“We are pleased that significant developments on the advancement of the Los Azules Copper Project towards feasibility have brought Stellantis as a strategic partner in the future development of this giant copper, gold and silver project. An additional investment of US $30 million in McEwen Copper has been also been invested by Rio Tinto’s Venture Nuton in 2023 after their initial investment of US $25 million in 2022,” stated Kirill Klip, TNR’s Chief Executive Officer.

“TNR Gold’s vision is aligned with the leaders of innovation among automakers like Stellantis, with the aim of decarbonizing mobility, and our mining industry leaders like Rob McEwen’s vision ‘to build a mine for the future, based on regenerative principles that can achieve net zero carbon emissions by 2038’.

The green energy rEVolution relies on the supply of critical metals like copper; delivering “green copper” to Argentina and the world will contribute to the clean energy transition and electrification of transportation and energy industries.

Strong team performance is accelerating the McEwen Copper Los Azules program in 2023. These new exploration results highlight the potential to create additional value for the Los Azules Project, and continuity of mineralization in the infill program is de-risking the project.

It’s very encouraging to see the opportunity to expand the deposit. Together with Nuton, McEwen Copper is exploring new technologies that save energy, water, time and capital, advancing Los Azules towards the goal of the leading environmental performance. The involvement of Rio Tinto with its innovative technology, may also accelerate realizing the enormous potential of the Los Azules Project.

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). TNR Gold does not have to contribute any capital for the development of the Los Azules Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

"Vancouver, British Columbia – May 9, 2023: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce an update from McEwen Mining Inc. (“McEwen Mining”) on the Los Azules copper, gold and silver project in San Juan, Argentina. TNR holds a 0.4% net smelter returns royalty (“NSR Royalty”) (of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder) on the Los Azules Copper Project. Los Azules is held by McEwen Copper Inc. (“McEwen Copper”), a subsidiary of McEwen Mining.

The news release issued by McEwen Mining stated:

“TORONTO, May 05, 2023 (GLOBE NEWSWIRE) — McEwen Copper Inc., 52%-owned by McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), today reports the latest assay results from Los Azules, where an ongoing infill drilling program continues to delineate copper mineralization in the core of the deposit. Infill drilling serves several purposes: providing better data density to upgrade confidence in the mineral resources, providing material and data for metallurgical, geotechnical, and hydrological studies, and potentially defining higher grade mineralization by drilling inclined holes across vertical structures (such as breccias).

Located in San Juan, Argentina, the Los Azules Project has many features comparable to world-class copper-gold deposits in South America, including a thick blanket of higher-grade Enriched mineralization.

Significant Infill Intercepts

231 m of 0.97% Cu, including 188 m of 1.09% Cu (AZ22182A)

550 m of 0.50% Cu, including 216 m of 0.72% Cu (AZ23196)

Highlights

- Hole AZ22182A intercepted an Enriched zone of 231 m of 97% Cu (est. true thickness) and a Primary zone with mineralization that remains “open” at depth.

- Hole AZ23196, returned an overall intercept of 550 m of 50% Cu (est. true thickness) and included 216 m of 0.72% Cu within the Enriched zone portion.

- Drilling completed during the current season to April 30th stands at 32,758 m in 125 holes, having exceeded the 25,000 meters initially planned. Drilling will continue until the end of the field season in May and will resume in October, at the end of winter in Argentina.

Table 1 summarizes recent copper (Cu), gold (Au) and silver (Ag) assay results.

Figure 1 presents a plan view of the location of four sections and the holes reported. Adjacent cross sections are located 50 m apart from each other, starting with the lowest numbered section at the south end of the deposit and progressing to the north.

Results are summarized in four schematic cross sections (Figures 2 to 5), which include simplified interpretations of the Overburden, Leached, Enriched and Primary zones. The Enriched mineral zone refers to the enrichment of a copper deposit by precipitation-derived water circulation that carries copper minerals downward through the rocks to accumulate in a thick, often horizontal “blanket”. Immediately above the Enriched zone is the Leached zone, from which copper was removed and transported. Weathering and oxidation often aid in this process. Below the Enriched zone, the Primary (or Hypogene) zone is formed by ascending copper-rich thermal fluids having a much deeper magmatic origin. The green line indicates the pit floor of the 30-year pit shell from the 2017 NI 43-101 Preliminary Economic Assessment (PEA).

