Guest post:

Gold in the USA, the Alaskan Elephant Country: the Pitch for Elevation to Climb a Huge Wall of Worry, Ignition Stage - TNR Shotgun Gold

Gold surged to the highest daily close in history at $2,788 on October 30th this year. Nothing grows straight into the sky and gold enters the well-deserved and much-needed consolidation stage. This exceptionally powerful gold bull market will continue its climb to new highs following the healthy consolidation phase after the amazing breakout earlier this year. The gold bull market must properly digest the gains following the parabolic breakout move. Still, we are not in "Gold Bubble" territory yet.

There is no "Gold Bubble" yet. Retail investors are not chasing gold gains FOMO by buying gold ETFs in droves. Gold ETF share of Equity ETFs is still below post-2013 average and below 3%. This share hit a high of above 17% in 2011 signifying the top of gold parabolic move at that time.

Another chart from Graddhy "Gold vs M2" (currency supply) demonstrates it as well: gold is not in the bubble territory yet, while general equities are being stretched into the bubble territory already. There is room for this gold bull market to go much higher after this consolidation stage.

It is time for gold miners to begin to follow gold and climb a huge wall of worry separating them from the outstanding performance of gold. The new M&A wave can ignite this rally for gold miners and push up valuations in the gold sector. Miners are long due for breaking out and can start outperforming gold advancement during this healthy consolidation phase for the powerful gold bull market. Increased operation margins and profits for the major gold miners are making their way into financial reports which should bring the headlines and introduce new investors to the sector.

Gold miners have a lot of work to do just to catch up outstanding performance of gold this year. Excitement will be building up during the coming M&A wave and investors will rediscover gold exploration companies.

Greed and FOMO will be forcing hedge fund managers to gain exposure to the gold and mining sectors, otherwise risking underperforming the more savvy forward-looking peers who are building their positions in the real hard assets and commodities.

This very impressive chart from Formula Stocks shows "Gold Miners Will Move More Than 40X from 2024". Now it is time for gold miners to start making headlines while gold will be consolidating before its next big move up.

With their expanding margins, "gold miners are printing money", and this news is slowly making its rounds among investors. M&A is the only way for major gold mining companies to rebuild the falling gold reserves and keep the existing gold production from falling over the cliff.

The smart money is taking profits in gold and looking for new M&A targets among the best-run gold miners. These investments are lifting gold producers first and even a minimal spillover in the junior mining with gold exploration companies will create fireworks there. This coming wave of M&A among gold producers and the success of investments made by Rob McEwen, Erik Sprott and other prominent gold entrepreneurs in the new promising projects will drive the next stage of remarkable gains for intelligent investors.

TNR Gold shareholder NovaGold is putting the Peak Gold situation into perspective after reporting another set of great exploration results at the Donlin Gold Project in Alaska. The scarcity will drive up the strategic value of the gold projects in the best mining jurisdictions.

Your further research can show why NovaGold is holding its stake in TNR Gold. With the rising gold price and a new era for the development of natural resources on US soil particularly in Alaska, the Shotgun Gold Project is coming very close to its launch on the new orbit of valuation and development.

The CEO of Barrick Gold has been talking about "unlocking the tremendous potential of Donlin Gold", and it is time for us to discuss Shotgun Gold's value proposition. Smart money is accumulating the best Gold Stories to climb over a huge wall of worry following another major leg up for this Gold Bull Market, propelled by the debasement of all currencies.

My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin.

Kirill Klip, Executive Chairman

TNR Gold Corp.

Shotgun Gold is a Project located in South West Alaska, USA, in the same regional area as Novagold’s Donlin Gold Project.

Lang’s & Baker’s 2001 academic study specifically identifies both projects as "major porphyry granite-related gold deposits" that are related to a widespread magmatic gold mineralising event. Riveting stuff. What it implies in layman’s terms is that both projects arose from the same geological kitchen sink, leading one to the supposition that they should both possess similar favourable geological properties.

To that effect, Shotgun’s general mineralisation style resembles the neighbouring Donlin Gold project. For instance, Shotgun’s particular intrusion is associated with 69.7Ma magmatism while Donlin Gold holds 70ma magmatism.

Shotgun’s particular boon is in the details. Shotgun’s mineralisation has been identified to possess little-to-no "nugget effect". A high ‘nugget effect’ means high variability between samples that are closely spaced. "No nugget effect" implies tight-fisted uniform mineralisation of a bulk tonnage gold system. There’s no need to dig up empty rock space so the stripping ratio for any potential mine will be low, keeping costs way down.

What’s more, when a system’s topographical layout lines up neatly at the top of a ridge-like Shotgun's, it means the extraction of resource systems in similar conditions is very efficient - there is no need to remove layers of empty waste rock by tentatively stripping the ridge. Instead, one decisively takes the top of the hill in its entirety. Shotgun’s targeted bulk tonnage gold system runs from the very surface down to *at least* a depth of 150m (Open). "Open" means exploration to date has not identified the end of the mineralization from the drilling performed so far.

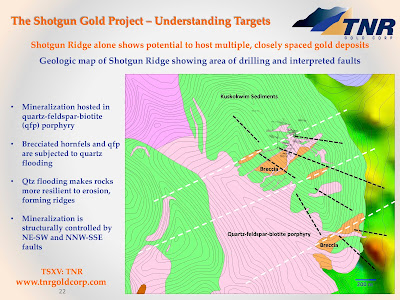

For the Shotgun Gold Project, Shotgun Ridge is just one of the multiple gold target areas controlled by TNR Gold. "Shot", "King" and "Winchester" add to the collection to form a distinct district with five (5) separate gold exploration targets identified so far.

The Company is actively introducing Shotgun Gold to potential partners to decisively drill the entirety of these prospects. The objective of such a partnership would be to expand the known area of mineralisation, define new mineralised areas and conclusively assess the Project’s potential top-end valuation.

“We need to bring US$10mln in to drill the project very strongly,” says TNR Gold Executive Chairman Kirill Klip. “The first US$5mln to take the project from the current 700,000-ounce resource up to the two million ounce mark, the rest to drill out five nearby targets. There’s no reason to suppose that our ground cannot hold multiple mineralised systems.”

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

“Since our initiating report in September 2023, TNR’s royalty projects have made significant progress,” the analysts wrote in a report. “TNR is up 40% since September 2023.” (Emily Jarvie)

"The report from Fundamental Research underscores the company's near-term royalty potential, particularly from Ganfeng Lithium's Mariana project, and reaffirms a Buy rating with an adjusted fair value estimate of C$0.24 per share." (Angela Harmantas)

Disclaimer: Please be aware that any opinions, estimates or forecasts regarding the performance of TNR Gold Corp. in any research reports do not represent the opinions, estimates or forecasts of TNR Gold Corp. or of its management.

Alastair Ford: TNR Gold’s Recent Rejection of a Takeover Bid From Lithium Royalty Has Shone a Spotlight on the Value of Its Royalty and Exploration Portfolio

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blogs. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

No comments:

Post a Comment