ReNewEconomy reports on the Morgan Stanley analysis about the launch of Apple Electric Car. I personally think that Apple is losing time and money now, Tim Cook should just buy Tesla and put Elon Musk in charge of The Energy rEVolution at Apple. Than they will have everything to bring millions of the best electric cars very fast: Technology, Brand Power and very low manufacturing base with Foxconn, which is building already its own Megafactory and mysterious $15k electric cars to be produced in China at its almost $1 Billion facility. The problem is that Elon Musk will hardly sell Tesla and another opportunity can be the strategic alliance with Apple investing in 3-5 Lithium Batteries Gigafactories all around the world and buying Tesla Model 3 power-trains. Than we will have our magic cost for lithium battery at $100 per kWh and my formula 20/200 for the mass market of electric cars will be a reality by 2020.

International Lithium continues to build vertically integrated lithium business with $4.5 Billion MC giant from China Ganfeng Lithium and now we have 3 Lithium projects in our Upper Canada Pool to secure lithium supply for the West and North American market.

Trillion Market Cap Dreams For Apple: Buy Tesla And Put Elon Musk In Charge Of Energy rEVolution.

"Trillion market cap dreams for Apple are fading with its slump in sales of iPhones. China is taking over this sector as well ... as lithium market already, lithium batteries next and electric cars this year. Tim Cook is great COO, but Steve Jobs is gone ... Apple watch will not count even close to the Next Big Thing. Energy sector will do. Elon Musk and Warren Buffet are taking on 12 Trillion Energy and Transportation industries disrupting it with Solar Energy and Electric Cars. Tesla and BYD are becoming synonymous for EVs in the West and in China.

Apple still has a chance to buy Tesla and put Elon Musk in charge. He has the vibe, the technology and the lithium drive. Apple has Capital and huge iconic brand following and distribution chain. Foxconn with its own Lithium Batteries Megafactory will come as a very nice addition to the Tesla's Gigafactory and low cost manufacturing base in China. Foxconn's last year $800 million investment in electric car factory in China will bring it all together very fast. Next step is Lithium Solid State batteries with cost per kWh dropping to $100. Than we can talk about Tesla Model 3 60 kWh battery cost of ... only $6k! We are getting to my magic formula for the EVs mass market 20/200, when $20k buys you BMW 2 type electric car with 200 miles range. In this case we can talk about real Energy rEVolution with million of the best electric cars coming on-line very fast. And do not you worry - International Lithium is building the lithium supply chain for this Energy rEVolution already. Read more."

Tesla Model 3: Apple, Google Or Facebook? Who Will Buy Tesla Motors Now To Make Electric Cars For All Of Us?

Update from Elon Musk, this is super positively insane!

Model 3 orders at 180,000 in 24 hours. Selling price w avg option mix prob $42k, so ~$7.5B in a day. Future of electric cars looking bright!

Reservations for Tesla Model 3 have already passed 150,000, what does it mean? It means that people are ready to buy the good electric cars and Tesla is making the best of them. Who will buy Tesla Motors now to make electric cars for all of us? This opportunity will be paying handsomely back to the shareholders whoever will be able to make this move, we are talking about the first Trillion Market Cap company here. Will it be Apple, Google or Facebook? And do not you worry International Lithium will find enough Lithium for all of us!

Race For Renewable Energy Technologies Charges Lithium Market. Chinese Lithium Leader Secures Supply Sources.

ReNewEconomy:

By Giles Parkinson on 30 May 2016

Have you come across the term “share mobility” yet? If you haven’t already, you are about to. It refers to the new concept of electric, autonomous and shared vehicles – and it will be huge” So huge in fact that some analysts put the value of the market at $US2.6 trillion, by 2030.

The concept of electric, autonomous and shared vehicles is likely to have a major impact on the global transport industry – cars and the massive fuel industry – and in the way we run our lives. There may be no more individual ownership of vehicles, humans might even be banned from driving. And it is also presenting either massive headaches, or massive opportunities for the big corporates, and there are signs that they are investing heavily.

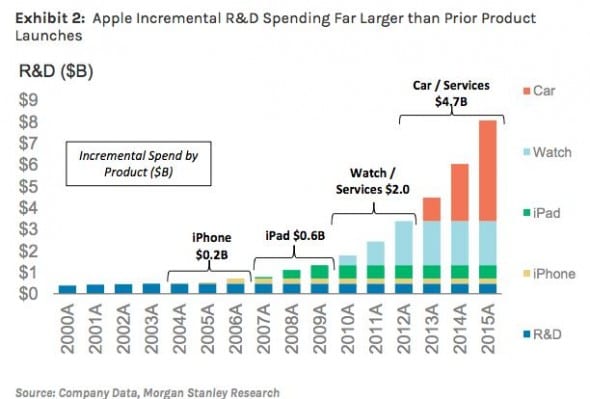

This graph from a Morgan Stanley report on software giant Apple is a case in point. It shows that Apple has spent more on R&D into car and related services in the past few years than it did on the Apple Watch, iPad and iPhone combined. And it still doesn’t have any products to show for its efforts.

Even more astonishingly, Apple is outspending the major car manufacturers at a rate of 20:1. The near $US5 billion it has spent in the last three years compares to the average spend of $US192 million at the top 14 auto makers. It even outranks Tesla by a factor of more than 10:1.

So what market is it addressing?

According to Morgan Stanley, it is a $2.6 trillion market that will emerge by 2030. It bases that calculation on 26 per cent of the 20 trillion miles driven in 2030 are through “shared vehicles” and that this will be worth around US50c/mile.

To give that market size some context, this compares to the roughly $800 billion market Apple addresses with its iPhone, iPad and associated products today.

Morgan Stanley notes that “shared mobility” is the intersection of three disruptive forces – electric, autonomous, and shared vehicles, the need for improved “digital experience in vehicles, and faster technology cycles, which now average 1-2 years, at most, compared to auto design cycles of 5-7 years.

“With Apple outspending the major auto (manufacturers) on this opportunity, we believe Apple could gain at least 16 per cent of the shared mobility market, similar to the company’s share in smartphones today,” Morgan Stanley writes.

“This translates to over $400 billion of revenue and $16 earnings per share for Apple in 2030 – more than the rest of Apple generates today ($234 billion/$9.22 EPS in FY15). Which may explain why Apple is betting the house on new car technology."

Elon Musk

Elon Musk

No comments:

Post a Comment