“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”Kirill Klip, Executive Chairman TNR Gold Corp.

TNR GOLD CORP.

> THE GREEN ENERGY METALS ROYALTY AND GOLD COMPANY.

"TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-six years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and the Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR Royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR Royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR Royalty and its shareholder holding a 0.05% NSR Royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

Mariana Lithium Project* measured and indicated resource: 4,410,000 T of LCE and 49,700,000 T of potash with the additional inferred resource: 786,000 T of LCE and 9,260,000 T of potash.

(Updated Mariana Lithium Project measured and indicated resource: 6,854,000 T of LCE with the additional inferred resource: 1,267,000 T of LCE – Company news release, July 14, 2021)

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

Los Azules Copper Project** indicated resource: 10.2 B lbs copper, 1.7 Moz gold and 55.7 Moz silver with the additional inferred resource: 19.3 B lbs copper, 3.8 Moz gold and 135.4 Moz silver.

TNR also holds a 7% net profits royalty (“NPR”) holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources.

Shotgun Gold Project*** inferred resource: 705,960 ounces Au at 1.06 g/t, mineralization appears to be open at depth and along the strike.

The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I &II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

* “NI 43-101 Technical Report Update of Lithium Brine Mineral Resources; Mariana Project, Salar de Llullaillaco, Argentina” dated January 12, 2020. Prepared by Geos for Ganfeng Lithium.

** “NI 43-101 Technical Report – Preliminary Economic Assessment Update for the Los Azules Project, Argentina” dated October 16, 2017. Prepared by Hatch for McEwen Mining.

*** “NI 43-101 Technical Report on the Shotgun Gold Project, Southwest Alaska” dated May 27, 2013. Prepared by Nicholas Wyck and Allan Armitage for TNR Gold."

Alastair Ford: TNR Gold’s Recent Rejection of a Takeover Bid From Lithium Royalty Has Shone a Spotlight on the Value of Its Royalty and Exploration Portfolio

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

“Since our initiating report in September 2023, TNR’s royalty projects have made significant progress,” the analysts wrote in a report. “TNR is up 40% since September 2023.” (Emily Jarvie)

"The report from Fundamental Research underscores the company's near-term royalty potential, particularly from Ganfeng Lithium's Mariana project, and reaffirms a Buy rating with an adjusted fair value estimate of C$0.24 per share." (Angela Harmantas)

TNR Gold Eyes Growth With Strategic Royalty Investments and Share Buybacks

“We are building the green energy metals royalty and gold company”, commented Kirill Klip, Executive Chairman of TNR Gold. “Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

“Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle; the potential of blue-sky discovery at Shotgun Gold Project and important partnerships with industry leaders Like Ganfeng Lithium, McEwen Mining and Lundin Mining as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

“Last year we repaid our investment loan in full, and our Company has no debt. We believe that the recent market prices of our Shares do not properly reflect the underlying value of the Shares and the normal course issuer bid allows us to purchase Shares in the market to help increase the shareholder value for the shareholders.

“We are very pleased that the Mariana Lithium Project is progressing smoothly towards expected commercial production in 2024. Representatives of Ganfeng Lithium confirmed to the Governor of Salta Gustavo Sáenz that the Mariana Project, on which construction began in June 2022, will start producing, in 2024, an estimated 20 thousand tons per year of lithium chloride.

The Government of Salta has reported on Ganfeng Lithium’s announcement that the operational phase of the Mariana Lithium Project began in January 2023. We are looking forward towards our first NSR royalty cash flow payments from the Mariana Lithium Project.

“TNR does not have to contribute any capital for the development of the Mariana Lithium Project, the Los Azules Copper Project or the Josemaria Project. The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

TNR Gold:

NEWS RELEASE

TNR Gold Bought 5,616,000 Shares to Date Under Normal Course Issuer Bid

"Vancouver, British Columbia – February 21, 2024: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to provide a corporate update and announce that the Company has purchased 5,616,000 shares to date under its normal course issuer bid.

As announced on June 1, 2023, TNR Gold is conducting a normal course issuer bid (the “Bid“) pursuant to which the Company may purchase up to a maximum of 9,548,639 common shares of the Company (the “Shares”), representing approximately 5% of the Company’s outstanding common shares (“Shares”). No more than 2% of the outstanding Shares may be purchased in any 30-day period.

The Company intends to terminate the Bid on or about June 4, 2024. Purchases pursuant to the Bid are being made from time to time by PI Financial Corp. on behalf of the Company through the facilities of the TSX Venture Exchange. Shares purchased will be paid for with cash available from the Company’s working capital. All Shares purchased pursuant to the Bid will be returned to treasury as authorized and unissued shares.

