Lynette Zang has produced a great video featuring Jim Rickards and providing us with the opportunity to sit down and dive into FED and monetary history, Jim's journey on the Wall Street and the big picture of the international finance and money. We are discussing here gold as the store of the solid value in the uncertain times and the recent dramatic shift in the financial markets. Goldman Sachs is talking about Yen as "a better hedge than gold", but not a lot of people are buying it anymore. Central Banks are buying gold.

And then again just check who has the largest derivatives books with ticking financial nuclear bombs on Wall Street. JP Morgan quite suddenly and for a change is talking now about the US Dollar losing its reserve currency status and introducing the idea of gold in the diversified portfolio.

Gold cooperates and after making the buy signal in last December and the golden cross in January is pushing above $1,400 to the all-important $1,500. Only then, finally, banks will call the bull market comeback in gold.

Gold cooperates and after making the buy signal in last December and the golden cross in January is pushing above $1,400 to the all-important $1,500. Only then, finally, banks will call the bull market comeback in gold.

I will leave all the details for you to follow with Jim and his brilliant presentation but would like to point out his very simple explanation of the tectonic shift in our society: money is based on confidence. "Confidence is fragile, it's very easily lost and it's impossible to regain it." There is no confidence anymore that the US Dollar will provide this precious value of preserving wealth.

The new "debt ceiling" deal is opening the chequebook for growth by any means and the US Dollar will be the designated victim. Ray Dalio, the manager of the largest hedge fund, is talking about gold as a safe haven and explaining that record pile of negative-yielding debt cannot compete with gold anymore. Quite suddenly, for a lot of people, the pyramid is turning upside down. "The Paradigm Shift". The switch.

The largest financial institutions including pension funds are not talking about return on invested capital anymore, but only about return of that capital. All expenses and payments out now will be made from principals further eroding the capital. We are entering the financial death spiral.

Central Banks have been buying gold from the last Great Financial Crisis, they know what is coming. Deutsche Bank is in the news again with it's $50 trillion book of derivatives WMD - nuclear financial weapons on the Wall Street. Its unwinding can propel gold to a much higher level than a lot of people think. It is important to note that all this trouble, record pile of debt with negative rates and FED cutting rates are coming with Gold just above $1,400.

This level is the new historic low for the gold price if we account properly for real consumer inflation. Below you can find more details about this FED Summer 2019 Gold Party and Titanic party organisers.

This level is the new historic low for the gold price if we account properly for real consumer inflation. Below you can find more details about this FED Summer 2019 Gold Party and Titanic party organisers.

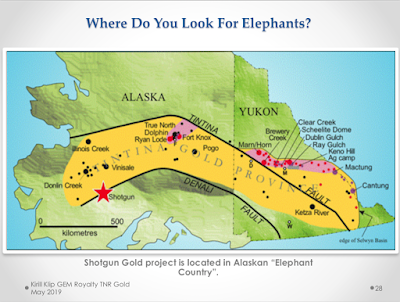

All this new demand for gold will be meeting the declining production and the Gold Reserves Crisis which is explained very vividly by McKinsey. Now you can better understand the place of Donlin Gold among the gold deposits in the world. Development of this 39M oz giant will build a major mining camp on the US soil and will bring life and infrastructure to the whole south-west part of the great state of Alaska. TNR Gold is advancing Shotgun Gold exploration in the Donlin Gold mining district and is looking for the strategic partner to grow together in "The Alaskan Elephant Country" in the USA.

Gold In The USA: Kirill Klip GEM Royalty TNR Gold Presentation May 2019 - Gold In The Alaskan Elephant Country.

LEGAL DISCLAIMER

Please read legal disclaimer. There is no investment advice on this blog. Always consult a qualified financial adviser before any investment decisions. DYOR.

Gold And Snowflakes Before The Avalanche: Something's Broken, Something Unspoken: "After A $354 Billion U.S. Bailout, Germany’s Deutsche Bank Still Has $49 Trillion In Derivatives."

