A lot of things Tony Seba has been talking about for years are happening now very fast. Disruption is all around us and Energy rEVolution will bring the most significant one which will affect billions of people. We are leaving the ICE Age with centrally controlled Energy Sources based on Oil and other Fossil Fuels. We are entering the new age of distributed energy generation based on Solar and Wind, when Solar, particularly, makes it possible to become truly energy independent. Energy Storage makes it possible. We are talking here not about 3% - 5% - 20% of cars being electric. We are talking here about all cars being electric and very fast. Why and How? Tony Seba is one of the best to explain. What will be the far-reaching implications? This blog is about it. Enjoy.

Power of Blue Sky Discoveries + Green Technology. Private Diary: Chronicles of the Energy rEVolution.

Friday, 30 June 2017

Thursday, 29 June 2017

The Switch And Lithium Race: Transport Sector Primed For The Growth Of Electric Vehicles.

International Energy Agency: In Order To Limit Temperature Increase Below 2º C The Number Of Electric Cars Needs To Reach 600 Million By 2040.

Transport Sector Primed for the Growth of Electric Vehicles

"When it comes to reducing the greenhouse gas emissions, the electricity sector gets much of the attention, considering that it is responsible for 29% of those releases. But the transportation sector makes up 26% of them. If that is going to change, the electric car will have to make significant inroads. Is that possible?

As for those stats, that’s the US Environmental Protection Agency speaking, which also says that industry is responsible for 21% of greenhouse gas emissions while commercial and residential users comprise 12%. Meantime, the agricultural sector makes up 9%. The electricity sector is having success because of the switch from coal-to-gas. And industry is committed to such reductions because that is what their customers want, forcing them to track their releases and find new ways to cut them.

One method that companies could use to have an impact is to buy into the electric car. While the automotive sector has been a slow mover, things could change if industry gets involved.

In the International Energy Agency’s ‘Global EV Outlook 2017,’ it shows a lot of acceleration in the last year. Kirill Klip, executive chairman of International Lithium Corp. points out in a blog that there were 2 million electric cars on the road in 2016. “It took us all human history to get to 1 million of electric cars in 2015 and just over 1 year to double this amount and exceed 2 million EVs by now,” he writes.

“Electric Cars still represent only 0.2% of all cars in the world,” Klip added. “Worldwide sales of electric cars have reached 1.1% of total auto sales in 2016. In order to limit temperature increase below 2º C the number of electric cars needs to reach 600 million by 2040.”

China has been the biggest market, he adds, at 40% of all sales. It also has 2 million electric bikes. Norway, meantime, was a third of the EV market in 2016.

But the global EV market is at a tipping point, he says. The impetus? The Tesla Model 3, which is due out this summer and which has a 200 mile range. It is to be priced in the mid $30,000 range. And it will rely on the lithium battery that Tesla will mass produce at its giga-factor.

“Very slowly Lithium Industry is starting to get some attention from the investment crowd, but the real awakening is still ahead of us,” says Klip. “This summer will be very hot for the lithium supply chain, and the first real test is coming. Tesla Gigafactory will start mass production of Tesla Model 3 batteries in July and 4 Lithium Mega-factories are coming online in China.”

But what type of environmental impact will EVs have? Wood Mackenzie is saying that the Tesla Model 3 will help cut gasoline consumption by 300,000 barrels per day by 2035.

By 2035, Wood Mackenzie estimates that electric vehicles will be 12 percent of all new car sales, or 16 million vehicles, says an earlier report in Environmental Leader. Such a base case scenario, it adds, would mean that the country consumes 5% less oil than today, or 350,000 barrels per day. Electric vehicle sales now make up less than 1 percent of the market.

“EVs would likely become a disruptive force in the oil industry before they do for the power industry, especially considering that much of the charging infrastructure is currently being built in areas affected by renewable over-generation, where additional demand would be welcomed,” said Prajit Ghosh, research director at Wood Mackenzie, as reported by Greentech Media.

To be sure, obstacles abound. Fitch Ratings calculates that at a 32.5% compound annual growth rate, it would be nearly 20 years before electric vehicles comprised 25% of the auto market. So, it does expect oil to be around for a while.

“The transition to EVs will be slow due to the need for infrastructure investment and the fact that new vehicles can have a 20-year lifespan,” the ratings service says.