Figure 1 – Plan View Location of Cross-sections and Drill Holes in the Deposit

Figure 2 highlights a 231 m interval in the Enriched zone grading 0.97% Cu (AZ22182A), including 188 m grading 1.09% Cu within the center of the section. Drilling on this section is more limited laterally and has not tested the Primary zone beyond a 16.6 m interval, which graded 0.55% Cu. The interpretation of the mineral zones is supported by the definition drilling completed 50 m away on Section 36 (not shown) during the 2022 portion of the program.

Figure 2 – Section 35 – Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Figure 3 – Section 43 – Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Figure 3 presents an overall 550 m intercept of 0.50% Cu (AZ23196). Its Enriched zone measures 486 m of 0.52% Cu, including a 216 m sub-interval of 0.72% Cu. These values correlate well with nearby holes, such as AZ22176 with 226 m grading 0.87% Cu (including 96 m grading 1.13% Cu) and hole AZ22169, with 262 m grading 0.55% Cu (including 74 m grading 0.93% Cu). Both intervals correspond to the Enriched zone, which is interpreted to have a true thickness of 200 m to 250 m. Copper mineralization is tested with limited drilling at depth on this section.

Figure 4 highlights 186 m grading 0.52% Cu, including 78 m of 0.64% Cu (AZ23201) in the Enriched zone. The hole continues in the Primary zone with a 195 m section grading 0.59 % Cu and remains open at depth. The nearby previously released hole AZ22171 showcases 341 m grading 0.53% Cu, including 88 m grading 1.06% Cu in the Enriched zone and the hole ending in 35.2 m grading 0.27% Cu in the Primary zone.

Figure 4 – Section 45 – Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Figure 5 profiles hole AZ23198in the Enriched zone with a 408 m interval grading 0.56% Cu, including 176 m with 0.80% Cu. When compared with nearby hole AZ1060A with a significant 211 m section grading 0.55% Cu, hole AZ23198 shows higher initial grades at the top of the Enriched zone.

Figure 5 – Section 47 – Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Technical information

The technical content of this press release has been reviewed and approved by Stephen McGibbon, P. Geo., McEwen Mining’s Senior Consulting Geologist, and a qualified person as defined by NI 43-101.

All samples were collected in accordance with generally accepted industry standards. Drill core samples, usually taken at 2 m intervals, were split and submitted to the Alex Stewart International laboratory located in the Province of Mendoza, Argentina, for the following assays: gold determination using fire fusion assay and an atomic absorption spectroscopy finish (Au4-30); a 39 multi-element suite using ICP-OES analysis (ICP-AR 39); copper content determination using a sequential copper analysis (Cu-Sequential LM-140). An additional 19-element analysis (ICP-ORE) was performed for samples with high sulphide content.

The company conducts a Quality Assurance/Quality Control program in accordance with NI 43-101 and industry best practices using a combination of standards and blanks on approximately one out of every 25 samples. Results are monitored as final certificates are received, and any re-assay requests are sent back immediately. Pulp and preparation sample analyses are also performed as part of the QAQC process. Approximately 5% of the sample pulps are sent to a secondary laboratory for control purposes. In addition, the laboratory performs its own internal QAQC checks, with results made available on certificates for Company review.

