Rio Tinto comes to the giant Rob McEwen's Los Azules Copper, Gold and Silver Project. Rob McEwen answers a lot of very important questions in one brilliant move. Who can build this giant project? Who has the appropriate balance sheet to finance its development? Who has "the innovative technology to accelerate the realisation of the enormous potential of the Los Azules Copper"?

“We are pleased to see these significant developments on the Los Azules Project and continued support by Rob McEwen of McEwen Copper,” stated Kirill Klip, TNR’s Chief Executive Officer. “It’s very encouraging to see the opportunity to expand the deposit, and the involvement of Rio Tinto, which may accelerate realizing the enormous potential of the Los Azules Project with Rio Tinto’s innovative technology.

The personal commitment from Rob McEwen and his investment of US$40 million enabled the rapid advancement of this deposit to this new phase of development in an appropriate corporate structure. McEwen Copper has raised more than US$81 million and is well positioned for further stages of development of the Los Azules Project.

TNR Gold does not have to contribute any capital for the development of Los Azules. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blogs. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

TNR Gold:

NEWS RELEASE

"Vancouver, British Columbia – September 6, 2022: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce that McEwen Mining Inc. (“McEwen Mining”) provided an update on the Los Azules Copper Project in San Juan, Argentina. TNR holds a 0.4% net smelter returns royalty (“NSR Royalty”) (of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder) on the Los Azules Copper Project. The Los Azules Copper Project is held by McEwen Copper Inc., a subsidiary of McEwen Mining.

The news release issued by McEwen Mining on August 31, 2022, stated:

“McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to announce the closing of the third and final tranche of the previously announced private placement offering (the “Offering”) of up to 8,000,000 common shares of McEwen Copper Inc. priced at US$10.00 per common share. The third tranche is comprised of a $25 million investment by Rio Tinto’s copper leaching technology venture, Nuton (“Nuton” or the “Investor”), and $1.85 million from other investors. The total Offering has been increased to 8,185,000 common shares, with the amounts raised in the three tranches of the private placement totalling $81.85 million.

McEwen Copper is well-funded to advance its Los Azules Project, located in the mining friendly province of San Juan, Argentina. The next milestones are the upcoming drilling season from October 2022 to June 2023, the completion of an updated preliminary economic assessment (PEA) in early Q1 2023, and the planned IPO of McEwen Copper in H1 2023.

In connection with the Offering, McEwen Copper entered into a collaboration agreement with Nuton (the “Nuton Collaboration Agreement”) to advance our understanding of the potential application of heap leach technology at Los Azules, including the testing of Nuton® Technologies for compatibility with Los Azules copper mineralization. Leaching has many potential economic and environmental benefits over a conventional milling scenario, including lower water and energy consumption, no large tailings storage facility or dam, and typically lower capital and operating costs.

McEwen Copper Chief Executive Rob McEwen said: ‘Los Azules is among the largest undeveloped copper assets in the world. We recognize the potential opportunity of using Nuton® Technologies to produce copper in greater amounts, more rapidly, and with less impact on the environment and water resources. I trust that our relationship with Nuton and Rio Tinto will accelerate the process of realizing the enormous potential of Los Azules.’

Rio Tinto Chief Executive, Copper, Bold Baatar said: ‘This agreement will allow us to evaluate the potential to commercially deploy Rio Tinto’s innovative Nuton® Technologies for copper leaching in McEwen Copper’s planned development of Los Azules. Our Nuton® Technologies have the capacity to unlock increased copper production for Rio Tinto and our partners, with a low carbon footprint and leading environmental performance.’

The principal terms of the Nuton Collaboration Agreement include:

- Nuton will invest $25 million in McEwen Copper, acquiring 2.5 million common shares at $10.00 per common share, for post-closing ownership of 9.73%.

- McEwen Copper and Nuton will jointly undertake copper leach testing using Nuton Technologies with samples from Los Azules. McEwen Copper has agreed to grant exclusivity to Nuton for one year in the area of novel, patented or trade secret leaching technology, while it will continue its independent test work and studies using conventional leach technologies.

