Koss Jansen continues his brilliant work and brings us another confirmation about the real situation with the Gold market. China moves into the next stage of Gold accumulation breaking all previous records.

Initial polls from Swiss Gold referendum put this news in the context, so who will come up on the top of this game and create the gold-backed currency first?

First Polls On Swiss Gold Referendum Show 45% Support, 39% Opposing, 16% Undecided.

"We have first reports on Swiss Gold Referendum polls and I would like to share the very important news for TNR Gold.

Do we have the chance now for the Gold backed Swiss Franc? Can the direct democracy in action initiate the change in the world financial system? Will China follow with its enormous appetite for Gold now? We have a lot of questions to answer, but these developments will mark the very important point in the history.

I am personally very impressed with these initial results considering almost total silence in mass media about this groundbreaking event in the heart of Europe. Read more."

Swiss Gold Initiative Referendum to Acquire 1500 tons of Gold.

Koos Jansen:

The Chinese Precious Metals Market Is On Fire

Chinese gold demand 67 tonnes in five days

Published: 19-10-2014 23:07

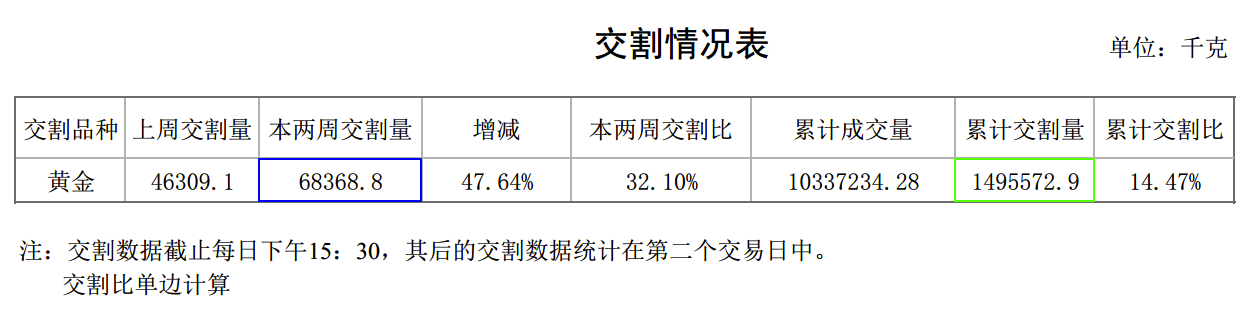

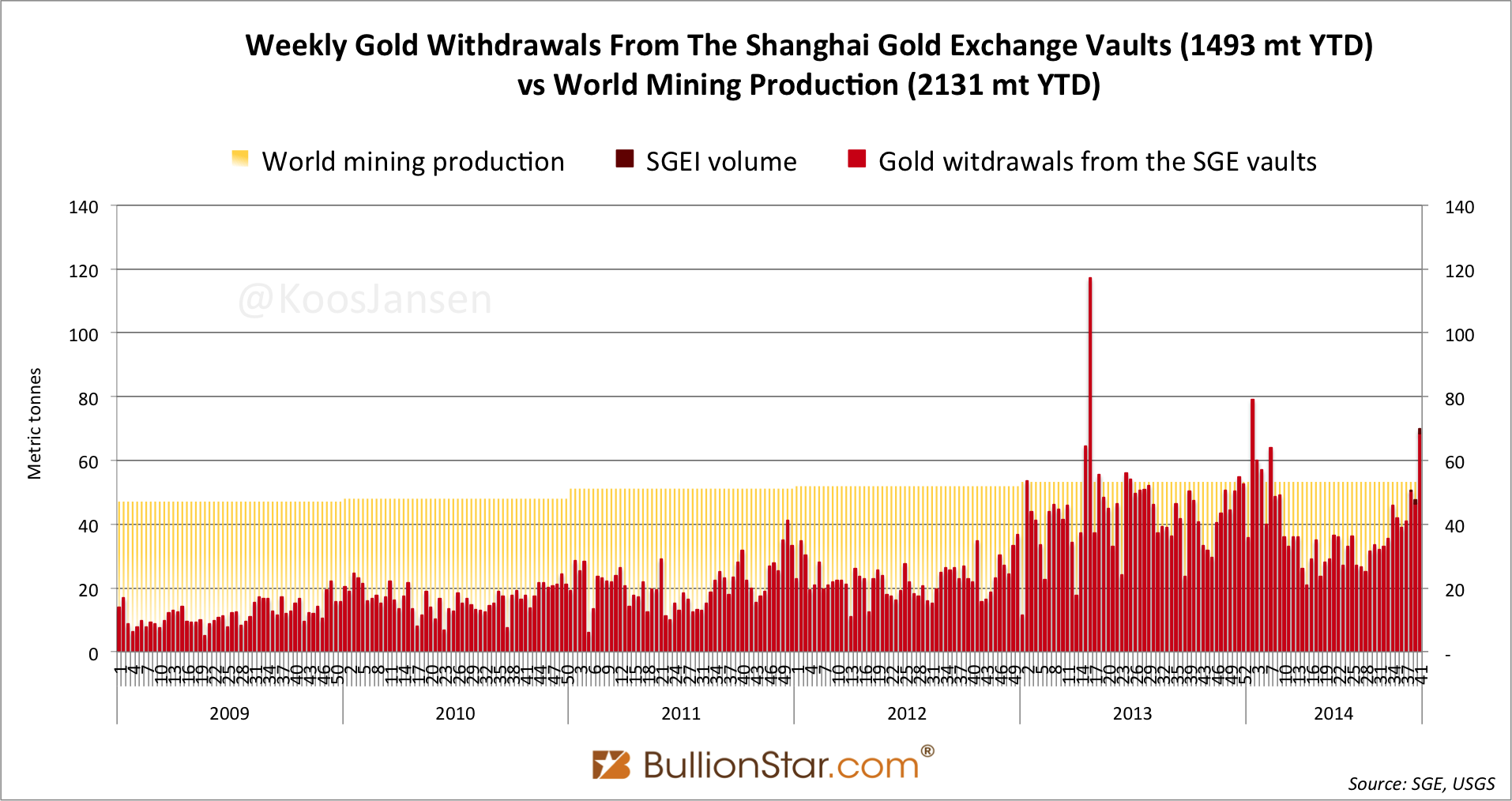

