Andy from Benchmark Minerals connects the dots in our Lithium Chronicles with his report from the ground of Tne Next Industrial rEVolution. I will draw for you a sketch why it is all about Power now.

It is all about Power, as usual, New Rising Power this time. For the whole 20th century Power meant Oil and Oil meant Power, the Kingdoms were built literally out of the sand, if you had enough blood spilled to get Oil running from the ground in the deserts - millions of people are still sacrificed just in order to get that stuff, ship it and burn ...

But not for long now, The Oil Party is over - hangover will be very brutal and afterparty is already sobering at least and more disruption is coming. Now Solar is the cheapest source of Energy and now we can store Electricity - the most efficient form of Energy known to us. Lithium is the magic metal at the very heart of this Energy rEVolution.

Steve Jobs gave you all your music at your fingertips available to you at any time. Elon Musk and a lot of others you have never heard about will give you all your Power when you want it. We are talking about Energy Storage and Computers on Wheels. Electric Car is the device you are looking for. You have to read next twenty minutes which will change next twenty years of your life. Go and test drive Tesla today, you will never ask me again what is the Power. Then come back and I will tell you why Lithium Will Power Us For The Next 50 Years And Then Robots.

Now we have to make millions of electric cars and sell them very fast. The Switch is ready and coming. We are talking here about the disruption of $12 Trillion industries: $8 Trillion Energy and Utilities and $4 Trillion Transportation. The Sun is coming out every day so far, now we can convert it into Energy and Store It. Tony Seba is talking about $1 per day as a cost of Energy Storage enough to power average house in America very soon. An average cost of transition of Electricity in the U.S. is 5 cents per kWh. Now Solar is cheaper to generate electricity than the cost of its transmission from anywhere. It means that Solar Panels on your roof financed together with your House will have cheaper Power Source than anything which is not built on your rooftop. Utilities already know what is coming, just look at Florida Solar fight. We are talking total obliteration here and Trillions of dollars in stranded assets. Elon Musk is adding fire talking about his Solar Roof which will be cheaper than a normal roof and generate electricity.

Tony Seba is talking about parking lots in the U.S. If we cover them all with Solar Panels we will have enough electricity to power all the U.S. We need just 10% of all parking space covered with Solar Panels to Power all cars in the U.S. when they will be all electric!

I am talking here about unleashed Energy when 25 companies are making 51 models of electric cars in China already. I am talking about Pay As You Go. You buy Solar System including Energy Storage and Electric Car. You pay quarterly. In the beginning, you pay more - in 3-5 years you have the best car for the price (best of any cars for that price, not just being electric) and you pay less than your energy bills now and cost of ICE car ownership including wear and tear and gas bills. Done. We are getting there very fast now.

"Tony Seba: Solar today is 1% of total Energy generation in the world. Solar generation now is 200 times cheaper than in 70s. Solar is technology and the price of Energy generation will go down. Cost of Lithium batteries is going down 16% every year. By 2020 the average household in America will be able to store energy for 1 day for $1. Fossil Fuels get $5 Trillion in subsidies all around the world with all market being $8 Trillion. By 2025 all new vehicles will be electric. Transportation is 80% of Oil usage. If Solar continues to double every two years, we will have all the U.S. powered by Solar in 14 years. All the energy used in the US can be generated by Solar today in the space equal to a square 100 miles by 100 miles, which is 10,000 sq miles. Today Oil and Gas produces 30% of the U.S. energy and uses 15 times more space in leases. In the U.S. we have 15,000 sq miles in parking space. Solar canopies on all parking spaces in the US can generate all energy for the U.S. When all cars in the U.S. will be electric, we need only 10% of all parking space to generate enough energy by Solar to power them for 1 year." Read more.

I am talking here about unleashed Energy when 25 companies are making 51 models of electric cars in China already. I am talking about Pay As You Go. You buy Solar System including Energy Storage and Electric Car. You pay quarterly. In the beginning, you pay more - in 3-5 years you have the best car for the price (best of any cars for that price, not just being electric) and you pay less than your energy bills now and cost of ICE car ownership including wear and tear and gas bills. Done. We are getting there very fast now.

Chrismas dreams and cheer? Yes, but we have China with its 50 years Plan for the New Power in place moving very fast in the same direction. Maybe you have missed it so far ... they have divided it in 10 Five Year Plans... China is the largest electric cars market (Checked), BYD with Warren Buffett's stake is the largest EVs maker in the world (Checked), China is the largest "lithium battery grade chemicals" producer (Checked), China is installing every single hour a football pitch size of new Solar Generation System and one major Wind Turbin (In Progress).

