I have this strange feeling, that everybody is talking about electric cars now, but nobody really believes it. Lithium supply chain is ready for maximum 10% - 15% of electric cars in the new auto sales, but only China is really serious about it with its state-level New Energy Plan. Chinese companies are executing this plan with military discipline and taking one check-point after another in the new geopolitical landscape moving into the Post Carbon Economy.

Ganfeng Lithium, the JV partner of International Lithium, has seen its market cap more than tripled this year alone, following the truly dramatic rise in sales. Meanwhile, In the West companies like Tesla are competing for lithium supply with the state-level New Energy Plan in China and still relying on lithium cells supply from Panasonic and Samsung.

A lot of investment advices will turn out to be very costly again. Analysts are still finding "oversupply" of lithium and Chairman of Volkswagen "still believes in DIEsel" and shareholders are not getting very angry yet. But they will. The Switch is for real now and Electrification already claims its first victims. It is time to check your portfolios and move to the right side of the history. The ICE Age is over and disruption of $12 Trillion Transportation and Energy Industries means literally billions of dollars in stranded assets.

"The stock has been pummeled by some of China’s biggest economic policy shifts of the past decade, including the government’s move away from a commodity-intensive development model and its attempts to clamp down on speculative manias of the sort that turned PetroChina into the world’s first trillion-dollar company in 2007.Throw in oil’s 44 percent drop over the last 10 years and Chinese President Xi Jinping’s ambitious plans to promote electric vehicles, and it’s easy to see why analysts are still bearish. It doesn’t help that PetroChina shares trade at 36 times estimated 12-month earnings, a 53 percent premium versus global peers."

Lithium Race And Energy rEVolution: Reds Are Going Green - Electric Cars Are A Hit With Chinese Consumers.

Wall Street Journal made a very good report on the electric cars rEVolution which is happening today in China. The video report is stressing that all this success is the result of the industrial policy by the government in China. We have The New Energy Plan for the transition to Post Carbon Economy in action in China on a state level. With announcements from GM and Ford embracing electric cars, we have some hope in the West now not to be left in the poisonous DIEsel and Gas ICE Cars dust as well.

Lithium is the magic metal at the very heart of this Energy rEVolution and China is building the supply chains for the Next Industrial rEVolution with military discipline leaving the rest of the world totally unprepared for the coming geopolitical transition.

As you know, I have been preaching for years that security of lithium supply will be the most important factor determining the competitive advantage among different producers of critical raw materials for the Energy rEVolution. This Lithium Race will have the very far-reaching geopolitical implications. Now it looks like that Tesla is realizing that there is no secure supply of lithium for its massive expansion of operations from the underneath of Gigafactory floor in Nevada. Even if Panasonic is producing cathode for lithium cells which are made at Tesla Gigafactory in Nevada the supply chain is going all over the globe and back to China.

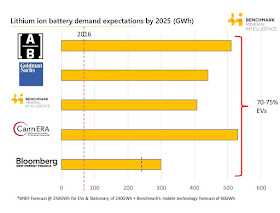

The real test to the market and supply chains for Energy rEVolution will come with the coming tide of Electric Cars and the following tsunami of Energy Storage. Bloomberg has recently reported that there will be more than 120 models of electric cars by 2020 and you should not be surprised as we have discussed here before that there are more than 70 models of electric cars on sale in China already. The next few years will determine who will have the keys to the new Energy rEVolution and control the supply chains. Hungry Dragons are flying high already and mostly in China, the question remains who and how will feed them without fear of being burnt in the process.

Lithium Race: The Switch Is On - China Sets New Deadline For Electric Car Quota From 2019.

We have finally actual steps taken by China in its transition into the Post Carbon Economy and leaving literally The ICE Age in the poisonous dust behind. China is The Centre of The Lithium Universe and now they are ready to start geopolitical shift which will affect everything. BYD is talking about China going all electric from 2030, but today we have the first major step in that direction with an introduction of a quota for electric cars from 2019. In short two years time, all automakers in China with over 30,000 cars in annual sales will have to produce at least 10% electric cars. It can be translated in over 2.8 million new electric cars in China being sold in 2019! Last year China has seen the fastest growth pace in three years with total auto sales climbing to 28.03 million cars. From 2020 automakers will have to produce 12% of electric cars.

Now we have a better understanding why Ganfeng Lithium: JV partner of International Lithium - was going vertical last few months. This kind of news is travelling very fast in the state corridors of power in China. This geopolitical move will have very wide political and economic implications as we have discussed it here for a long time. China is very well positioned to take the lead now and the ICE Age Of Oil is officially over.

We are reaching the tipping point this year: convergence of technology, new players who bring competition and prices down; and anti-pollution movement by the most important countries for the automakers. DIEselGate was the last drop and auto lobby cannot just swipe it under the rug anymore, consumers are not buying "Clean DIEsel".

Needless to say that lithium supply chains are not even close to the coming Tsunami of electric cars after Tesla Model S Earthquake. Countries like China and India are very serious to clean up their skies from deadly pollution and now we have lithium technology to make it possible: electric cars will take the world over much faster than a lot of people think.

Electrification of China and India will drive the next phase of the worldwide growth in EV fleet. India has announced that all new cars on sale will be electric by 2030 and they are taking it seriously making the first tender for 10,000 EVs to be supplied for the government ministries and agencies now. Transfer of the best technology for Lithium Batteries and Electric Cars will be next. China is already The Centre of The Lithium Universe and exercises its state-level New Energy Plan step by step with the military discipline, starting with securing a Lithium Supply Chain.