The Chinese national holiday, The Golden Week, is over and the latest data from the Shanghai Gold Exchange (SGE) shows the Chinese have been buying extraordinary amounts of gold before and after this holiday. The SGE was closed from October 1 to 7, the latest SGE withdrawal numbers cover September 29 and 30, and October 8, 9 and 10. In these 5 days 68.4 tonnes were withdrawn from the SGE vaults (in the mainland and the Shanghai Free Trade Zone)

Blue is weekly withdrawals in Kg's, green is year to date withdrawals in Kg's.

Because the SGE still isn't disclosing withdrawal numbers from mainland and FTZ vaults separately we have to subtract the volume traded on the Shanghai International Gold Exchange (SGEI), located in the FTZ, from total withdrawal numbers, just in case all buyers on the SGEI opted for withdrawal, to come to the amount of withdrawals in the mainland (which equals Chinese wholesale demand). Although it's highly unlikely all SGEI traded volume is withdrawn from the vaults, for the time being I'm forced to choose understating mainland withdrawal numbers rather than overstating.

After subtracting SGEI volume from total withdrawals numbers, withdrawals from the mainland vaults (= Chinese wholesale demand) can not have been less than 66.91 tonnes. Year to date withdrawals can not have been less than 1492.59 tonnes.

According to my simplified equation to calculate Chinese gold import (import = SGE withdrawals - mine - scrap), China has imported 957 tonnes year to date. Domestic mining stands at 356 tonnes (based on an estimated total of 451 tonnes for 2014) and scrap stands at 181 tonnes (based on 229 tonnes recycled gold in 2013).