Tesla, though, is a powerful catalyst driving electric cars. In fact, just about every car maker in the world is developing either an all-electric car or a hybrid vehicle that runs on both electricity and petroleum. As they continue to improve, so do the efficiencies — or the ability to input a unit of energy and to realize more output. In fact, traditional cars running on an internal combustion engine have a 30% efficiency rate. The rest is lost to heat, sound and energy.

But vehicles that run on electricity have an 80% efficiency rate, or they convert 80% of those Btus to energy, says Thor Hinckley, an electric vehicle and renewable energy expert with CLEAResult, a consulting specializing in energy efficiency. The efficiencies are greater because of the superiority of the electric motor over that of the internal combustion engine — not because one unit of energy is better than another.

“With an efficiency difference that great, anything will be cleaner than burning gasoline,” says Hinckley."

Tuesday, 27 June 2017

Sunday, 25 June 2017

International Energy Agency: In Order To Limit Temperature Increase Below 2º C The Number Of Electric Cars Needs To Reach 600 Million By 2040.

International Energy Agency: In Order To Limit Temperature Increase Below 2º C The Number Of Electric Cars Needs To Reach 600 Million By 2040.

Kirill Klip, Executive Chairman of International Lithium Corp.

International Energy Agency has presented "Global EV Outlook 2017". Numerous statistics are painting the picture of exponential growth in sales of electric cars. The number of electric cars on the roads rose to 2 million in 2016. It took us all human history to get to 1 million of electric cars in 2015 and just over 1 year to double this amount and exceed 2 million EVs by now.

Kirill Klip, Executive Chairman of International Lithium Corp.

International Energy Agency has presented "Global EV Outlook 2017". Numerous statistics are painting the picture of exponential growth in sales of electric cars. The number of electric cars on the roads rose to 2 million in 2016. It took us all human history to get to 1 million of electric cars in 2015 and just over 1 year to double this amount and exceed 2 million EVs by now.

In 2016 40% of all electric cars were sold in China. China sells more electric cars than the US and Europe. And China is also the global leader in the electrification of other forms of transport. There are more than 70 models of electric cars on sale in China now. There are 2 million electric bikes, 4 million small low-speed EVs and 350,000 electric buses in China as well. BYD backed by Warren Buffet is not only the largest electric buses maker but has become the largest electric vehicles manufacturer in the world. And now Tesla is coming to China as well ...

In Norway nearly a third of all cars sold in 2016 were electric. We are at the tipping point for the mass market in electric cars. 95% of EV sales were concentrated in just 10 countries. Electric Cars still represent only 0.2% of all cars in the world. Worldwide sales of electric cars have reached 1.1% of total auto sales in 2016. In order to limit temperature increase below 2º C the number of electric cars needs to reach 600 million by 2040.

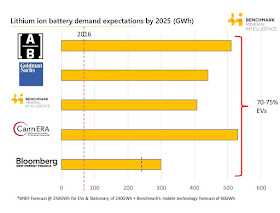

The cost of lithium batteries is going down very fast and I believe that fully electric cars will rule the world very soon. Tesla Model 3 with 65 kWh lithium battery provides over 200 miles of range and will become the standard in the industry with its mass volume production from this July. There is around 60 kg of LCE (Lithium Carbonate Equivalent) in one Tesla Model 3 battery. We will need 36 Million Tonnes of LCE to be produced by 2040 to put this IEA plan into life.

To put it into perspective, the total lithium production last year was around 200,000 T of LCE. Now you can better understand why there is the real cut throat competition for the security of lithium supply which is still hidden from the most of the people by the clouds of toxic cancer hazard fumes emitted by all DIEsel cars on our roads. ICE (Internal Combustion Engines) are on the way out, all cars will be electric very soon and we are facing the total disconnect between the coming demand for lithium and the available supply.

Lithium supply chains will be tested this year by Tesla Gigafactory starting lithium batteries mass production for Model 3 and by a few lithium batteries Megafactories which are coming online in China. Lithium giants from China like Ganfeng Lithium are building vertically integrated businesses to supply critical material to this Energy rEVolution. Ganfeng Lithium has finally closed its deal with Lithium Americas and now Argentina will become the real Powerhouse of Energy rEVolution. Lithium is the magic metal at the very heart of this Energy rEVolution and International Lithium is a Lithium Strategic Investments and Royalty Company which is plugged-in to the most dynamic EV and Energy Storage markets in China, with partners like Ganfeng Lithium, a giant from China.