You saw that War in the headline - there is no need for any anymore now ... but so many will push you into it. Empires have never come down easy. The vacuum is filled with uncertainty first and later with the those who dare to challenge the status quo. You can never rehearse the reality, let's just start with you and your family. Go and test drive Tesla first. Then come back and we will talk - your kids deserve better and it is coming.

Lithium Race: Which Will Be The First Country To Ban Fuel-Burning Cars: Norway, Netherlands, Germany, India or China?

"Dr. Joe Romm provides us with more information on the recent decision of German Bundesrat to ban fuel-burning cars. This tipping point for electric cars to become the fast growing mass market is the result of the technological advance called "The Learning Curve" when doubling of production brings on average 26% in cost reduction. It is true for the price of Solar PV, it is even faster for the chip makers and for Lithium Batteries Bloomberg reports about 14-19% cost reduction every year.

Now we are in the fast lane approaching this transition with first electric cars priced below $40k and with a range of over 200 miles coming to the market: GM Bolt and Tesla Model 3. BMW i3 with the new larger battery, Renault Zoe with 400 km range and Nissan Leaf with upgraded battery are driving the sales in Europe and China stands on its own with 25 companies making 51 models of electric cars. Read more."

Energy rEVolution: The World Just Before The INTERNET - Lithium’s Boom Year: 2016 In Review.

‘China’ the Centre of the Lithium Universe.

Benchmark Minerals:

STRONG LITHIUM PRICE SIGNS FOR 2017 SHOW REAL DEMAND STORY

Andy

"During our world travels and meetings with investors, we constantly get asked where we see prices in 2017. We have consistently answered that we do not expect a lithium price crash in 2017 and the signs are pointing to further price increases, especially in China after Galaxy Resources signed a spodumene contract for $830-905/tonne – way up from the ~$650/tonne peaks in 2016.

The contract Galaxy has signed is binding and includes a $15/tonne premium for every 0.1% Li2O the company’s spodumene can reach up to 6.0% Li2O. For example, the lowest price that the company is guaranteed to receive is $830/tonne for 5.5% Li2O material. The deal has set a new high in the lithium feedstock market.

Benchmark Mineral Intelligence originally forecasted a spodumene price increase of 15% in 2017 as Chinese chemical converters compete for limited supply on the market place. With Galaxy Resources and Neometals both ramping up new operations in 2017 and further additional supply expected from Talison, the indicators would logically point to a price decline from 2016’s highs.

However, Benchmark’s position is that such is the demand from the battery sector and cathode manufacturers expanding operations within China, spodumene supply will remain in shortage for the next 12 months – the players in the lithium market are far more concerned about supply than price at the moment.

Within China, the competition for lithium feedstock continues to be aggressive as lithium converters vie for ever increasing market share. Therefore, we continue to foresee a sellers’ market and strong prices despite increased spodumene competition.

The difference with lithium and other minerals and metals is that it is underpinned by a real demand story – the evolution of the lithium ion battery sector with force significant change in the raw materials we track at Benchmark Mineral Intelligence, especially lithium, graphite, cobalt and nickel.

Of the 14 lithium ion megafactories Benchmark is tracking under construction, 9 are based in China and the supply chain from mine to market is evolving to serve these operations. We expect this evolution to take place over the next four years and it will subject each link in the chain (raw materials, lithium chemicals, cathodes, cell manufacturers) to unprecedented volatility.

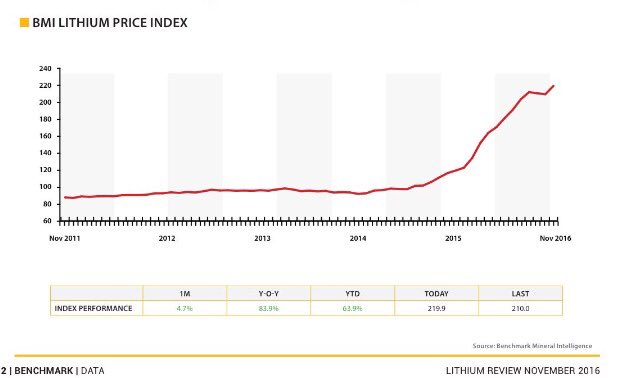

Lithium’s price trend is evidence of this but just the start."