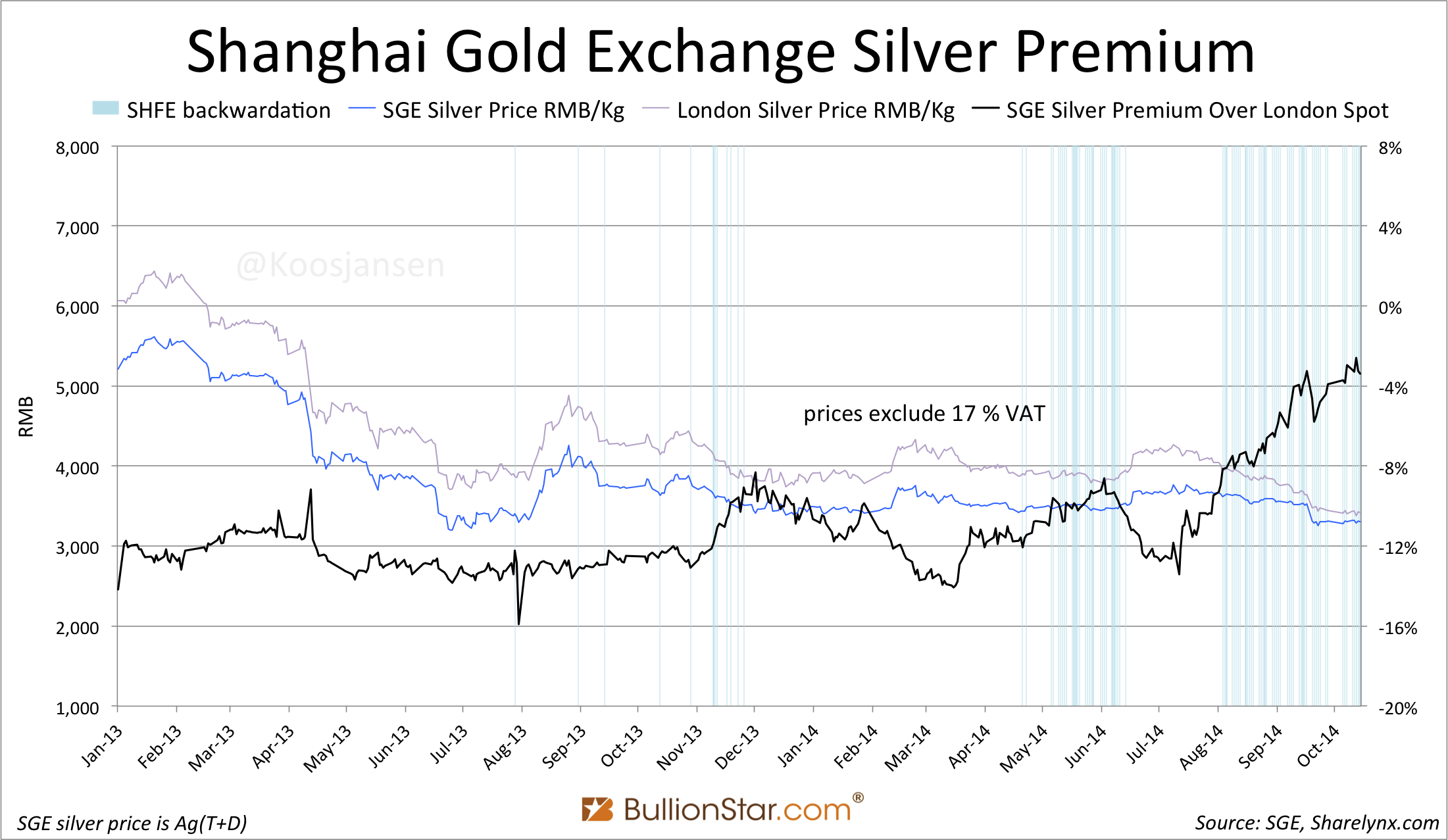

Shanghai silver remains scarce, on the Shanghai Futures Exchange (SHFE) silver has been trading in backwardation Since august 6. The scarcity has diminished the discount of silver in China relative to London significantly. Throughout October the discount was lower than 4 %.

If the discount of the pure price of silver in Shanghai reaches zero and becomes a premium, demand for silver on the world market will increase as the Chinese will start importing silver bullion.