The Company is of the view that the recent market prices of its Shares do not properly reflect the underlying value of the Shares. No insiders of the Company intend to participate in the Bid.

“We are building the green energy metals royalty and gold company”, commented Kirill Klip, Executive Chairman of TNR Gold. “Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

“Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle; the potential of blue-sky discovery at Shotgun Gold Project and important partnerships with industry leaders Like Ganfeng Lithium, McEwen Mining and Lundin Mining as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

“Last year we repaid our investment loan in full, and our Company has no debt. We believe that the recent market prices of our Shares do not properly reflect the underlying value of the Shares and the normal course issuer bid allows us to purchase Shares in the market to help increase the shareholder value for the shareholders.

“We are very pleased that the Mariana Lithium Project is progressing smoothly towards expected commercial production in 2024. Representatives of Ganfeng Lithium confirmed to the Governor of Salta Gustavo Sáenz that the Mariana Project, on which construction began in June 2022, will start producing, in 2024, an estimated 20 thousand tons per year of lithium chloride. The Government of Salta has reported on Ganfeng Lithium’s announcement that the operational phase of the Mariana Lithium Project began in January 2023. We are looking forward towards our first NSR royalty cash flow payments from the Mariana Lithium Project.

“TNR does not have to contribute any capital for the development of the Mariana Lithium Project, the Los Azules Copper Project or the Josemaria Project. The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

The Shotgun Gold Project is an advanced-stage exploration prospect in southwestern Alaska. The Company’s exploration field program in 2022-2023 at the Shotgun and Winchester prospects, located in the Taylor Mountain Quadrangle, Alaska, investigated the geochemical anomalies generated by the 1998 Novagold Resources soil surveys and the geophysical targets indicated by anomalies from the SJ Geophysics 2011 and 2012 EM surveys.

“The Company’s strategy with the Shotgun Gold Project is to attract a partnership with a major gold mining company. TNR Gold has successfully consolidated and updated its mining claims in Alaska and is actively introducing the project to interested parties,” commented Kirill Klip. “We may be at the beginning of a great discovery. There is a clear path on how to move this prospective project forward using the geological and geophysical research currently available to target drilling to expand the resource. The next step is to acquire a partner that shares our vision and recognizes the growth potential and value to be added to the Shotgun Gold Project over time. The latest exploration program allows us to provide additional information on TNR’s Shotgun Gold Project for our potential strategic partners.”

About the Shotgun Gold Project

TNR holds a 90% interest in the Shotgun Gold Project that is located 190 kilometres south of the Donlin Gold Project deposits within the Kuskokwim Gold Belt in southwestern Alaska. This area is emerging as a multi-million-ounce gold district. The Shotgun property includes a number of prospects, including Shotgun Ridge and nearby Winchester. The Donlin Gold Project is an intrusion-associated system and represents one of the largest undeveloped gold deposits in the world. The Company believes that there are several key similarities between prospects on the Shotgun property and that of the Donlin Gold Project deposits as well as other important intrusion-associated deposits worldwide.

The Company is targeting a large tonnage porphyry system at Shotgun Ridge. Structural repeats, as interpreted from airborne magnetic data and ground geophysical surveys, provide TNR with encouraging targets for future drill testing.

Detailed information about the inferred mineral resource estimate is included in the technical report titled, “Technical Report on the Shotgun Gold Project, Southwest Alaska”, dated May 27, 2013 that can be found on the TNR Gold website at www.tnrgoldcorp.com or on SEDAR at www.sedar+.ca.

Mariana Lithium NSR Royalty Holding

On May 2, 2023, TNR Gold announced that Ganfeng Lithium (“Ganfeng Lithium”) provided an update on the Mariana Lithium Project. TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR Royalty is held on behalf of a shareholder.

In its 2022 Annual Report, Ganfeng Lithium reported:

“The Mariana lithium salt lake project in Argentina is progressing smoothly at present, the first evaporation pond of which has been in the stage of water injection. It is expected that the project will commence production in 2024.”

Kirill Klip, TNR’s Chief Executive Officer commented, “We are very pleased that the Mariana Lithium Project is progressing smoothly towards expected commercial production in 2024.

“Representatives of Ganfeng Lithium confirmed to the Governor of Salta Gustavo Sáenz that the Mariana Project, on which construction began last June, will start producing, in 2024, an estimated 20 thousand tons per year of lithium chloride. The Government of Salta has reported on Ganfeng Lithium’s announcement that the operational phase of the Mariana Lithium Project began in January 2023.