Link to drill results, locations and lengths of drillhole collars corresponding to January 2023 through April 2023 at Los Azules:

https://www.mcewenmining.com/files/doc_news/archive/2023/2023-05LA/2023-05LA-AssayResults-HoleLocations.xls

Table 2 – Hole Locations and Lengths for Los Azules Drilling Results

| HOLE-ID | Azimuth | Dip | Length | Loc X | Loc Y | Loc Z |

| AZ22182A | 250 | -74 | 302.6 | 2383376 | 6559139 | 3648 |

| AZ23195 | 0 | -90 | 1,076.0 | 2382332 | 6558193 | 3944 |

| AZ23196 | 70 | -69 | 610.0 | 2383022 | 6559436 | 3636 |

| AZ23197 | 250 | -71 | 379.4 | 2382741 | 6559653 | 3621 |

| AZ23198 | 70 | -80 | 469.0 | 2383206 | 6559702 | 3630 |

| AZ23201 | 70 | 74 | 464.5 | 2382953 | 6559518 | 3629 |

| AZ23202 | 70 | -85 | 329.7 | 2383086 | 6559353 | 3640 |

| AZ23203 | 66 | -74 | 313.9 | 2383294 | 6558950 | 3667 |

| AZ23207A | 250 | -62 | 591.0 | 2383200 | 6559703 | 3630 |

| AZ23208 | 250 | -82 | 308.0 | 2382841 | 6559583 | 3618 |

| Coordinates listed in Table 2 based on Gauss Kruger – POSGAR 94 Zone 2 | |

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it has large exposure to copper through its 52% ownership of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and extend the life of its mines with the objective of increasing its share value and price and providing a yield. Rob McEwen, Chairman and Chief Owner, has personal investment in the company of US$220 million. His annual salary is US$1.”

The McEwen Mining press release appears to be prepared by Qualified Persons (as that term is defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects) and the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no Qualified Person engaged by TNR has done sufficient work to analyze, interpret, classify or verify McEwen Mining’s information to determine the current mineral resource or other information referred to in its press releases. Accordingly, the reader is cautioned in placing any reliance on the disclosures therein.

“We are pleased that significant developments on the advancement of the Los Azules Copper Project towards feasibility have brought Stellantis as a strategic partner in the future development of this giant copper, gold and silver project. An additional investment of US $30 million in McEwen Copper has been also been invested by Rio Tinto’s Venture Nuton in 2023 after their initial investment of US $25 million in 2022,” stated Kirill Klip, TNR’s Chief Executive Officer. “TNR Gold’s vision is aligned with the leaders of innovation among automakers like Stellantis, with the aim of decarbonizing mobility, and our mining industry leaders like Rob McEwen’s vision ‘to build a mine for the future, based on regenerative principles that can achieve net zero carbon emissions by 2038’.

The green energy rEVolution relies on the supply of critical metals like copper; delivering “green copper” to Argentina and the world will contribute to the clean energy transition and electrification of transportation and energy industries.

Strong team performance is accelerating the McEwen Copper Los Azules program in 2023. These new exploration results highlight the potential to create additional value for the Los Azules Project, and continuity of mineralization in the infill program is de-risking the project.

It’s very encouraging to see the opportunity to expand the deposit. Together with Nuton, McEwen Copper is exploring new technologies that save energy, water, time and capital, advancing Los Azules towards the goal of the leading environmental performance. The involvement of Rio Tinto with its innovative technology, may also accelerate realizing the enormous potential of the Los Azules Project.

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). TNR Gold does not have to contribute any capital for the development of the Los Azules Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-seven years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

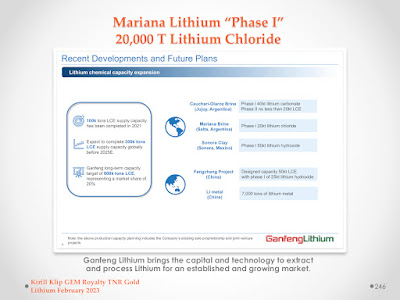

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% net profits royalty holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

Kirill Klip

Executive Chairmanwww.tnrgoldcorp.com

For further information concerning this news release please contact Kirill Klip +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, changes in share capital, market conditions for energy commodities, the successful completion of sales of portions of the NSR royalties and decisions of the government agencies and other regulators in Argentina. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s profile on www.sedar.com. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will be able to repay its loans or complete any further royalty acquisitions or sales; debt or other financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties challenging in the future the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium, and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."