment for gold. However, after the gold all-time high at $1889.70 in 2011 negative real rates were in an upward trend. This increased the opportunity cost of holding gold, which created the recent bear market in gold. This will be changed next week with FED cutting rates. Just a few short months ago we were expecting that FED will be able "to normalise" rates and continue to raise them.

As always with all our brave scientific mental experiments it is important that the real money will be following the new paradigm. As we can see the stealth gold bull market in 2018 has broken out into the headlines in 2019 and gold price is climbing on top of the pile of record negative-yielding debt.

It is important to note that FED was never able to reload its monetary gun in order to be ready to meet the next financial crisis. These are the most dangerous words in investment, but it is clearly different this time. And not in a good sense at all. With markets at the all-time high in the US, the economy in Europe is melting down and ECB is talking about the new alphabet soup of stimulus. Talking heads on the Bubble TV are discussing even before washing their hands that the next step for ECB can be buying stocks just to stimulate the economy.

Another observation, which is even more important for us here, will be the facts and FED will be cutting rates with the record pile of negative-yielding debt already which is pushing over $14 Trillion and the new historical record low price of gold at $1,400 if we will account properly for the real inflation.

All market manipulations can be working only up to a certain extent and gold has started its powerful move clearing $1,350 and now breaking out above $1,400. The higher prices will come with more allocations to gold investments by the institutions who will be facing "Paradigm Shift" brilliantly explained by the manager of the largest hedge funds in the world.

We discussed Ray Dalio book in our post "Gold And Commodities In The Debt Cycle: Ray Dalio - "US Dollar Can Easily Depreciate 30% During The Next Debt Crisis" one year ago here. He has his own audience: Central Banks and billionaires are buying gold. We are in a very good company. Never fight the FED and FED would really like US Dollar to go down now. Growth solves a lot of problems, but what to do when it is not here anymore? US Dollar will be the designated victim of the next reinflation QE phase.

The chart above from Marin Katusa illustrates brilliantly what will be the next catalyst for the valuations of gold companies with the rising price of gold during The Switch. "Rise to the generational average of 0.23% in gold weighting in the S&P 500 could cause gold stocks to skyrocket." We should only add here that some special situations among gold explorations stocks could now provide a truly unique entry point when some motivated sellers among banksters who turned miners are finally fading out of their abrupt disgraceful appearance in the noble mining history.

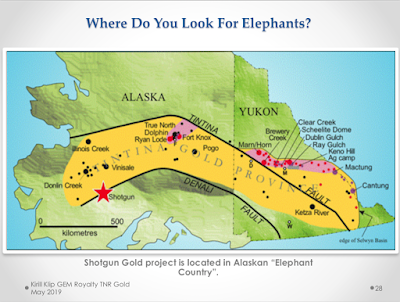

Gold In The USA: Kirill Klip GEM Royalty TNR Gold Presentation May 2019 - Gold In The Alaskan Elephant Country.

Barrick Gold is developing together with NovaGold 40MOZ giant Donlin Gold in Alaska - "arguably the most important Gold project in the world." So where will you be looking for the new elephants? Maybe in the Alaskan Elephant Country. Barrick Gold received crucial permits to advance Donlin Gold now and this new developing mining district in the US can make the promise of "Gold In the USA" providing stable supply feasible again and it can become that solution to "The Gold Mining Reserve Crisis" McKinsey is talking about:

"The Company's strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR Gold ("TNR") is actively introducing the project to interested parties," commented Kirill Klip, Executive Chairman of TNR. "We may be at the beginning of a great discovery. There is a clear path on how to move this project forward using the geological and geophysical research currently available to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner that shares our vision and recognizes the growth potential and value to be added to the Shotgun project over time."

LEGAL DISCLAIMER

Please read legal disclaimer. There is no investment advice on this blog. Always consult a qualified financial adviser before any investment decisions. DYOR.

Gold In The Alaskan Elephant Country: TNR Gold Shotgun Gold Presentation April 2019.

"The Company's strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR Gold ("TNR") is actively introducing the project to interested parties," commented Kirill Klip, Executive Chairman of TNR. "We may be at the beginning of a great discovery. There is a clear path on how to move this project forward using the geological and geophysical research currently available to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner that shares our vision and recognizes the growth potential and value to be added to the Shotgun project over time."