Power of Blue Sky Discoveries + Green Technology. Private Diary: Chronicles of the Energy rEVolution.

Saturday, 25 December 2021

Beautiful Argentina And Lithium - The Divine Match Made In Heaven. Rio Tinto Joins Lithium Race, Buys Rincon Brine Project For US$825 Million

Argentina has everything to become the Power House of the Tesla Energy rEVolution. Its proud people deserve now wise leaders who can nurture and grow this generational investment opportunity. Beautiful Argentina and lithium - the divine match made in Heaven.

May our Christmas wish for all proud people of Argentina come true and manifest in health and prosperity. International majors are ready to invest capital, bring so much needed jobs to the thousands of skilled workers and build the supply lines for Energy rEvolution.

Companies like Ganfeng Lithium and McEwen Mining are investing many millions of dollars to bring giant projects like Mariana Lithium and Los Azules copper, gold and silver into the next stage of development. Now Argentina receives one more vote of confidence in its future. Rio Tinto joins the lithium race with the lithium giants like Ganfeng and buys Rincon Brine Project for US$825 million.

"LONDON--(BUSINESS WIRE)-- Rio Tinto has entered into a binding agreement to acquire the Rincon lithium project [1]in Argentina from Rincon Mining, a company owned by funds managed by the private equity group Sentient Equity Partners, for $825 million.

The acquisition demonstrates Rio Tinto’s commitment to build its battery materials business and strengthen its portfolio for the global energy transition.

Rincon is a large undeveloped lithium brine project located in the heart of the lithium triangle in the Salta Province of Argentina, an emerging hub for greenfield projects. The project is a long life, scaleable resource capable of producing battery grade lithium carbonate. It has the potential to have one of the lowest carbon footprints in the industry that can help deliver on Rio Tinto’s commitment to decarbonise its portfolio.

Rio Tinto Chief Executive Jakob Stausholm said “This acquisition is strongly aligned with our strategy to prioritise growth capital in commodities that support decarbonisation and to continue to deliver attractive returns to shareholders. The Rincon project holds the potential to deliver a significant new supply of battery-grade lithium carbonate, to capture the opportunity offered by the rising demand driven by the global energy transition. It is expected to be a long life, low-cost asset that will continue to build the strength of our Battery Materials portfolio, with our combined lithium assets spanning the US, Europe and South America.”

(Rio Tinto)

ReTail loves to chase everything that moves up these days. Brave, fearless people "have seen it all" by their mid-20s, they are going "all in" and accumulating bags and memories about promised LAMBos. But the real fireworks start when big boys are FOMO on Energy Transition and electric cars.

Trading Economics

Lithium prices are skyrocketing and smashing one all-time high record after another. Lithium prices went literally through the roofs of the empty warehouses in China and hit a new all-time high record at US$35,500 per T just before Christmas Day.

Fireworks are here, but a lot of boardrooms are far from cheer this time. The dreams to survive "The End of the ICE Age" for many legacy automakers are under threat after Tesla has shattered their cosy corporate world into a thousand pieces.

The premium customers are not buying "Clean DIEsel" anymore, they demand the best electric cars available. Pumping of the GM as a "leader of electrification" brings only one sobering realisation about Digital Divide: legacy automakers have only started their journey chasing stable supplies of safe and efficient lithium batteries.

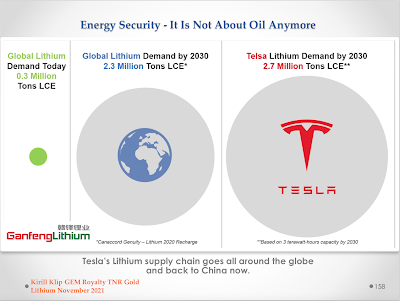

Supply chains are not ready. All stability of the US$12 Trillion dollars of the inverted Pyramid of Energy and Transportation Sectors depends on the security of supply provided by the lithium market with a size of less than US$4 Billion dollars by sales in 2020.

The tsunami wave after the Tesla earthquake has shattered all ICE legacy automakers is hitting the very small market of specialised lithium chemicals products. Price shocks for Battery Grade Lithium were imminent.

Lithium price goes up first and a new stable secure supply of Battery Grade Lithium will be coming much later after many years of development. The industry might and investments of Billions of dollars are only the start, each lithium project is a unique "chemical soup" and only a few companies in the world have a "Know-How" to unlock the potential of new projects and reach the "Number Plate" - Battery Grade Lithium quality and announced capacity of annual production. "Skyrocketing lithium prices unlikely stabilise soon", says Ganfeng Chairman and now you can understand why.

Those who started many years ago will rip the rewards of the massive margins driven by the price premiums first. They are consolidating their positions now with this wave of M&A hitting the lithium industry. Smart money controls bottlenecks. Now you can better understand our GEM Royalty Story.

