LEGAL DISCLAIMER

“I would like to thank Xiaoshen and David for their positive contributions to International Lithium. We are pleased to have completed a maiden resource estimate that includes both an indicated and inferred resource estimate, published in a technical report and available at SEDAR http://www.sedar.com. As we no longer have a potential conflict of interest, we are looking forward to working with Xiaoshen and David and building our JV operations with Ganfeng on an arms’ length basis and in the most efficient way, for the benefit of both companies,” stated Kirill Klip, Executive Chairman of International Lithium.

International Lithium's JVs With Ganfeng Lithium Is An Entry Point To A Vertically Integrated Business With An Industry Giant From China.

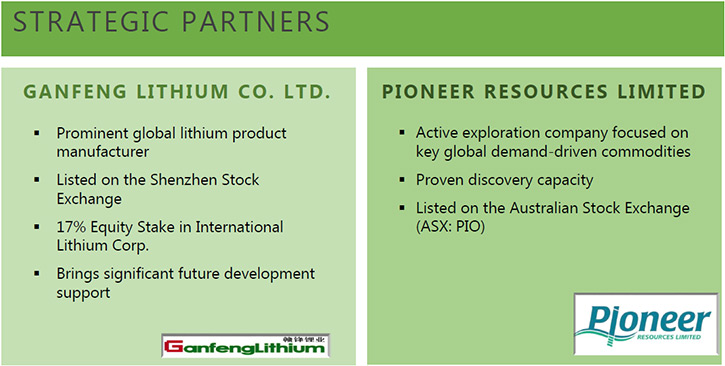

International Lithium's (TSXV: ILC) Joint Ventures with Ganfeng Lithium in Argentina and Ireland is an entry point to a vertically integrated lithium business with a USD $6 Billion market cap industry giant from China. ILC's strategy is to build VC Capital in a number of M&A transactions. Construction of ILC Royalty Portfolio is our underlining business model. International Lithium's stake in the Mariana joint venture is of particular interest for OEMs entering into the electric car and lithium battery business looking to secure their long term lithium supply. Read more.

Please contact us to explore this opportunity. Thank you! InternationalLithiumCorp@gmail.com

International Lithium:

International Lithium Update on Mariana Lithium Brine Project, Argentina

Vancouver, B.C. August 28, 2017: International Lithium Corp. (the “Company” or “ILC”) (TSX VENTURE: ILC) is pleased to announce, with JV partner Ganfeng Lithium Co. Ltd., (“GFL”) and together the “Companies”, an update for the Mariana lithium brine project (the “Project”) located in Salta, Argentina.

Mariana Lithium JV Update

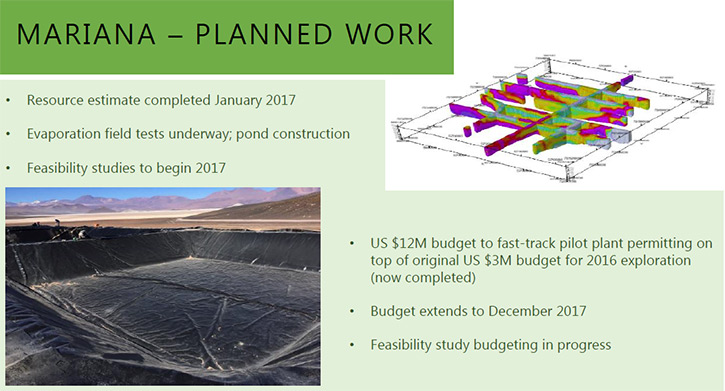

Further to the Company’s news release dated April 10, 2017, announcing a maiden resource estimate for the Mariana lithium brine project, the following activities have been ongoing at the project site as the project advances toward the commencement of preliminary economic and pre-feasibility studies.

On April 25, 2017, the Company was informed by manager of the Mariana Joint Venture that three large evaporation ponds measuring 14 x 14 metres have been constructed at site and filled to 30 centimetres depth with raw brine from Salar de Llullaillaco to conduct large scale evaporation tests and begin the development of a natural evaporation concentration process for the brine. Two smaller ponds that are to be used for the later stages of the brine concentration were also constructed at the site. A field laboratory and liming plant are currently under construction with the field laboratory expected to be completed by the end of August or early September and the liming plant targeted for mid-September.

A series of snow storms in the property region in late May and early June, 2017 seriously impacted access to the site and throughout the district. Access to the camp facilities was limited to 4×4 pickup trucks during this period. Large truck access was restored to the site by July 17, 2017.

Natural evaporation concentration field tests continued through June and July with recorded evaporation rates reported to be low due to the cooler temperatures and the introduction of freshwater into the ponds by snowfall events.

Environmental impact studies were completed in the period and a draft report is expected by the end of August.

Upcoming work consists of geophysical surveys, including electromagnetic surveys to highlight possible freshwater sources and a second phase of gravity surveying to provide a more complete map of the depth of the basin.

Pumping test well MA17-20PW (Figure 1) was drilled to an approximate depth of 232 metres before being placed on hiatus in May due to the winter storms. It will now be completed to its final depth of 256 metres. Pump test results will be reported as they become available.

Community relations continue to form an integral part of the site work. Additionally, ILC is informed that the vetting process for the first feasibility study to be conducted on the project is nearing completion with the goal to begin preliminary economic studies later this year.

Afzaal Pirzada, Geological Consultant of the Company, and a “Qualified Person” for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

Other News

The Company also announces that directors, Xiaoshen Wang and David Shen have resigned from the board of directors.

“I would like to thank Xiaoshen and David for their positive contributions to International Lithium. We are pleased to have completed a maiden resource estimate that includes both an indicated and inferred resource estimate, published in a technical report and available at SEDAR http://www.sedar.com. As we no longer have a potential conflict of interest, we are looking forward to working with Xiaoshen and David and building our JV operations with Ganfeng on an arms’ length basis and in the most efficient way, for the benefit of both companies,” stated Kirill Klip, Executive Chairman of International Lithium.

On behalf of the Board of Directors,

Kirill Klip

Executive Chairman

For further information concerning this news release please contact +1 604-700-8912

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information or forward-looking statements in this news release include: the timing and anticipated results of environmental impact studies and pump tests, timing of preliminary economic studies on the Mariana project, the expectation of feasibility studies, timing of completion of a laboratory and plant, and the Company’s continued ownership in the Mariana, Mavis and Raleigh projects. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the interim and annual Management’s Discussion and Analysis which are available at www.sedar.com. While management believes that the assumptions made are reasonable, there can be no assurance that forward-looking statements will prove to be accurate. Should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Forward-looking information herein, and all subsequent written and oral forward-looking information are based on expectations, estimates and opinions of management on the dates they are made that, while considered reasonable by the Company as of the time of such statements, are subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."