Kirill Klip, TNR’s Chief Executive Officer commented, “We are very pleased that after many months of deliberate negotiations we have achieved this major milestone for our Company and a further validation of TNR Gold’s business model. By monetizing part of our royalty holdings, we are providing a very important benchmark for valuations of assets in our royalty portfolio and generating very significant capital, while selling to LRC only a portion of our royalty holding on the Mariana Lithium Project.

This strategic transaction with LRC allows us to significantly improve our working capital position and strengthen our balance sheet. The parties expect the transaction to close within 60 days. The Company has received an initial advance of USD$350,000 from LRC under the terms of the royalty purchase agreement.

We believe that our royalty holdings are undervalued, and their appropriate values are not reflected in the Company’s share price. This transaction clearly demonstrates it. We have generated a total amount of cash for TNR Gold that is well above the Company’s recent market capitalization. We have received significant industry interest in our assets and the Company is working on potential new strategic partnerships to provide further benchmarks for the market valuations of our royalty holdings.”

NEWS RELEASE

TNR Gold Monetizes Royalty Holding on Mariana Lithium by Partial NSR Sale to Lithium Royalty Corp

Vancouver, British Columbia – July 26, 2022: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce that it has entered into a royalty purchase agreement dated July 22, 2022 with an Ontario limited partnership affiliated with Lithium Royalty Corp (“LRC”) for the sale of a portion of its net smelter returns royalty (“NSR”) involving the Mariana Lithium Project (“Mariana”). LRC has purchased from TNR, 0.5% NSR royalty for USD$9,000,000, including 0.05% NSR royalty sold by TNR on behalf of its shareholder. This represents one-quarter of the NSR royalty held by the Company. LRC is an arms’ length party to the Company.

On October 21, 2021, TNR Gold announced that, further to the Company’s news release dated September 27, 2021, International Lithium Corp. (“ILC”) had announced the completion of the sale to Ganfeng Lithium Netherlands Co., B.V. of ILC’s remaining 8.58% stake in Litio Minera Argentina S.A. (“LMA”), the owner of the Mariana Lithium Project in Salta, Argentina. The deal included confirmation that LMA would assume all rights or obligations that ILC had in respect of the Mariana property. TNR Gold holds a 2.0% NSR royalty on the Mariana Lithium Project.

Both TNR Gold and LMA have acknowledged LMA’s responsibility to pay the 2% NSR royalty on the commencement of Commercial Production at the Mariana Lithium Project, and LMA has assumed the right to the repurchase of 50% of the NSR royalty (that is 1%).

TNR sold the portion of the NSR royalty which is not subject to any buy-back rights of LMA. After the closing of transaction with LRC, TNR will hold a 1.5% NSR royalty, including a 0.15% NSR royalty held on behalf of a shareholder (which represents a 1.35% NSR held by TNR and a 0.15% NSR in favour of the shareholder). The closing of the sale with LRC, is subject to the parties’ filing of certain notices in the Salta Mining Court in Argentina.

LMA has the right to purchase from TNR 1.0% of the NSR royalty for aggregate payment of CAN$1,000,000 at any time within 240 days of “Commencement of Commercial Production” as defined in the underlying agreement. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the completion of the repurchase by LMA. If such purchase was made by LMA, TNR would hold a 0.45% NSR and its shareholder would hold a 0.05% NSR.

Kirill Klip, TNR’s Chief Executive Officer commented, “We are very pleased that after many months of deliberate negotiations we have achieved this major milestone for our Company and a further validation of TNR Gold’s business model. By monetizing part of our royalty holdings, we are providing a very important benchmark for valuations of assets in our royalty portfolio and generating very significant capital, while selling to LRC only a portion of our royalty holding on the Mariana Lithium Project. This strategic transaction with LRC allows us to significantly improve our working capital position and strengthen our balance sheet. The parties expect the transaction to close within 60 days. The Company has received an initial advance of USD$350,000 from LRC under the terms of the royalty purchase agreement.

We believe that our royalty holdings are undervalued, and their appropriate values are not reflected in the Company’s share price. This transaction clearly demonstrates it. We have generated a total amount of cash for TNR Gold that is well above the Company’s recent market capitalization. We have received significant industry interest in our assets and the Company is working on potential new strategic partnerships to provide further benchmarks for the market valuations of our royalty holdings.”

ABOUT LITHIUM ROYALTY CORP

Lithium Royalty Corp (“LRC”) is a North American royalty corporation focused on investing in high quality low-cost projects in the battery materials sector with an emphasis on lithium. LRC was founded in 2018 and has now established itself as a leading financier in the lithium industry having completed 20 royalties since inception exclusive of this transaction. Its investments are diversified across the world with exposure in Australia, Argentina, Brazil, Canada, Serbia, and the United States of America. LRC is a signatory to the United Nations Principles for Responsible Investing and seeks to invest in companies with high environmental, social, and governance standards. Waratah Capital Advisors is the sponsor and general partner of Lithium Royalty Corp.

ABOUT TNR GOLD Corp.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

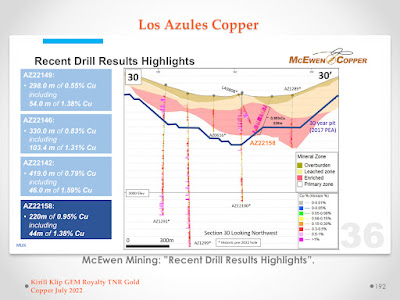

Over the past twenty-six years, TNR, through its lead generator business model, has been successful in generating high-quality exploration projects around the globe. With the Company’s expertise, resources and industry network, it identified the potential of the Los Azules Copper Project in Argentina, which is being developed by McEwen Mining Inc. now. TNR Gold holds a 0.4% NSR Royalty on the Los Azules Copper Project, including a 0.04% held on behalf of a shareholder.

TNR retains a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% of the 1.5% NSR is held on behalf of a shareholder. LMA, has a right to repurchase 1.0% of the NSR Royalty on the Mariana Project, as described above.

TNR also holds a 7% NPR holding on the Batidero I and II properties of the Josemaria Project, which is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources Inc.

The Company’s strategy with Shotgun Gold Project is to attract a joint venture partnership with one of the gold major mining companies. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and Argentina (the Los Azules Copper and the Mariana Lithium projects) and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

For further information concerning this news release please contact +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, market conditions for energy commodities, the closing of the royalty sale on the terms disclosed and improvements in the financial performance of the Company. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s profile on www.sedar.com. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will be able to repay its loans or complete any further royalty acquisitions or sales; debt or other financing will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties challenging in the future the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium, Josemaria Resources and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."