To put it into perspective, the total lithium production last year was around 200,000 T of LCE. Now you can better understand why there is the real cut throat competition for the security of lithium supply which is still hidden from the most of the people by the clouds of toxic cancer hazard fumes emitted by all DIEsel cars on our roads. ICE (Internal Combustion Engines) are on the way out, all cars will be electric very soon and we are facing the total disconnect between the coming demand for lithium and the available supply.

Lithium supply chains will be tested this year by Tesla Gigafactory starting lithium batteries mass production for Model 3 and by a few lithium batteries Megafactories which are coming online in China. Lithium giants from China like Ganfeng Lithium are building vertically integrated businesses to supply critical material to this Energy rEVolution. Ganfeng Lithium has finally closed its deal with Lithium Americas and now Argentina will become the real Powerhouse of Energy rEVolution. Lithium is the magic metal at the very heart of this Energy rEVolution and International Lithium is a Lithium Strategic Investments and Royalty Company which is plugged-in to the most dynamic EV and Energy Storage markets in China, with partners like Ganfeng Lithium, a giant from China.

International Lithium: Royalty And Strategic Investments Company Presentation.

International Lithium And Ganfeng Mariana Lithium JV Exploration Target And Indicated Resource Of 1.25 M T of LCE.

"Kirill Klip, Executive Chairman of ILC stated, "We are very pleased with the results of the maiden resource estimation at the Mariana lithium potash brine project, together with our strategic partner Ganfeng Lithium. This project is now moving from an early exploration stage to an advanced exploration stage where it will be more easily compared to other lithium brine projects in Argentina. We are looking forward to follow up with Ganfeng Lithium on the recommendations of this report in order to ensure the rapid advancement of the project towards the pilot stage and to conduct further feasibility studies that will investigate the economic viability of the Mariana project."

The Switch And Lithium Race: Tesla Has Reached An Accord With Shanghai To Explore Production In China.

It is happening! Tesla comes to China, now the security of lithium supply will be in the headlines for the rest of the summer. We are at the tipping point for the lithium industry, the supply is not there to accommodate the exponential growth in EVs and Energy Storage space. Read more.

I expect this trend to be continued, lithium is taking its geopolitical place now and countries hosting these deposits will move up the value chain producing lithium chemicals, batteries and EVs finally. The recent visit of Tesla's officials to Argentina is showing the dramatic change in the attitude to the lithium supply. EVs and ESS producers will have to migrate to the countries with resources to feed Energy rEVolution. International Lithium's JV operations with Ganfeng attract a lot of interest as an entry point in the building of vertically integrated lithium business with one of the world's top lithium producers and we are examining these strategic opportunities. Read more."

Awakening: Tesla Model 3 And The Hot Summer 2017 For The Lithium Supply Chain.

"Very slowly Lithium Industry is starting to get some attention from the investment crowd, but the real awakening is still ahead of us. This summer will be very hot for the lithium supply chain, and the first real test is coming. Tesla Gigafactory will start mass production of Tesla Model 3 batteries in July and 4 Lithium Megafactories are coming online in China.

Ganfeng Lithium has made a very interesting public disclosure in China about SQM "stopping a supply of Lithium Brine to Ganfeng in June". It is very difficult to judge the scope of this interruption in the lithium supply chain for Ganfeng at this moment, its reasons and when the situation will normalize, but the message is clear - the security of lithium supply is the critical issue for all the major players in this exponentially growing market. And the real test is still ahead of us, the auto industry is still talking about 5% - 10% - 15% of electric cars in total auto sales, but what will happen when all cars will be electric after 2025?

Update:

It looks like the change is affecting SQM's supply of concentrated brine to Ganfeng as raw material and changes in import and export policies in Chile demand to produce high value added products in the country. These products will cut the margins for converters - producers of lithium chemicals from raw materials like lithium brine. Argentina is coming to the front line of lithium brine projects developments now.

It looks like the change is affecting SQM's supply of concentrated brine to Ganfeng as raw material and changes in import and export policies in Chile demand to produce high value added products in the country. These products will cut the margins for converters - producers of lithium chemicals from raw materials like lithium brine. Argentina is coming to the front line of lithium brine projects developments now.