“TNR does not have to contribute any capital for the development of the Mariana Project. The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

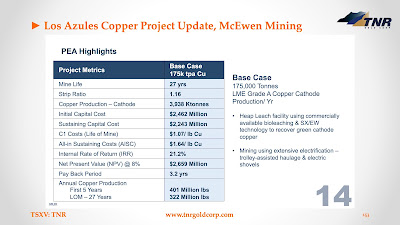

Los Azules Copper, Gold and Silver NSR Royalty Holding

On December 18, 2023, TNR Gold announced that, McEwen Mining Inc. provided an update on the Los Azules Copper Project in San Juan, Argentina. TNR holds a 0.4% NSR Royalty (of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder) on the Los Azules Copper Project. The Los Azules Copper Project is held by McEwen Copper Inc., a subsidiary of McEwen Mining.

The news release issued on December 12, 2023, by McEwen Mining stated:

“McEwen Copper

“Eighteen drill rigs are currently on site at Los Azules and over 18,000 meters of drilling have already been completed, representing more than one-third of the planned meters for this season’s campaign.

“Recently, key management and directors from McEwen Mining and McEwen Copper visited the project to review the progress made towards delivery of the feasibility study for the future Los Azules Mine. Michael Meding, Vice President and General Manager of McEwen Copper, commented: ‘We are very pleased with the progress at Los Azules since 2021, when McEwen Copper was created to drive forward the development of one of the world’s largest undeveloped copper projects. Our vision is to develop Los Azules as a model for the future of mining.”

“Technical Information

“The technical content of this news release related to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 “Standards of Disclosure for Mineral Projects.”

The news release issued by McEwen Mining on February 12, 2024, stated:

“McEwen Copper

Twenty drill rigs are currently on site at Los Azules and over 36,000 meters (118,000 ft) of drilling have been completed so far this season, to advance all areas that contribute to the upcoming Feasibility Study (FS), which is expected to be published in Q1 2025.

At the Los Azules Project, we’ve made significant progress. Our drilling program is over halfway complete, with 36,000 meters drilled out of the 55,000 planned for our comprehensive feasibility study. The work necessary for the completion of the feasibility study includes mineral resource estimation, metallurgical testing, equipment selection, final completion and cost estimation of design for the mine and our facilities. Additionally, we will work to advance our power and road infrastructure plans and establish preliminary site-wide water balance including pit dewatering.

On the ground, we’ve made tangible progress with the drilling program, construction of our winter camp and improvements to the exploration road facilitating year-round operations. We’re also on track with environmental permitting, reflecting our commitment to responsible development.

Financially, we’ve been diligent in protecting our treasury. The majority of our funds have been invested in depository receipts of foreign and major Argentinean corporations, to shield us from devaluation. This strategic move ensures that the Los Azules project’s financial backbone stays robust in supporting our project development.

“We are adapting to a changing environment in Argentina, recognizing the importance of current political and economic reforms for the future stability and growth of the nation. Mining is a vital component of Argentina’s economy and, under the right conditions, one that is poised to grow significantly and support the country’s economic recovery,” said Michael Meding, VP of McEwen Copper and General Manager of the Los Azules Project.”

“Technical Information

“The technical content of this news release related to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 “Standards of Disclosure for Mineral Projects.”

“About McEwen Copper

McEwen Copper Inc. holds a 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA.

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.9 billion pounds at a grade of 0.40% Cu (Indicated category) and an additional 26.7 billion pounds at a grade of 0.31% Cu (Inferred category). A PEA published in June 2023 estimated a $2.7 billion after-tax NPV8% at $3.75/lb Cu and a 27-year mine life.” TNR Gold News Releases dated June 26 and October 18, 2023.”

The McEwen Mining press release appears to be reviewed and verified by a Qualified Person (as that term is defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects) and the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no Qualified Person engaged by TNR has done sufficient work to analyze, interpret, classify or verify McEwen Mining’s information to determine the current mineral resource or other information referred to in its press releases. Accordingly, the reader is cautioned in placing any reliance on the disclosures therein.

“We are pleased that significant developments on the advancement of the Los Azules Copper Project towards feasibility have led to the increased Stellantis holdings in McEwen Copper, as a strategic partner in the future development of this large copper, gold and silver project, stated Kirill Klip, TNR’s Chief Executive Officer. “In February 2023, Stellantis invested ARS $30 billion, and with an additional investment of ARS $42 billion made after the new preliminary economic assessment (PEA) publication, has a total investment of ARS $72 billion. An aggregate of US $65 million in McEwen Copper was also invested by Rio Tinto’s Venture Nuton in 2022 and 2023”. . TNR Gold’s vision is aligned with the leaders of innovation among automakers like Stellantis, whose aim is decarbonizing mobility, and mining industry leaders such as Rob McEwen, whose vision is ‘to build a mine for the future, based on regenerative principles that can achieve net zero carbon emissions by 2038.