TNR Gold has found our lithium in Argentina a long time ago. Now Ganfeng Lithium is building the giant Mariana Lithium Brine Project with its US$600 million investment plan. Our Company is plugged into Tesla Energy rEVolution with NSR Royalty Holdings on the entire Mariana Lithium Project and Los Azules Copper, Gold and Silver Project.

"Ganfeng has gained a lot of experience while building up with Lithium Americas Cachari-Olaroz Lithium Project into the production stage. They became not only one of the largest lithium companies in the world but the authority in the industry which requires a deep understanding of the best available extraction technology and its successful implementation process. Every salar is a unique chemical soup, which requires the exact recipe to produce the best results.

Ganfeng has this unique "Know-How", technology and capital to move things fast now in Argentina. US$600 million investment plan, including solar power plant to power the operations, gained praise from the Governor of Salta. All green lights to go into construction were issued by local authorities and REMSA after Environmental Impact Report was approved for 20,000 T of LCE lithium chloride production."

On the links below you can find more information about TNR Gold, our assets and learn more about the lithium market. As usual, make your own research, stay safe and prosper. Join rEVolution!

"Skyrocketing Lithium Prices Unlikely To Stabilize Soon", Says Ganfeng Chairman: "Overall Global Demand For The Material Could Reach 3 Million Tons By 2030".

"All this flood of money that is seeking the best investment returnsduring the Energy Transition and Electrification of our Energy and Transportation sectors will be creating a tsunami of shock waves across Lithium supply lines that are not ready and still being built to feed Tesla Energy rEVolution."

"All Lithium market was less than US$4 Billion in size just a year ago. Now Lithium price has tripled. Choose very wisely among the best lithium companies to participate in this generational investment trend."

Caixin Global:

Skyrocketing Lithium Prices Unlikely to Stabilize Soon, Says Ganfeng ChairmanTNR Gold Mariana Lithium Royalty Holding Partner: "China's Ganfeng Lithium Inks 3-year Supply Contract With Tesla."

We extend our congratulations today to our Mariana Lithium Royalty Holding Partner - Ganfeng Lithium. Reuters reports: "China's Ganfeng Lithium inks 3-year supply contract with Tesla".

We have discussed in depth here that Tesla Lithium supply lines are going all around the globe and back to China. Today we have another confirmation for the Ganfeng Lithium's status as a major leader in the technology of the reliable and sustainable production of battery-grade Lithium.

Ganfeng is already supplying Lithium to Tesla, Volkswagen and BMW among many other battery producers and automakers. Reuters reports today that a new deal will be in place for Ganfeng and Tesla for another 3 years starting from 2022.

Now Ganfeng's "Phase 1" plan for 20,000 T of LCE annual production at Mariana Lithium can be seen via the new perspective. The whole Lithium industry will be put to a major test of its ability to ramp up the supply of battery-grade Lithium just in a few years.

"We are very pleased to see that this new plan represents a 100% increase of the previously planned lithium annual production rate presented in the Mariana Project preliminary economic assessment (“PEA”), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR Royalty from Mariana’s life of mine cashflow, which has now been very significantly increased."

Hopefully, "Phase 2" will be following after "Phase 1" at Mariana Lithium and it will potentially increase TNR Gold NSR Royalty Holding valuation and the potential future cash flow even more.

TNR Gold Royalty Holding Update: ILC Reports Ganfeng Subsidiary Litio Minera Argentina Assumes All Rights And Obligations In Respect Of Mariana Lithium.

Kirill Klip, Executive Chairman of the Company commented, “We are pleased with the great news regarding Ganfeng Lithium, our NSR Royalty holding and advance of the Mariana Lithium Project to construction. I am also very pleased to see that this deal between ILC and Ganfeng Lithium included confirmation that Ganfeng’s subsidiary, Litio Minera Argentina, assumes all rights and obligations that ILC had in respect of the Mariana Lithium Project, including in respect to TNR Gold NSR Royalty Holding. Ganfeng Lithium has now consolidated 100% of the Mariana Lithium Project and advanced it to the construction stage.

This news comes after a 55% increase in the measured and indicated resource estimate from the previously announced 2020 increase of more than 250% in measured and indicated resources at the Mariana Lithium Project. We extend our congratulations to Ganfeng and salute the people of Argentina on the celebration of ‘Pachamama’ – the ritual that thanks the earth for all that we receive from it. This ritual was performed at Mariana Lithium in September after successful approval of the Environmental Impact Report by the Salta regional government in Argentina and approvals for the construction of a plant with a designed annualized capacity of 20,000 tonnes per annum of lithium chloride.

We are very pleased to see that this new plan represents a 100% increase of the previously planned lithium annual production rate presented in the Mariana Project preliminary economic assessment (“PEA”), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR Royalty from Mariana’s life of mine cashflow, which has now been very significantly increased. We welcome the news from the Salta regional government, following its discussions with Ganfeng, that the likely project expenditure to bring the Mariana Project to full production is approximately US$600 million.