I expect this trend to be continued, lithium is taking its geopolitical place now and countries hosting these deposits will move up the value chain producing lithium chemicals, batteries and EVs finally. The recent visit of Tesla's officials to Argentina is showing the dramatic change in the attitude to the lithium supply. EVs and ESS producers will have to migrate to the countries with resources to feed Energy rEVolution. International Lithium's JV operations with Ganfeng attract a lot of interest as an entry point in the building of vertically integrated lithium business with one of the world's top lithium producers and we are examining these strategic opportunities. Read more."

Tesla Officials Visit Argentina’s Governor Of Salta For Solar And Storage Projects And Sourcing Lithium.

ElectTrek reports that "salt on the salad'": this is how Elon Musk has described lithium before - must be very important for Tesla's digestive system after all. I am writing here extensively about the coming control of the Lithium supply by Chinese companies who are very aggressively buying all the best lithium projects worldwide. It is very difficult to pretend anymore that any lithium will be coming from any signed by Tesla agreements with some junior miners in the nearest future. Lithium cathode is still produced by Panasonic for Tesla Gigafactory.

Another part of this story is the rising price of lithium in China again. Last year we have seen only 14% rise in lithium supply and prices have increased by 74%. In December, Benchmark Minerals has reported that LCE (Lithium Carbonate Equivalent) was priced below $15k/T and Lithium Hydroxide (the particular lithium based chemical which is used in Tesla batteries) was around $18k/T. Last week I have received reports that in Shanghai LCE was priced at $18k/T and Lithium Hydroxide was at $22k/T. Today there are reports that LCE is already pushing $19k/T. It is all happening just before 4 major Lithium batteries Megafactories will be coming online in China this year and Tesla will move into the mass market stage with the production launch of Tesla Model 3 in July.

As you know, I have been preaching for years that security of lithium supply will be the most important factor determining the competitive advantage among different producers of critical raw materials for the Energy rEVolution. This Lithium Race will have the very far-reaching geopolitical implications. Now it looks like that Tesla is realizing that there is no secure supply of lithium for its massive expansion of operations from the underneath of Gigafactory floor in Nevada. Even if Panasonic is producing cathode for lithium cells which are made at Tesla Gigafactory in Nevada the supply chain is going all over the globe and back to China.

The real test to the market and supply chains for Energy rEVolution will come with the coming tide of Electric Cars and the following tsunami of Energy Storage. Bloomberg has recently reported that there will be more than 120 models of electric cars by 2020 and you should not be surprised as we have discussed here before that there are more than 70 models of electric cars on sale in China already. The next few years will determine who will have the keys to the new Energy rEVolution and control the supply chains. Hungry Dragons are flying high already and mostly in China, the question remains who and how will feed them without fear of being burnt in the process.

Friday, 23 June 2017

International Lithium: Royalty And Strategic Investments Company Presentation.

International Lithium And Ganfeng Mariana Lithium JV Exploration Target And Indicated Resource Of 1.25 M T of LCE.

"Kirill Klip, Executive Chairman of ILC stated, "We are very pleased with the results of the maiden resource estimation at the Mariana lithium potash brine project, together with our strategic partner Ganfeng Lithium. This project is now moving from an early exploration stage to an advanced exploration stage where it will be more easily compared to other lithium brine projects in Argentina. We are looking forward to follow up with Ganfeng Lithium on the recommendations of this report in order to ensure the rapid advancement of the project towards the pilot stage and to conduct further feasibility studies that will investigate the economic viability of the Mariana project."

Energy rEVolution And Lithium Race: International Lithium Presentation May 2017.

Thursday, 22 June 2017

The Switch And Lithium Race: Tesla Has Reached An Accord With Shanghai To Explore Production In China.

It is happening! Tesla comes to China, now the security of lithium supply will be in the headlines for the rest of the summer. We are at the tipping point for the lithium industry, the supply is not there to accommodate the exponential growth in EVs and Energy Storage space.

I expect this trend to be continued, lithium is taking its geopolitical place now and countries hosting these deposits will move up the value chain producing lithium chemicals, batteries and EVs finally. The recent visit of Tesla's officials to Argentina is showing the dramatic change in the attitude to the lithium supply. EVs and ESS producers will have to migrate to the countries with resources to feed Energy rEVolution. International Lithium's JV operations with Ganfeng attract a lot of interest as an entry point in the building of vertically integrated lithium business with one of the world's top lithium producers and we are examining these strategic opportunities. Read more."