- Nuton will have the right to select one nominee who will be appointed as a director or observer to the Board of McEwen Copper. This right will continue for as long as Nuton holds greater than 7.5% of the issued and outstanding shares of McEwen Copper.

- McEwen Copper and its controlling shareholders will not complete a liquidity event (such as the planned IPO) until after March 31, 2023.

- McEwen Copper has agreed to limit related party transactions in certain situations until the earlier of the planned IPO (or alternative liquidity event) or Nuton ceasing to hold 7.5%.

- Customary standstill and lock-up agreement between the Investor and its affiliates and McEwen Copper and its affiliates.

- Other customary representations and warranties.

About McEwen Copper

McEwen Copper Inc. holds 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA. McEwen Mining Inc. (NYSE/TSX:MUX) owns a 68% share of McEwen Copper.

About Los Azules

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.2 billion pounds at a grade of 0.48% Cu (Indicated category) and an additional 19.3 billion pounds at a grade of 0.33% Cu (Inferred category).

About Nuton

Nuton is an innovative new venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leach-related technologies and capability – a product of almost 30 years of research and development. Nuton® Technologies offer the potential to economically unlock copper sulphide resources, copper bearing waste and tailings, and achieve higher copper recoveries on oxide and transitional material, allowing for a significantly increased copper production. One of the key differentiators of Nuton is the potential to deliver leading environmental performance, including more efficient water usage, lower carbon emissions, and the ability to reclaim mine sites by reprocessing mine waste.

About Rio Tinto

Rio Tinto is the second largest mining and metals company in the world, operating in 35 countries, and producing the raw materials essential to human progress. It aims to help pioneer a more sustainable future, from partnering in the development of technology that can make the aluminum smelting process entirely free of direct greenhouse gas (GHG) emissions, to providing the world with the materials it needs – such as copper – to build a new low-carbon economy and products like electric vehicles, charging infrastructure and smartphones.”

“We are pleased to see these significant developments on the Los Azules Project and continued support by Rob McEwen of McEwen Copper,” stated Kirill Klip, TNR’s Chief Executive Officer. “It’s very encouraging to see the opportunity to expand the deposit, and the involvement of Rio Tinto, which may accelerate realizing the enormous potential of the Los Azules Project with Rio Tinto’s innovative technology.

The personal commitment from Rob McEwen and his investment of US$40 million enabled the rapid advancement of this deposit to this new phase of development in an appropriate corporate structure. McEwen Copper has raised more than US$81 million and is well positioned for further stages of development of the Los Azules Project.

TNR Gold does not have to contribute any capital for the development of Los Azules. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-six years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina among many others have been recognized.

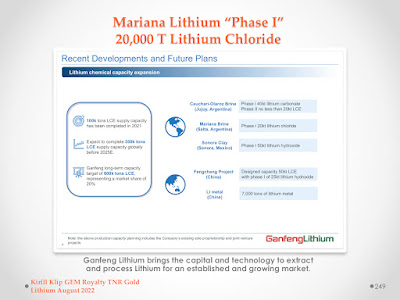

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR Royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR Royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR Royalty and its shareholder holding a 0.05% NSR Royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% net profits royalty (“NPR”) holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I &II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

Kirill Klip

Executive Chairman

www.tnrgoldcorp.com

For further information concerning this news release please contact Kirill Klip at +1 604-229-8129.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, changes in share capital, market conditions for energy commodities, the results of McEwen Mining’s, Ganfeng Lithium’s and Lundin Mining’s preliminary economic assessments, Feasibility Study, or Mineral Resource and Mineral Reserve estimations, life of mine estimates, and mine and mine closure plans and improvements in the financial performance of the Company. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s profile on www.sedar.com. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will be able to repay its loans or complete any further royalty acquisitions or sales; debt or other financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties challenging in the future the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."