"My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin."

Kirill Klip, Executive Chairman

TNR Gold Corp.

We extend our congratulations today to TNR Gold shareholder NovaGold and their Donlin Gold JV partner, Barrick Gold. Donlin Gold has produced another set of spectacular results and Kitco is reporting that "Barrick Gold "reaffirmed its confidence" in Donlin Gold Project":

"Barrick President and Chief Executive Mark Bristow said, “Getting together in Alaska, visiting the Donlin project site and sitting down with stakeholders drove home the significance and importance of Donlin to both partners. We have a unique opportunity to progress a world-class project in both a jurisdiction and with local partners that recognize the contribution such an asset can bring to the lives of future generations of Alaskans. Our priority is to do that responsibly and sustainably and it is an illustration of Barrick’s and NOVAGOLD’s strong partnership that we were able to have such a productive workshop and come away with next steps to move the project forward.” (NovaGold NR December 1, 2021)

It is important to note that QP of TNR Gold, as it is defined by NI 43-101, has not verified independently any results reported by NovaGold - you should study all results in their entirety including technical disclaimers on the NovaGold website and consult your qualified financial advisor before any investment decision. But what we can discuss here are the grades reported by Barrick Gold and NovaGold and the depth of those intersections:

"Now you can better understand my personal excitement finding these additional confirmations to my belief that the Shotgun Ridge system has all geological indications pointing to the potential to grow further. It is important to mention here that TNR' Shotgun Gold Project is a Porphyry Gold system as well, with a similar geo signature as Donlin Gold."

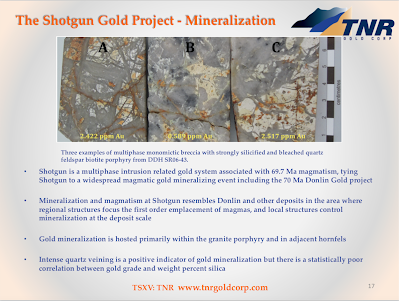

"Shotgun Gold is a multiphase intrusion-related system associated with 69.7 Ma magmatism, tying Shotgun Gold to a widespread magmatic Gold mineralising event including the 70 Ma Donlin Gold project. Mineralisation and magmatism at Shotgun Gold resemble Donlin Gold and other deposits in the area where regional structures focus the first order emplacement of magmas, and local structures control mineralisation at the deposit scale."

Northern Miner:

Barrick, NovaGold to update $7.4B Donlin feasibility

Barrick Gold (TSX: ABX; NYSE: GOLD) and NovaGold Resources (TSX: NG; NYSE: NG), 50:50 owners of the Donlin gold project are working on an updated feasibility study, scheduled for release next year. The partners say that recent work on the project has resulted in clear improvement in definition of controls and mineralization, and recent drill results continue to yield high-grade gold.

The property is 450 km northwest of Anchorage, Alaska, and hosts a deposit containing 541 million measured and indicated tonnes grading 2.24 grams gold per tonne for 39 million oz. of gold and an inferred resource of 92 million tonnes grading 2.02 grams gold per tonne for 6 million oz. of gold.

Senior leaders, including Barrick and NovaGold CEOs Mark Bristow and Greg Lang, recently met with the Donlin management team, local stakeholders and both federal and state government officials who expressed their continued support for the project.

The 2021 drill program was completed in September with 79 holes over 24,264 metres. Assay results from 65% of the holes had been received by the end of November. Drill assays continue to return high-grades and confirm grade continuity.

Barrick released five of the best recent intervals. Highlights included hole DC21-1976 that cut 57.3 metres grading 6.87 grams gold per tonne, including 4.1 metres at 18.13 grams gold per tonne; hole DC21-1970, which returned 19.2 metres grading 12.57 grams gold per tonne, including 12.2 metres grading 17.28 grams gold per tonne; and hole DC21-1964, which intersected 37.9 metres grading 6.28 grams gold per tonne, including 8 metres at 15.99 grams gold per tonne and 3.1 metres at 10.21 grams gold per tonne.

“Donlin Gold’s 2021 drill program is producing some of the best drill results seen lately in the gold mining industry, from juniors to majors,” NovaGold’s Lang stated in a press release.

The Donlin project hosts one of the largest and highest grade undeveloped deposits in the world. The first feasibility study for the project was completed in 2009.

“Getting together in Alaska, visiting the Donlin project site and sitting down with stakeholders drove home the significance and importance of Donlin to both partners,” said Barrick’s Bristow. “We have a unique opportunity to progress a world-class project in both a jurisdiction and with local partners that recognize the contribution such an asset can bring to the lives of future generations of Alaskans.”

Donlin value in billions of dollars

Based on the economic valuation of the Donlin project (using US$1,500 per oz. gold), the project has an after-tax net present value with a 5% discount of US$3 billion and an internal rate of return of 9.2%. Payback will be achieved 7.3 years after the start of production.

The initial capital requirement is US$7.4 billion, followed by sustaining capital of US$1.7 billion. Closure costs are estimated to be US$292 million.

An open pit mine would be developed to deliver 53,500 tonnes per day of ore to a mill with a flowsheet containing semi-autogenous grinding (SAG) and ball milling, flotation, pressure oxidation leach, and carbon-in-leach circuits. Combined total plant gold recovery would be 89.8%. Concentrates produced would grade 11 to 15 g/t gold."

No comments:

Post a Comment