Awakening: Tesla Model 3 And The Hot Summer 2017 For The Lithium Supply Chain.

"Very slowly Lithium Industry is starting to get some attention from the investment crowd, but the real awakening is still ahead of us. This summer will be very hot for the lithium supply chain, and the first real test is coming. Tesla Gigafactory will start mass production of Tesla Model 3 batteries in July and 4 Lithium Megafactories are coming online in China.

Ganfeng Lithium has made a very interesting public disclosure in China about SQM "stopping a supply of Lithium Brine to Ganfeng in June". It is very difficult to judge the scope of this interruption in the lithium supply chain for Ganfeng at this moment, its reasons and when the situation will normalize, but the message is clear - the security of lithium supply is the critical issue for all the major players in this exponentially growing market. And the real test is still ahead of us, the auto industry is still talking about 5% - 10% - 15% of electric cars in total auto sales, but what will happen when all cars will be electric after 2025?

Update:

It looks like the change is affecting SQM's supply of concentrated brine to Ganfeng as raw material and changes in import and export policies in Chile demand to produce high value added products in the country. These products will cut the margins for converters - producers of lithium chemicals from raw materials like lithium brine. Argentina is coming to the front line of lithium brine projects developments now.

It looks like the change is affecting SQM's supply of concentrated brine to Ganfeng as raw material and changes in import and export policies in Chile demand to produce high value added products in the country. These products will cut the margins for converters - producers of lithium chemicals from raw materials like lithium brine. Argentina is coming to the front line of lithium brine projects developments now.

I expect this trend to be continued, lithium is taking its geopolitical place now and countries hosting these deposits will move up the value chain producing lithium chemicals, batteries and EVs finally. The recent visit of Tesla's officials to Argentina is showing the dramatic change in the attitude to the lithium supply. EVs and ESS producers will have to migrate to the countries with resources to feed Energy rEVolution. International Lithium's JV operations with Ganfeng attract a lot of interest as an entry point in the building of vertically integrated lithium business with one of the world's top lithium producers and we are examining these strategic opportunities. Read more."

Tesla Officials Visit Argentina’s Governor Of Salta For Solar And Storage Projects And Sourcing Lithium.

ElectTrek reports that "salt on the salad'": this is how Elon Musk has described lithium before - must be very important for Tesla's digestive system after all. I am writing here extensively about the coming control of the Lithium supply by Chinese companies who are very aggressively buying all the best lithium projects worldwide. It is very difficult to pretend anymore that any lithium will be coming from any signed by Tesla agreements with some junior miners in the nearest future. Lithium cathode is still produced by Panasonic for Tesla Gigafactory.

Another part of this story is the rising price of lithium in China again. Last year we have seen only 14% rise in lithium supply and prices have increased by 74%. In December, Benchmark Minerals has reported that LCE (Lithium Carbonate Equivalent) was priced below $15k/T and Lithium Hydroxide (the particular lithium based chemical which is used in Tesla batteries) was around $18k/T. Last week I have received reports that in Shanghai LCE was priced at $18k/T and Lithium Hydroxide was at $22k/T. Today there are reports that LCE is already pushing $19k/T. It is all happening just before 4 major Lithium batteries Megafactories will be coming online in China this year and Tesla will move into the mass market stage with the production launch of Tesla Model 3 in July.

As you know, I have been preaching for years that security of lithium supply will be the most important factor determining the competitive advantage among different producers of critical raw materials for the Energy rEVolution. This Lithium Race will have the very far-reaching geopolitical implications. Now it looks like that Tesla is realizing that there is no secure supply of lithium for its massive expansion of operations from the underneath of Gigafactory floor in Nevada. Even if Panasonic is producing cathode for lithium cells which are made at Tesla Gigafactory in Nevada the supply chain is going all over the globe and back to China.

The real test to the market and supply chains for Energy rEVolution will come with the coming tide of Electric Cars and the following tsunami of Energy Storage. Bloomberg has recently reported that there will be more than 120 models of electric cars by 2020 and you should not be surprised as we have discussed here before that there are more than 70 models of electric cars on sale in China already. The next few years will determine who will have the keys to the new Energy rEVolution and control the supply chains. Hungry Dragons are flying high already and mostly in China, the question remains who and how will feed them without fear of being burnt in the process.