Something's broken, something unspoken... The chatter about something very serious which is happening in the financial markets is intensifying in Europe. Gold is pushed down today below $1,400 again on the "very solid" NFP numbers, but the resilience of this new Gold Bull is making people talk. Even G20 manipulation was not able to bring gold down and it snapped back above $1,400 almost immediately. Today there will be a lot of talk about the double top in gold, but do not miss the Big Picture with all market noise these days.

In our quest for the answers, maybe, we should go no further than the numerous headlines about "restructuring" of Deutsche Bank today. We should revisit first the blog post from 2016 and the $60 Trillion "derivatives nuclear bomb" on the Deutsche Bank's books. All good things take time, people are getting old and some of us are getting wiser, but here as it looks now - it is not the case.

As Pam Martens and Russ Martens wrote in their article in April: "After a $354 Billion U.S. Bailout, Germany’s Deutsche Bank Still Has $49 Trillion in Derivatives". Even after all efforts "to trim the derivatives exposure" and bailouts Deutsche Bank was still holding ... $49 Trillion in Derivatives in 2018 - the largest derivatives book on the Wall Street.

That Derivatives WMD Bomb has never been really defused. We can only speculate now how this "new restructuring" is affecting Deutsche Bank derivatives portfolio and, hopefully, this "reorganisation" will be happening orderly. Otherwise, as we all know, the financial system can be tested to its core with the systemic shock in case if this largest derivatives counterparty goes dark. It is great to discuss the Net Exposure to derivatives in the financial system when there is somebody to deliver that Hedge. In the case when the major counterparty in all these financial games with derivatives will be gone missing, gold has a very long way to go up recalibrating what will be left of the financial systems.

In our quest for the answers, maybe, we should go no further than the numerous headlines about "restructuring" of Deutsche Bank today. We should revisit first the blog post from 2016 and the $60 Trillion "derivatives nuclear bomb" on the Deutsche Bank's books. All good things take time, people are getting old and some of us are getting wiser, but here as it looks now - it is not the case.

As Pam Martens and Russ Martens wrote in their article in April: "After a $354 Billion U.S. Bailout, Germany’s Deutsche Bank Still Has $49 Trillion in Derivatives". Even after all efforts "to trim the derivatives exposure" and bailouts Deutsche Bank was still holding ... $49 Trillion in Derivatives in 2018 - the largest derivatives book on the Wall Street.

That Derivatives WMD Bomb has never been really defused. We can only speculate now how this "new restructuring" is affecting Deutsche Bank derivatives portfolio and, hopefully, this "reorganisation" will be happening orderly. Otherwise, as we all know, the financial system can be tested to its core with the systemic shock in case if this largest derivatives counterparty goes dark. It is great to discuss the Net Exposure to derivatives in the financial system when there is somebody to deliver that Hedge. In the case when the major counterparty in all these financial games with derivatives will be gone missing, gold has a very long way to go up recalibrating what will be left of the financial systems.

It is important to note that the record amount of debt with negatives rates and the planed FED rates cut in July are happening with the gold price still at the record low if we will adjust it properly for the real consumer inflation. And yes, a blast from the past, which is now officially confirmed:

"FED has never had a chance to reload "Efficient Central Bankers Economy" gun this time."

Why Gold? Deutsche Bank And $60 Trillion Derivatives - Is It The Last Snowflake Before The Avalanche?

"Dan Stringer wrote a great article covering Deutsche Bank's exposure to derivatives, why it doesn't matter you can read in the official reports. Why it does matter the market is telling us today: DB is at all time low, Credit Swiss is at all time low and Barclays is down another 5% today. As you know, I have a very unconventional theory: that actual state of the financial system is so bad that they will save it by all means now. By the way, if they fail - it will not matter any more anyway. Tomorrow just watch Janet Yellen turning this market around and US Dollar will be the victim. Gold is shining bright now. We will have a very interesting situation with the majority of market participants reversing the trades this year from being Short Gold and other Commodities and Long Us Dollar, once the message from the FED will be clear - we have just made a policy mistake. FED has never had a chance to reload "Efficient Central Bankers Economy" gun this time."

No comments:

Post a Comment