“The green energy rEVolution relies on the supply of critical metals like copper; delivering “green copper” to Argentina and the world will contribute to the clean energy transition and electrification of transportation and energy industries.

“Strong team performance is accelerating the McEwen Copper Los Azules program. The Los Azules Project PEA results highlighted the potential to create very robust leach project, while reducing environmental footprint, and greater environmental and social stewardship sets the Project apart from other potential mine developments.

“It’s also very encouraging to see an updated independent mineral resource estimate that has increased significantly.

“Together with Nuton, McEwen Copper is exploring new technologies that save energy, water, time and capital, advancing Los Azules towards the goal of the leading environmental performance. The involvement of Rio Tinto with its innovative technology, may also accelerate realizing the enormous potential of the Los Azules Project.

“Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). TNR Gold does not have to contribute any capital for the development of the Los Azules Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Batidero I and II NPR Royalty Holding

On April 28, 2022, TNR Gold announced that Lundin Mining Corporation completed a plan of arrangement pursuant to which Lundin acquired all of the issued and outstanding shares of Josemaria Resources Inc. (“Josemaria Resources”) and Josemaria Resources became a subsidiary of Lundin. TNR holds a 7% net profit interest royalty (“NPR”) on the Batidero I and II properties of the Josemaria copper-gold project located in San Juan, Argentina that is owned by Josemaria Resources.

In its news release dated April 28, 2022, Lundin stated:

“The addition of the Josemaria project to Lundin Mining’s portfolio solidifies our position as a leading base metals producer with high-quality copper exposure and significant growth. We look forward to building upon the excellent reputation of Josemaria Resources in San Juan and Argentina,” said Peter Rockandel, Lundin Mining President and CEO, “We are excited to lead the project through the remaining stages of development and into production to create significant value for all stakeholders.

“Josemaria Project Update

As announced by Josemaria Resources on April 11, 2022, the Mining Authority of San Juan, Argentina has approved the Environmental Social Impact Assessment for the Josemaria Project, marking a significant milestone in the project’s permitting process. Lundin Mining and the Josemaria project team are working with the national and provincial authorities to progress the project through the next stages of development. Discussions regarding commercial agreements and securing of additional sectoral permits are ongoing and anticipated later this year prior to a definitive construction decision.

The Josemaria project is progressing through basic engineering with procurement of long-lead equipment, including securing key items of crushing and processing. Study work is ongoing, including updating of cost estimates to be reflective of current conditions and evaluation of potential scope changes compared to plans envisaged in the Josemaria Resources 2020 Feasibility Study (“NI 43-101 Technical Report, Feasibility Study for the Josemaria Copper-Gold Project, San Juan Province, Argentina” dated November 5, 2020 (the “Josemaria Resources 2020 Feasibility Study”)). Lundin Mining aims to complete an updated Technical Report for the project in the fourth quarter of 2022. While this work has not yet concluded, the Company expects the initial capital expenditure estimate of the project to be greater than $4 billion. Effective post-closing, the Company intends to spend up to $300 million to advance the project ahead of a construction decision in the second half of 2022, including engineering, commitments for long lead items, preconstruction activities and drilling.

As part of the updated Technical Report, Lundin Mining plans to complete new Mineral Reserve and Resource estimates. Approximately 20,600 meters of drilling have been completed on the project since the most recent 2020 Josemaria Resources mineral estimates and 35,000 meters of additional drilling are planned to be completed ahead of the new estimates.

In its news release dated January 14, 2024, Lundin stated:

“2024 Capital Expenditure Guidance

Josemaria Project ($225 million): The estimated capital expenditures in 2024 will continue to support advancing the project prior to a construction decision. An updated capital cost estimate and project schedule is pending completion that will incorporate results from project de-risking initiatives and optimization studies. Capital expenditures primarily include continuation of hydrology work, delivery of long-lead mills and motors. Field activities will include road upgrades and geotechnical work as well as permitting initiatives, mainly for the powerline, access road and community relations programs.”

About Lundin Mining

Lundin Mining is a diversified Canadian base metals mining company with operations and projects in Argentina, Brazil, Chile, Portugal, Sweden and the United States of America, primarily producing copper, zinc, gold and nickel.”

TNR’s 7% NPR holding on the Batidero I and II properties of the Josemaria Project held by Lundin Mining represents future growth potential for the royalty portfolio.

ABOUT TNR GOLD CORP.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-eight years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% net profits royalty holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

For further information concerning this news release please contact Kirill Klip +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, and future potential transactions being considered by the Special Committee and the Board. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s SEDAR+ profile on www.sedarplus.ca. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will enter into one or more strategic transactions, partnership or a spin-out, or be able to complete any further royalty acquisitions or sales of royalty interests, or portions thereof; debt or equity financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties, in future, challenging the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."