Bloomberg:

Tesla has reached an accord with Shanghai to explore production in China

Wednesday, 21 June 2017

Tesla's Energy rEVolution: Elon Musk’s Grand Plan To Power The World With Batteries.

Elon Musk TED Talk: We Need 100 Gigafactories To Go 100% Renewable Energy And Tesla Will Announce 3 or 4 This Year.

Elon Musk was making his Ted talk recently in Vancouver and you can experience his ability to distort reality in our Lithium Universe first hand. Among very many mind-boggling ideas he reiterated that we will need 100 Tesla Gigafactories to move to 100% Renewable Energy for the whole world and Tesla will announce 3 or 4 new Gigafctories this year!

Gigafactory 1 has tripled its production goal to over 100 GWh per year and China has announced to add more than 120 GWh production capacity per year as well. Security of Lithium Supply becomes the major competitive advantage for all major players in this phase of Energy rEVolution which is going into the mass market exponential growth stage with electric cars and Energy Storage Systems.

Tesla Officials Visit Argentina’s Governor Of Salta For Solar And Storage Projects And Sourcing Lithium.

ElectTrek reports that "salt on the salad'": this is how Elon Musk has described lithium before - must be very important for Tesla's digestive system after all. I am writing here extensively about the coming control of the Lithium supply by Chinese companies who are very aggressively buying all the best lithium projects worldwide. It is very difficult to pretend anymore that any lithium will be coming from any signed by Tesla agreements with some junior miners in the nearest future. Lithium cathode is still produced by Panasonic for Tesla Gigafactory. Read more

Another part of this story is the rising price of lithium in China again. Last year we have seen only 14% rise in lithium supply and prices have increased by 74%. In December, Benchmark Minerals has reported that LCE (Lithium Carbonate Equivalent) was priced below $15k/T and Lithium Hydroxide (the particular lithium based chemical which is used in Tesla batteries) was around $18k/T. Last week I have received reports that in Shanghai LCE was priced at $18k/T and Lithium Hydroxide was at $22k/T. Today there are reports that LCE is already pushing $19k/T. It is all happening just before 4 major Lithium batteries Megafactories will be coming online in China this year and Tesla will move into the mass market stage with the production launch of Tesla Model 3 in July.

As you know, I have been preaching for years that security of lithium supply will be the most important factor determining the competitive advantage among different producers of critical raw materials for the Energy rEVolution. This Lithium Race will have the very far-reaching geopolitical implications. Now it looks like that Tesla is realizing that there is no secure supply of lithium for its massive expansion of operations from the underneath of Gigafactory floor in Nevada. Even if Panasonic is producing cathode for lithium cells which are made at Tesla Gigafactory in Nevada the supply chain is going all over the globe and back to China.

The real test to the market and supply chains for Energy rEVolution will come with the coming tide of Electric Cars and the following tsunami of Energy Storage. Bloomberg has recently reported that there will be more than 120 models of electric cars by 2020 and you should not be surprised as we have discussed here before that there are more than 70 models of electric cars on sale in China already. The next few years will determine who will have the keys to the new Energy rEVolution and control the supply chains. Hungry Dragons are flying high already and mostly in China, the question remains who and how will feed them without fear of being burnt in the process.

International Lithium And Ganfeng Mariana Lithium JV Exploration Target And Indicated Resource Of 1.25 M T of LCE.

Exploration target at Mariana Lithium, Argentina.

International Lithium NI 43-101 report.

Kirill Klip, Executive Chairman of ILC stated, "We are very pleased with the results of the maiden resource estimation at the Mariana lithium potash brine project, together with our strategic partner Ganfeng Lithium. This project is now moving from an early exploration stage to an advanced exploration stage where it will be more easily compared to other lithium brine projects in Argentina. We are looking forward to follow up with Ganfeng Lithium on the recommendations of this report in order to ensure the rapid advancement of the project towards the pilot stage and to conduct further feasibility studies that will investigate the economic viability of the Mariana project."

LEGAL DISCLAIMER

Please read legal disclaimer. There is no investment advice on this blog. Always consult a qualified financial adviser before any investment decisions. DYOR.