At this moment the pure price of silver in China is lower than in London for two reasons:

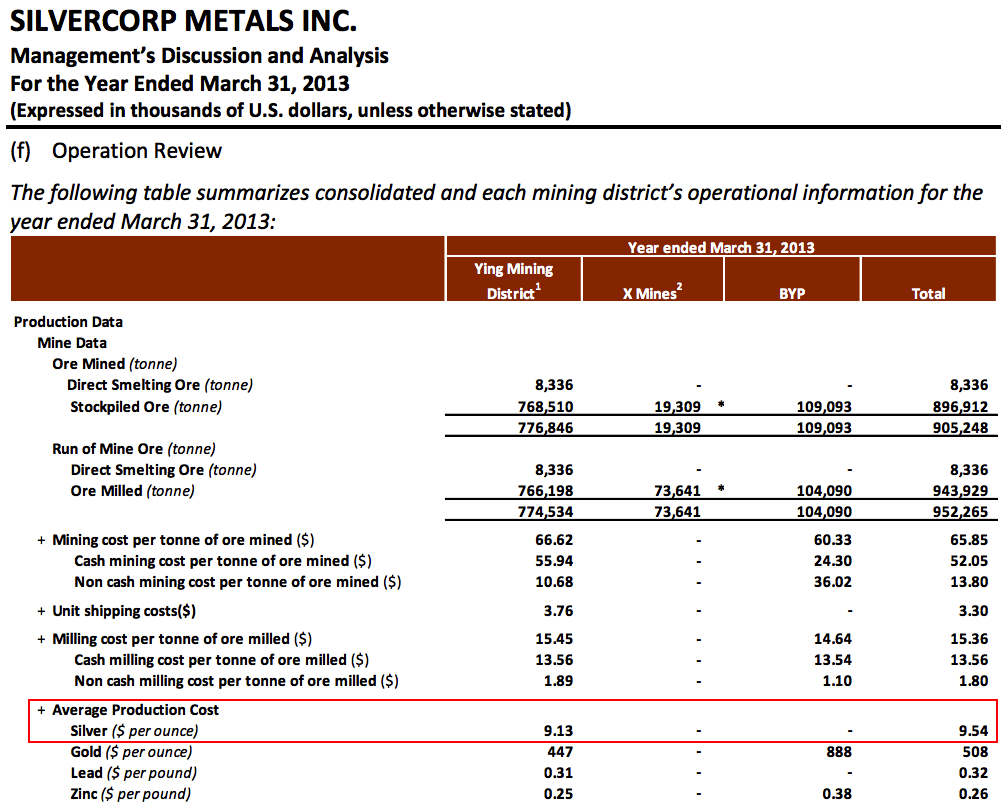

(i) The costs for mining silver in China is significantly lower than elsewhere across the globe. For example Silvercorp can mine silver in the mainland for $9 an ounce.

(ii) China's economy is heavily dependent on copper and other base metals such as lead and zinc. By importing copper, lead and zinc concentrates that contain silver as a byproduct China is incidental importing silver.

The reason the price difference is a not arbitraged is silver bullion export from the mainland enjoys 17 % VAT (no restitution). Which in affect is an export tariff of 17% to protect silver from leaving the mainland. Read: the State Council is protecting the Chinese silver market to offer their citizens to invest in silver below international prices.

SHFE silver inventory has stabilized now all the metal that was brought into the warehouse to cash and carry silver (in times of a steep futures contango curve) has been depleted. Total SHFE silver inventory now stands at 94.807 tonnes.

If we combine the last to charts we can see that whenever silver is trading in backwardation, inventory is dropping or stabilizing. If silver is not trading in backwardation (and the contango curve is steep enough), it can cause inventory to increase as the cash carry arbitrage opportunity arises (explained here).

All in all, there is strong demand for silver and gold currently in China, though the mainstream media might tell you different.

Koos Jansen

Copyright information: BullionStar permits you to copy and publicize blog posts or quotes and charts from blog posts provided that a link to the blog post's URL or to https://www.bullionstar.com is included in your introduction of the blog post together with the name BullionStar. The link must be taret="_blank" without rel="nofollow". All other rights are reserved. BullionStar reserves the right to withdraw the permission to copy content for any or all websites at any time."

No comments:

Post a Comment