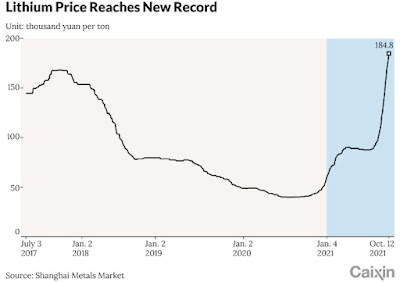

Lithium prices are printing new all-time highs faster than I can find new charts illustrating the dramatic tectonic clash of the dreams about electrification of all energy and transportation with the reality of our supply lines which were built mostly in the last century.

Supply shock drives the tsunami wave lifting lithium prices after Tesla's earthquake shattered all legacy ICE auto industry. Consumers are ready and demanding the best electric cars. EVs are getting better and they are already cheaper to own than comparable ICE cars. The next step is when electric cars will become even cheaper to buy in the first place.

We have a huge disconnect between available technology to produce millions of new electric cars and the supply lines for all critical metals which are needed for this production. Fasmarkets reports about lithium prices reaching a new all-time high in China at USD$33,000 per T. Headlines are screaming about the shortages of safe lithium batteries and alliances are made in the hot EV batteries space. The ugly truth is that all automakers depend now on the lithium supply bottleneck.

Investors are piling billions of dollars in the EVs sector, searching for the next Tesla. Automakers are finally investing billions of dollars in order to still produce cars in the nearest future and not to become just part of the ICE Age exhibitions in the history museums.

But mines producing lithium cannot grow overnight to supply all these beautiful dreams at once with the Battery Grade Lithium. This flood of money that is seeking the best returns in the EVs space is hitting a very small lithium market. Price shocks are imminent. All lithium market was less than USD$4B in size by sales in 2020! The prices are going up first and additional lithium supply will be coming much later.

All legacy ICE automakers are chasing Tesla. Now they all will be chasing a secure lithium supply.

The Switch is here. Millions of people are switching to electric cars.

Sales of electric cars are going exponentially and reaching new highs as a percentage of total auto sales. This incredible growth is happening from a very low base. The main adoption wave is still to come to the major auto markets. We are talking here about another 90% of all new cars sales becoming the sales of electric cars very fast.

Norway is showing the way and what is coming in the nearest future - the total domination of electric cars. Analysts are finally waking up after their investment banks have been being poisoned for years by DIEselGate money and fumes, Finally, they dusted off their calculators and start writing about the coming deficits to the lithium market which will continue to push lithium prices higher.

"

Skyrocketing lithium prices unlikely stabilise soon", according to the chairman of the giant Ganfeng Lithium. Benchmark Mineral Intelligence slide demonstrates clearly what he means. We are talking here about "

The Digital Divide". There is a total disconnect between mushrooming Gigafactories, numerous new state-of-the-art facilities to produce electric cars and lithium industry production capacity for Battery Grade Lithium.

"Australian investment bank, Macquarie, forecasts the lithium market to be in a 2,900 tonnes deficit this year, rising to 20,200 tonnes in 2022, with the shortfall widening further to 61,000 tonnes in 2023.

Credit Suisse’s deficit projections were at 117,000 tonnes and 248,000 tonnes in 2024 and 2025, respectively.

The forecast market deficit has led many analysts to revise their short-term lithium trend and price forecast. In general, the lithium price forecast between 2025 to 2030 remained bullish. Due to the volatile nature of the lithium market, no analyst has given a forecast beyond 2025.

In November, Fitch Solutions revised its 2022 lithium carbonate prices to average at $21,000 a tonne, compared with the previous projection of $15,025 a tonne. With more production restarting and coming on stream in 2023, lithium carbonate price is expected to average lower at $19,000 a tonne in 2023.

Remember, analysts’ forecasts can be and have been wrong. If you would like to invest in lithium, you should do your own research first. Your investment decision should be based on your attitude to risk, your expertise in this market, the spread of your portfolio and how comfortable you feel about losing money. And never invest more than you can afford to lose." (Capital.com)

We started our Tesla Nikola rEVolution Gold journey and our Lithium Race a long time ago, now I do not have to tell you why we all will be driving electric cars and much faster than a lot of people are anticipating it even these days. The best industry players will be telling you our Story now. Fasten your seatbelts and enjoy the ride!

On my blog following the links below, you can find more information about TNR Gold Corp. and our Royalty Holdings. Do your own research, as usual, stay safe and prosper. Join rEVolution.

Ganfeng Lithium is going from strength to strength riding the tsunami wave after the Tesla earthquake shattered all legacy ICE Age auto industry. Our

Team at TNR Gold just congratulated our partner - Ganfeng is developing the giant Mariana Lithium Project where we have our NSR Royalty Holding - upon their signing a

3-year Lithium supply agreement with Tesla. All legacy automakers are chasing Tesla and investors are chasing their Lithium dreams. Your ability to find the best Lithium plays will define your success for the years to come. We have found our Mariana Lithium Project and Ganfeng Lithium many years ago and now industry insiders and investors are finding our

GEM Royalty Story.

"All Lithium market was less than US$4 Billion in size just a year ago. Now Lithium price has tripled. Choose very wisely among the best lithium companies to participate in this generational investment trend."

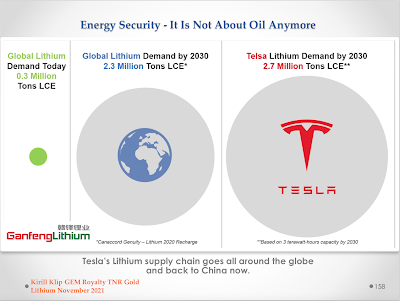

Due to the technical complexity, only the strongest Lithium companies will be able to develop new projects and achieve a significant production increase of Battery Grade Lithium. The whole industry produced only 369,000 T LCE of Lithium in 2020 and now we have to jump first to over 1 million T LCE by 2025. Ganfeng's Chairman is talking about 3 million T LCE annual demand by 2030 and Canaccord Genuity estimated that only Tesla will consume 2.7 million T LCE annually by 2030.

In early October, Ganfeng Lithium Team in Argentina presented Mariana Lithium Project in Salta to the local government. Governor of Salta praised Ganfeng Lithium Team and the proud people of Argentina are ready to open a new chapter for their beautiful country. Argentina has everything in order to become the powerhouse of the Tesla Energy rEVoltion.

The future is bright for Green Energy Metals, investors are waking up to the new generational opportunity. A very important slide from the Ganfeng presentation for TNR Gold shareholders shows that this fantastic increase of 100% in planned lithium production rate is called now "Phase 1"! Hopefully, we will see the further development of this giant Lithium project in the future and the potential cash flow for TNR Gold from our NSR Royalty Holding may increase very significantly as well.

On my blog following the links below, you can find more information about TNR Gold Corp. and our Royalty Holdings. Do your own research, as usual, stay safe and prosper. Join rEVolution.

Caixin Global:

Skyrocketing Lithium Prices Unlikely to Stabilize Soon, Says Ganfeng Chairman

"Skyrocketing lithium prices aren’t likely to stabilize unless the new-energy vehicle industry begins to mass-produce alternative battery technologies or major recycling programs are put in place, according to the head of China’s largest miner of the metal. Li Liangbin, chairman of Ganfeng Lithium Co. Ltd., told Caixin in an interview that the volume of installed batteries could exceed 3,000 gigawatt-hours (GWh) by 2030 and overall global demand for the material could reach 3 million tons."

No comments:

Post a Comment