TNR does not have to contribute any capital for the development of the Mariana Project. The 2.0% Mariana NSR Royalty on the Mariana Project with Ganfeng Lithium is a very important part of TNR Gold’s portfolio, (TNR holds a 0.2% NSR on behalf of a shareholder). The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Thursday, 23 December 2021

TNR Gold NSR Royalty Holding With McEwen Mining - McEwen Copper: Los Azules Progress Report

TNR Gold holds a 0.4% NSR royalty on the entire Los Azules Copper Project (TNR holds a 0.04% on behalf of a shareholder). TNR Gold does not have to contribute any capital for the development of Los Azules. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

McEwen Mining:

McEwen Copper: Los Azules Progress Report

"TORONTO, Dec. 22, 2021 (GLOBE NEWSWIRE) -- McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to provide a summary of the work at the Los Azules copper project in San Juan, Argentina, that started in earnest this July 2021. Our two immediate objectives on our path to designing and constructing the copper mine of the future are to:

- Advance Los Azules from its current stage of development (Preliminary Economic Assessment or PEA) to a Pre-Feasibility Study (PFS); and

- Construct a new road, the ‘ Northern Access Road’, that will provide critical year-round access to Los Azules. The current ‘ Exploration Road’ is generally only usable five months of the year due to winter weather.

Below is a photographic account of our activities to date.

Background

On July 6, 2021, we announced the creation of McEwen Copper and our intention to raise US$80 million in a private offering comprised of 8,000,000 shares priced at $10.00 per share. We closed the first $40 million tranche of the placement in August with Rob McEwen, and the balance of the financing is expected to close in January 2022. Assuming completion of the $80 million financing, McEwen Mining will retain 69% ownership in McEwen Copper, and new shareholders will hold 31%. McEwen Copper will continue to hold a 100% interest in the Los Azules project.

Los Azules is one of the largest undeveloped copper porphyry deposits in the world. It is located along the prolific Andes Copper Belt as shown in the location map below:

On December 1st, the medical services and emergency rescue teams had arrived at site and exploration drill platforms were being constructed.

By December 20th, 36 drill platforms had been constructed and 2 of the 10 exploration drills had arrived on site. The other 8 drills are expected to be arriving throughout January and into February. Drilling will start on January 4th. The first phase of our drill program will involve a 174,000-foot (53,000 m) program. It is designed to convert the Inferred mineral resources to the Indicated category, as well as to test deeper exploration targets, where historic drilling had ended in strong copper mineralization.

McEwen Copper currently has 282 people supporting the exploration drilling program at Los Azules, with approximately 85% being from San Juan.

Photo 8 and 9 - The first two exploration drills to arrive at the site.

Project Development Workshop

This past week, December 14th to 16th, we held an intensive workshop with senior management of both McEwen Mining and McEwen Copper and a powerful group of consultants and advisors. A total of 30 individuals well versed in designing and building, and operating copper mines, especially in South America, gathered physically and virtually from Argentina, Chile, USA, Canada, Australia, and New Zealand.

The workshop started with a presentation from Whittle Consulting from Australia, who for the past three months have been evaluating various development scenarios for the Los Azules Project. Their work suggests there is considerable room to improve the economics of the project.

Companies involved in moving Los Azules to PFS are:

- Bechtel Corporation, the largest construction company in America with a long history of advancing, building and developing large copper concentrators and infrastructure projects globally, including the recent feasibility study update on the El Pachon project approximately 75 km south of Los Azules; and

- Samuel Engineering, who will help oversee project management, controls, metallurgy and processing plant design, is a full service multi-disciplinary project development and execution company bringing a team with extensive large copper project experience in South America, including past involvement at the Los Azules project; and

- Stantec, a full service engineering and consulting firm, with offices in Argentina, Chile, and Peru, including select subcontract consultants will focus on geology, resource and reserve estimates, mining engineering, hydrology, geotechnical and the tailings, waste, and water management facility design.

Our overarching goal is to design a mine that will be the model for copper mining in the 21 st century. One that supplies the raw material to enable a greener world, while incorporating the use of renewable energy sources to have a low-carbon footprint and that uses technological innovation to achieve an energy efficient mine.

At several points during the workshop, Jason F. McLennan of McLennan Design in Seattle, a prominent figure in the field of architecture and green building movement, shared his thoughts on technologies, visions and attitudes on how mining could change to contribute to a healthy world and how lessons learned in other industries could be applied to transform certain elements of mine operations, infrastructure and facilities.

We all left the meeting energized and believing that the future of mining will be exciting, new and game-changing. For the world to make considerable progress towards a lower carbon emissions world, the world needs responsible mining to provide the materials to make that a reality.

We at McEwen Copper, along with our consultants, plan to design, build, and operate a facility, a community, that will be at the leading edge of a changing attitude in mining towards protecting our planet.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, contain McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to the calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc."